My daughter is the eight-year-old property investor who divided Australia by buying a $671,000 house. Here’s why she NEEDED to do it – and my withering response to the haters

The father of Australia’s youngest property investor, eight-year-old Ruby McLellan, has hit back at critics who attacked his daughter, saying many are jealous and unable to make the sacrifices required.

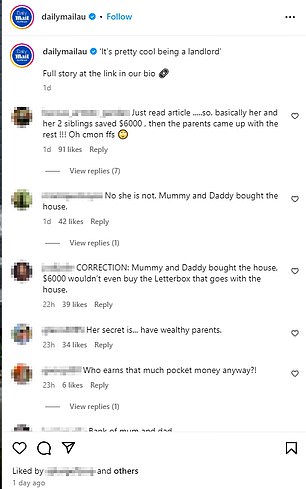

Online comments flooded Instagram And X after Daily Mail Australia told the story of how Ruby and her two siblings bought a $671,000 house in Clyde, Victoria, rather than spend pocket money on sweets and toys.

Using $6,000 of their pocket money, Ruby, 14-year-old Angus and 13-year-old Lucy made a payment for the four-bedroom house on Melbourne’s south-eastern edge two years ago.

The home has already increased in value to an estimated $960,000 as real estate prices skyrocket nationwide.

It seems like a smart investment, but online critics branded Ruby’s parents as shameful and exploitative and others speculated that it was all tax evasion, possibly illegal – and certainly bad parenting.

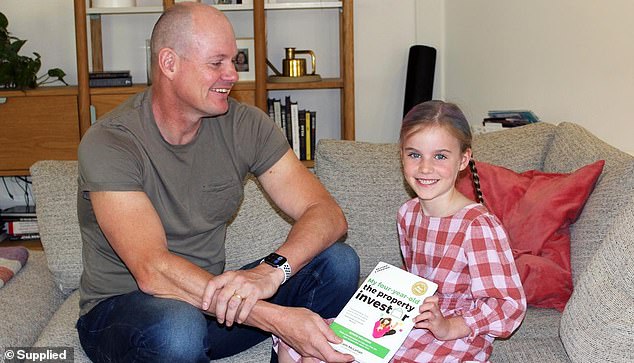

Ruby McLellan, 8, and her two siblings saved $6000 in spending money and bought a house now worth almost $1 million in Melbourne through a trust set up by their parents

Ruby’s father Cam McLellan, head of property group OpenCorp, shrugged off the criticism and told Daily Mail Australia his children would not read the personal attacks.

“It’s easy for someone who doesn’t have property or hasn’t made sacrifices to be angry about it, and it’s easy to target a young child who has an advantage,” McLellan said.

He said those attacking the precocious property buyers would be better off focusing their energy on finding extra work, cutting their discretionary spending and saving money for their own first home.

The lifestyle of ‘young adults’ is very flamboyant these days. I had three jobs, I didn’t go out, I sold my car,” Mr McLellan said.

“Eating in cafes and shopping has taken people’s money away. Even if they own a car, they like to change it every five years. I’ve had the same car for ten years.

‘You don’t want to aggressively push that onto the young generation, but they have to make sacrifices and delay gratification.

‘There is no easy solution, but although my children are given enough to get started, they are not silver spoons. They have an advantage, but so can anyone in Australia.”

Cam McLellan said he wasn’t concerned about negative comments following the story about his daughter Ruby (above father and daughter together) and wondered why all parents wouldn’t want to give their children a “leg up” into the property market.

The purchase of the three children is completely legal: their names are on the title, and once they reach adulthood, they share in the profits from a sale, plus capital gains taxes.

In the meantime, the house will be rented out, and while Mr McLellan understood why tenants might find it humiliating to have to pay rent to children, he said the purchase was motivated entirely by pragmatism, and not to prove any point.

“I want to avoid them having to save for deposits later,” he said. ‘I want to help them become smart real estate investors.

“When I started I was making $40,000 and the deposit on a house was $7,000. Now it is much harder to get a deposit when you make $60,000 and the deposits are $120,000.

“Ten years from now it will be worse and my kids won’t be able to make that down payment – four kids, so instead of four times a $200,000 down payment, (my wife) Felicity and I are giving them a head start now on buying a house later to get.’

Cam, 50, (pictured with wife Felicity and their children, Hannah, 17, Ruby, 8, Lucy, 13 and Angus, 14) taught his children the basics of investing to gain a foothold in the property market

He appreciated the frustration of those struggling to get into the housing market as mass migration and the resulting shortage of housing – both to buy and to rent – causes an incessant price spiral.

‘Unfortunately there is a growing gap between the haves and the have nots. “That doesn’t mean that people who own property are causing this,” he said.

‘It’s just that wage growth is slower than real estate price growth. Wouldn’t every parent like to educate and help their children acquire property?

‘Historically, real estate doubles in value every seven to ten years.

‘I have been investing for thirty years and now is a good time to invest based on falling inflation and the forecast of interest rate declines.’

Ruby, 8, said it was pretty “cool” that she owned a house by giving up toys and candy, and that she hadn’t told her friends about it in person yet

Ruby told FEMAIL that being a landlord is “pretty cool” but she had told her school friends about it.

She and her siblings are already planning their second real estate purchase, borrowing against the equity in the first, again with all their names on the title.

The family will keep the property until Lucy and Angus are in their early 20s, meaning they’ve waited a “full real estate cycle” and expect its value to well exceed $1 million.

When sold, the children receive an equal share of the after-tax profit.

Cam and Felicity McLellan (above) have invested in real estate to free up more time to spend with their kids

Mr McLellan wrote a book ‘My Four-Year-Old, the Property Investor’ 13 years ago, with his eldest child Hannah, now 17, in mind.

He updated it with new market realities and dangers Ruby and younger children will face in future real estate transactions.

“The industry is one that I love, but there is a dark side because it is not regulated,” McLellan said.

As a teenager, he bought an investment property and was “lucky enough to have a friend’s father teach him the basics.

“I rented a rental property in Melbourne’s beachside suburb of Elwood and I was protected from the seminar sharks,” he said.

He covers how to be safe from those ‘sharks’ in his book ’50 Questions People Should Ask Before Investing’, and how to avoid spruikers who say: “I will make you a real estate millionaire” and put you in a sell bad properties at the drop of a hat. t area and get a bribe’.

Ruby (above with her parents Cam and Felicity) started learning about real estate investing at the age of six, but had to understand that she couldn’t move in or take her friends there

Cam McLellan said he wasn’t bothered by doubters on social media and wanted to help people and parents get their children into real estate. His newly revised book (above right) tells how to avoid the pitfalls

Before buying the property in Clyde, Cam said he guided the children through the process using “lots of illustrations” to help them understand, but as Ruby was only six at the time, he admitted she didn’t understand how it all worked. worked.

He had to keep telling her that she couldn’t live on the property or bring her friends there.

Cam and Felicity bought their first property together in their early 20s with the goal of becoming “financially free.”

As a result, the couple has not had to work as much in the past fifteen years. For Cam, a typical week means working “four hours every few days.”

Every year he takes three months off, including all school holidays, to maximize the time he spends with his four children.

‘