NatWest shares post their best year since 1993… but gains in London are overshadowed by Wall Street

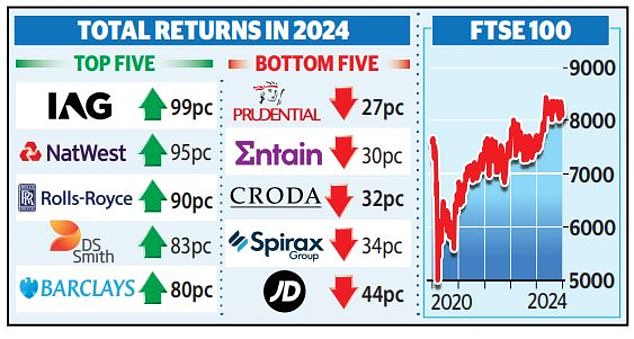

NatWest had its best year on the stock market for more than three decades as it joined Rolls-Royce and the owner of British Airways at the top of the Footsie leaderboard for 2024.

The bank’s shares rose 83 percent last year – taking its total return including dividends to 95 percent – a remarkable turnaround after years in the doldrums since its near collapse during the financial crisis when the bank was still It was called Royal Bank of Scotland.

It was the biggest annual share price rise since 1993. Only BA owner IAG did better, with a return of 99 percent, while RollsRoyce had another great year under ‘Turbo’ Tufan Erginbilgic.

Shares have risen more than 500 percent since he took over in 2023. IAG, NatWest and RollsRoyce were the biggest winners as the FTSE 100 posted its fourth year of gains since the pandemic.

NatWest: The bank has seen its shares rise 83% last year

In a boost for millions of savers with money in shares through pensions and other investments, the blue chip index added 52 points yesterday, taking its 2024 gain to 5.7 percent.

The FTSE 250 rose 4.7 percent last year but is 15 percent below its 2021 peak.

However, gains in London were overshadowed by those in New York, with analysts noting a ‘lack of enthusiasm’ on this side of the Atlantic even after the FTSE 100 hit a record high of 8,474 in May.

The rally lost steam in the second half of 2024 as optimism about political stability, ushered in by Labour’s landslide election victory, evaporated under Chancellor Rachel Reeves’ gloomy rhetoric and the £40 billion tax raid in the budget.

Matt Britzman, equity analyst at Hargreaves Lansdown, called it “a year of resilience rather than runaway success for the UK blue-chip benchmark” as it “played second fiddle to the tech-driven US markets”.

Spurred by the ‘magnificent seven’ technology stocks, the US benchmark S&P 500 index rose 25 percent, completing its best two-year run since 1997 and 1998.

Top of the pops: There are two banks in the top five, which is led by BA owner IAG

The tech-heavy Nasdaq index rose 30 percent. Chipmaker Nvidia stood out again with a 185 percent share price rise as it benefited from excitement about the artificial intelligence boom, while Apple is set to become the first company to be valued at $4 trillion (£3.2 trillion) this year.

Independent City commentator Michael Hewson said the UK stock market ‘appears to be suffering from a significant lack of enthusiasm on the part of global investors, especially compared to its peers’.

But with London shares seen as undervalued, analysts say further gains are in store this year, with AJ Bell’s Russ Mold predicting the FTSE 100 will reach 9,000 by the end of 2025.

“I’m more optimistic now than I have been in the last 30 years of my career,” said Gervais Williams, manager of the Diverse Income Trust at Premier Miton Investors, pointing to the “low valuation” of UK shares.

The rise in NatWest shares is a boost for boss Paul Thwaite, and comes as the government sold its stake to below 10 per cent, after taking an 84 per cent stake when it saved the lender from collapse with a bailout of £46 billion in the United States. Financial crisis of 2008-2009.

It is expected to sell the remainder of its stake in the next six months.