New lender Perenna to offer 30-year fixed rate mortgage after finally receiving regulatory approval

A new mortgage provider will offer borrowers the option to fix the interest on their home loan for up to 30 years.

Perenna, a new bank, has secured its unrestricted banking license, becoming the first startup to do so in 2023.

Plans were first unveiled in early 2021 for giant mortgages, a common product in many countries but not in Britain.

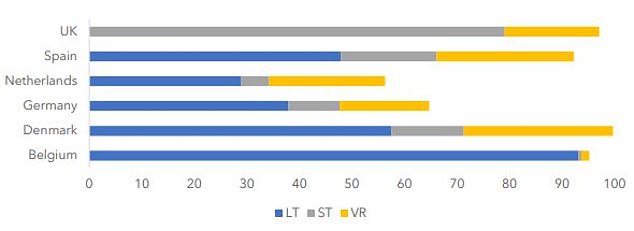

British borrowers are familiar with much shorter fixed rate deals, where the interest rate is guaranteed to remain the same for a set period of time – usually two or five years.

Perenna’s leadership team: Colin Bell, Founder and Chief Operating Officer (left), Arjan Verbeek, Founder and Chief Executive Officer (middle), Hamish Peacocke, Founder and Chief Capital Officer (right)

After this, borrowers typically get a higher rate or a new mortgage to get a better deal.

Perenna’s flagship product allows customers to lock in mortgage rates for twenty or thirty years.

The goal is to provide borrowers with both security and certainty about what they will pay each month for the next twenty years.

At the same time, however, Perenna offers borrowers an escape route during the fixed rate term, which is not common in shorter-term deals.

At Perenna, early repayment charges (ERCs) only apply for the first five years, meaning borrowers have the flexibility to switch to another lender after the first five years without incurring any fees.

Early repayment fees generally range from 1 to 5 percent of the mortgage amount.

Colin Bell, Chief Operating Officer and Co-Founder of Perenna, said: “Our mission is to create a nation of happy homeowners.

“We are pleased to be able to offer our flexible products to consumers who have been underserved for too long.

Colin Bell, the chief operating officer and co-founder of new mortgage lender Perenna

‘Our product offers improved affordability, security of monthly payments and flexibility through low ERCs.

‘We want people to be able to get on with their lives and not have to worry about their mortgage product.’

In addition to the added safety and security that a longer-term solution will provide people, Perenna says its products will have other benefits.

It will enable starters to potentially borrow more, because there is no stress test against interest rate risk. With stress testing, a lender checks whether a borrower would still be able to pay the mortgage if interest rates were to rise to a certain level.

Perenna will differ in this respect from most UK lenders, who require new borrowers to currently afford a mortgage stress rate of almost 8.5 per cent.

First-time buyers can take out a mortgage with Perenna with a minimum down payment of 5 percent.

Perenna claims this will allow first-time buyers to move up the ladder sooner or buy the place they really want.

Perenna will also offer customers the opportunity to borrow between five and six times their income.

Most mortgage lenders typically allow customers to borrow up to 4.5 times their annual income.

Customers can take out a new mortgage free of charge after five years

Bell says Perenna will not only help first-time buyers, but will also help mortgage holders who are currently stuck with their current lender’s standard variable rate and are unable to remortgage – as long as they have good credit.

He also says there is no upper age limit, which should benefit older borrowers looking to release capital from their homes without being limited by a shorter mortgage term.

Nicholas Mendes, mortgage technical manager at John Charcol, welcomed Perenna’s impending arrival.

He said: ‘After months of speculation, it looks like we may finally see Perenna in action.

“Perenna will offer homeowners a fixed rate for 30 years with up to five years of early repayment, a product unmatched by other longer-term fixed rate competitors.

‘Previously the problems with longer term fixed interest rates have been the limitations and potential costs when it comes to transferring or paying off the mortgage.

‘At a time when lenders are reducing a customer’s maximum loan amount to take into account the cost of living, this income multiple calculation will allow more homeowners and first-time buyers to potentially get onto the property ladder or provide them with a level of stability and flexibility that they need. need.’

However, it is thought that mortgage rates will be between 6.5 and 7.5 percent.

While this isn’t far off the average two-year fixed rate average of 6.66 percent, it is still far from the cheapest short-term deals on the market, according to Moneyfacts.

Borrowers can currently get 5.75 percent with a two-year fix, or just 5.16 percent with a five-year fix.

Shorter term obsession: The UK mortgage market is mainly made up of shorter term (ST) deals, unlike other European countries where longer term (LT) deals are much more the norm

Chris Sykes, associate director and mortgage adviser at broker Private Finance says: ‘I love the concept, we have been big proponents of long-term fixed deals for a long time – but if rates are between 6.5 and 7.5 per cent lie, that is so. just too much.’

Perenna’s proposal is achieved through a financing model that relies on issuing covered bonds to investors seeking stable long-term income, such as pension funds and insurance companies.

This will allow the company to offer its range of fixed, long-term deals, which it hopes will help first-time buyers, second movers and later homeowners.

Perenna will initially offer its mortgages to people on the waiting list, and later this year to the wider public.

Arjan Verbeek, CEO and co-founder of Perenna, said: “We are introducing much-needed structural change to Britain.

‘In other countries, billions of pounds of pension savings are being channeled into the real economy through covered bonds.

“Together, our unique financing model and banking license will enable us to do exactly the same in Britain and unlock the housing market, a key component of GDP.”

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.