My plan for a 37-year retirement: ANDREW OXLADE on the pension you need for a 100-year life

Andrew Oxlade: It feels morbid, but looking at life expectancy can help you plan a more satisfying retirement

One of the more somber activities I’ve imposed on friends and colleagues this week, amid conversations about the rising retirement age, is to encourage them to look for their “death day.”

This is a gift from the Office for National Statistics (ONS) in the form of a calculator on its website. Based on gender and age, it will reveal the expected average lifespan.

For me, at the age of fifty I still have an average of 34 years to go. Put this way it feels morbid and a bit depressing.

It doesn’t have to be that way. The Stoics and other philosophers argue that staring at one’s own mortality is life-affirming; a reminder to keep going and enjoy it.

I find it motivating to compare what’s left in figures: in the remaining 34 years I expect maybe 20 big holidays, maybe 25 theater nights, maybe 80 more novels, if I can read a little faster, and three more end-of-decade nights. celebrate.

My real passion is swimming in cold lakes and rivers, with an 8 mile swim in the Thames booked for August. Given the rising number of injuries, the list of future major swimming competitions may be shortened anyway.

Such numerical indications make you think.

On a more practical level, I am starting to focus more clearly on the details of how I will fund my retirement and, knowing that this will likely take 17 years from age 67, my official state pension age.

I should also prepare for scenarios where I last to 93 (a one in four chance), or 97 (a one in 10 chance), the ONS calculator suggests.

The long-term trends of increasing longevity have been underway for some time, with the costs of financing such long lives becoming an increasing concern for both the state and individuals.

The ONS calculator told a 25-year-old colleague she would probably live to be 89, with a one in 10 chance of living to 101.

For her and millions of other young people, this will require not only careful retirement preparation and planning, but perhaps also a more radical change in mindset.

There is a growing debate about ‘the 100-year life’ following the publication of a book with that name, published in 2016.

The idea of a three-stage life – education, work, retirement – could morph into something else.

Perhaps a life where longer lives are financed by longer careers, but where we work in different ways: more part-time work, more work that resembles our hobbies and interests, more entrepreneurship, and so on.

The explosion of “digital nomads” – those who sign up to work for home-based businesses while traveling the world – is one example. According to Nomad List, there are currently an estimated 16,000 such nomads working in Lisbon.

My fellow 50-year-olds must tackle the multitude of unknowns: how long you’ll live, how much money you’ll need, how much you’ll need to save

It may take decades for work patterns to fully evolve to the 100-year lifespan. But Britain will probably be a leader; it ranks seventh worldwide in the number of centenarians, ahead of countries such as Greece and Italy, famous for their life-extending Mediterranean diets.

Some of the solutions outlined for younger generations can also work for people closer to retirement, and may already be doing so.

Consider the increase in consulting work, where employees continue to earn less but delay the day they start reducing their retirement funds.

On a more prosaic level, my fellow 50-year-olds have to tackle the vast number of unknowns: how long you’ll live, what contributes to how much money you’ll need, what contributes to how much you’ll need to save.

How long will you live?

When you look at the data, there are a few things to keep in mind. The ONS life expectancy tool calculates that the longer we have lived, the longer we will live.

A 65-year-old man can therefore expect to live to be 85; A 90-year-old man is expected to live to 94. For this reason, my life expectancy of 84 will be higher when I reach my mid-60s.

It’s also worth noting that while increases in life expectancy have been extraordinary in recent decades, improvements may be slowing. Covid had an impact and the growing obesity epidemic will continue to have a greater impact.

It is incredibly difficult for a 25-year-old to calculate how long he will live and how long he will need to fund his retirement.

At what age will you retire?

Warnings about later retirement dates keep coming. Recently, the International Longevity Center has caused concern by suggesting that the state pension age should rise from 66 now to 70 or 71 by 2050.

The reality is less bleak. Under current rules, the state pension age will rise to 67 years between 2026 and 2028 and to 68 years in 2042-44.

The age at which you gain access to your own pension fund will also increase, from 55 to 57 years in 2028, and will probably follow the state pension age minus 10 years. In theory, this number would rise to 58 by 2034.

