Nationwide slashes mortgage rates AGAIN: Cheapest deal on the market is now 4.29%

Nationwide has cut mortgage rates again, taking the cheapest deal on the market to 4.29 percent.

Britain's largest building society has caused a stir in the mortgage market today after announcing its eleventh consecutive round of rate cuts in four months.

It means the best available interest rates are now almost 1 percent lower than the Bank of England's base rate.

Nationwide will cut rates by up to 0.31 percentage points across its two-, three- and five-year fixed rate product range from tomorrow.

Mortgage shake-up: Britain's largest building society caused a stir in the mortgage market today after announcing its eleventh consecutive round of rate cuts

Henry Jordan, director at Nationwide, said: 'In an ever-changing market, we always strive to remain competitive across the board for first-time buyers, home movers and those looking to remortgage.'

From tomorrow, someone moving with a 40 per cent deposit will be eligible for the five-year Nationwide fix of 4.29 per cent, which comes with a £999 fee.

A buyer who secures this deal on a £200,000 mortgage, repayable over 25 years, would be expected to pay £1,088 per month.

For those looking to repair their home for two years when they move, Nationwide is also offering a market-leading rate of 4.65 per cent, with a £999 reimbursement.

Starters can also benefit from this. Nationwide's cheapest five-year solution for them is now 4.34 per cent, but only if they have a minimum 40 per cent deposit.

But even first-time buyers with at least a 25 percent deposit can now get a rate of 4.85 percent if they sign a two-year contract with Nationwide.

> Get the best rate for your situation with This is Money's mortgage finder

What about the remortgage interest?

The mortgage bank has also expanded the choice for refinancing customers. The cheapest solution for five years – as long as you have at least 40 percent equity in your home – is now 4.68 percent.

Nicholas Mendes of mortgage broker John Charcol said: 'Nationwide has revealed what the final best buying price for the year could be.

'This gives them a strong lead over the competition ahead of the weekend in a strategic move to ensure they remain in pole position.

'If people were betting on the cheapest mortgage rate instead of the Christmas number one, I would bet on Nationwide.'

Chris Sykes, technical director at mortgage broker Private Finance, added: 'A new market-leading rate moving ever closer to 4 per cent is great news for those in the best of circumstances, but with cuts across all its products it will also be beneficial to people with smaller deposits or equity.'

Why are the cheapest mortgage rates below the base rate?

Mortgage rates have continued to fall, despite the Bank of England choosing to keep the base rate at 5.25 percent at its previous two meetings.

The cheapest mortgage rate is now almost 1 percentage point below the base rate and many analysts predict that the base rate will not fall until later next year.

> When will interest rates fall? Predictions about when the base interest rate will fall

Instead, lenders price their mortgages based on future market expectations for interest rates while simultaneously trying to meet their own financing and lending goals.

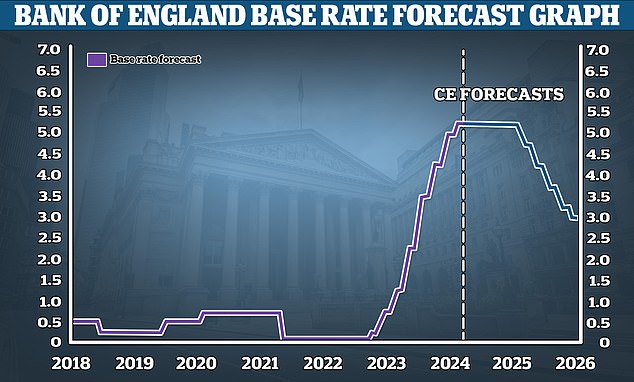

Future falls? Capital Economics predicts that the base rate will be lowered to 3% in 2026

Market interest rate expectations are reflected in the swap rate. These swap rates are influenced by long-term market projections for the Bank of England base rate, as well as the wider economy, internal bank targets and competitor prices.

Sonia swaps are used by lenders to price mortgages. This week, the five-year Sonia swap rate fell below 4 percent for the first time in months, to 3.96 percent. Two-year swaps now amount to 4.55 percent.

Overall, swap rates create a benchmark that can be seen as a gauge of where the market thinks rates will go.

Mortgage expert: Chris Sykes says at this time of year lenders often shut up and increase rates slightly, but this year the opposite is happening

Chris Sykes said: 'This week we have seen five-year Sonia swaps dip below 4 per cent for the first time in a while and this has allowed lenders to cut rates further.

“To be honest, I don't know why they have kept cutting, maybe there is just more confidence that interest rates won't stay that high for so long.

'There is also a lot of competition, because some margins on swaps are currently quite low. Many lenders have not met their targets for this year.

'Lenders often keep their mouths shut at this time of year and increase rates slightly in December if they have achieved their targets.

“But this year, with fewer people moving or buying, we have seen some very competitive offers from lenders, suggesting they are not meeting their annual lending targets and are looking for turnover.”

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.