To keep the AOW affordable, the government can accelerate the increase in the retirement age. The alternative is to relax the ‘triple lock’ obligation, under which state pensions rise faster than wages and inflation, with a guaranteed minimum increase of 2.5 percent.

This could become more bearable once the gap between labor and retirement incomes is further closed.

I have noticed that people in their 20s and 30s often dismiss the future of the state pension, believing it will be worthless or completely absent when they retire. I wondered the same thing at their age. Today I am more positive.

Providing retirement support is a fundamental principle of the social contract and improvements to it over the past decade reflect this.

The state pension will continue to exist and is already meaningful today. For many, the full state pension of £10,600 a year is all they have; for almost everyone else it makes a substantial contribution to their retirement planning.

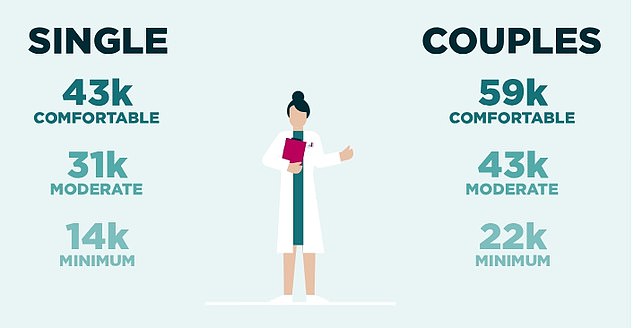

The PLSA costs of different types of pension: will you get the pension you want?

How much do you need for a decent pension?

New retirement income estimates were published earlier this month by the Pensions and Lifetime Savings Association (PLSA). Individuals looking for a comfortable retirement should now expect to spend £43,100 a year, an increase of 15.5 per cent.

At Fidelity we recently did some calculations based on retiring at 65, with the aim of achieving an income of £43,500 per year, rising as inflation increases.

The individual would receive the current full state pension from the age of 67, today £10,600 a year, reducing the income they need from investments to £32,882.

A woman would need to raise £640,000; a man would need less, £600,000, because of his shorter life expectancy.

This is based on income increasing at 2 percent inflation and assumes an investment growth of 5 percent gross with 1 percent fees and no plan to pass on an inheritance.

It is believed that life expectancy for a man is 20 years and for a woman 22 years. But if the man lived to be 92 instead of 85, they would have to save £750,000 – another £150,000.

Variables in investment returns can also skew the math. If the annual return is only 2 percent, the man would need £810,000. If the markets were kind and he made an 8 percent gain, he would only need £460,000.

Finally, we should not forget about inflation. If the consumer price index (CPI) were to reach 4 per cent in the very long term, the amount required would rise to £803,000.

Swimming: I’m making sure every holiday counts and that my remaining 25 plays and 80 novels and many great swims are all crackers, says Andrew

My potential 37 year retirement

Certainty is rarely a hallmark of modern retirement planning. I am part of a generation that has to deal with theoretical scenarios such as the above, as guarantees of final salary pensions become increasingly rare.

The only certainty is that I have to save more to increase the chances of the retirement I want.

The only certainty is that I have to save more to increase the chances of the retirement I want

I will continue to save in my company pension scheme, the most tax-efficient savings option for most people, and continue to combine old work pensions into one Self-Invested Personal Pension (Sipp).

Better visibility should mean better planning.

I also increasingly accept that I will work until my retirement age of 67. But I would also like to know that I can stop working early if necessary.

After all, healthy lives are no longer as long as they used to be.

The statistics tell me that I am more likely to develop ill health at age 60. I hope not, but I would like to know that I can retire or partially retire at age 60 if necessary – perhaps because of poor health, or simply because I have lost my zest for life at work .

In that case, I would have to fund a 24-year retirement, if you go by the averages, but I would have to have a plan for the one in ten chance of it being 37 years.

Until then, I’ll keep checking to make sure I’m on the right track. I will make every holiday count and that my remaining 25 plays, 80 novels and many big swims are all bangers. That’s the nice thing about it.

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.