Multi cap or flex fund? Where should you invest and why

While small-cap funds continued to be the most sought after in August, multi-cap, mid-cap and Flexi Cap funds also received significant flows from retail investors.

“Investors continued to hold their stakes in smallcap funds with inflows of Rs.4265 crore, keeping the run rate above Rs.4000 crore for the third month in a row. Multicap funds with inflows of Rs.3422 crore, Midcap funds of Rs.2512 crore and Flexi-cap funds of Rs.2193 crore were the other three categories that generated substantial flows from investors,” said Gopal Kavalireddi, Vice President of Research at FYERS.

The stock market consists of several listed companies that are broadly divided into three groups based on their market value. The first group is the large-cap group, which consists of the 100 largest companies with the highest market value. The second group is midcap and consists of companies with a market value between 101 and 250. The third group is the small-cap, to which all other listed companies belong.

Mutual fund investors looking for diversification can choose from two broad baskets: flexi-cap and multi-cap funds.

Both funds operate with the intention of investing in different market capitalizations, albeit to varying degrees.

Multi-cap funds must allocate at least 25 percent of their assets under management to large, mid and small cap stocks. The remaining 25% can be invested in companies, debt instruments, or held as cash. The flexi-cap category has no such restrictions on investing in large, mid or small cap stocks. Here the fund manager can change the allocation among the different categories of companies based on their research and market prospects. For example, a flexi-cap fund manager could allocate 50% of the fund to large caps, 20% to small caps, 10% to mid-caps and the remaining 20% to cash and bonds.

For example, in the last two to three years, many funds have moved into the flexi-cap category, while a few have remained in the multi-cap category.

The main difference between the two is that Multi-caps have a more balanced and disciplined approach where the minimum allocation is pre-defined. In the case of flexi caps, investors will have to rely on the ‘market capitalization allocation ability’ of the fund manager.

“Multi-cap funds take a well-rounded investment approach, typically maintaining a predetermined balance in their allocation to large-cap, mid-cap and small-cap stocks. This allocation strategy aims to provide a combination of stability and growth potential. As the name suggests, flexi-cap funds offer investors the freedom to invest in companies of all sizes and sectors. They are not required to invest across all market segments, which allows them to focus their portfolios on segments that offer the best opportunities, according to the fund manager,” explains Adhil Shetty, CEO of Bankbazaar.

Benchmark structure of Flexicap and Multicap funds:

The Nifty 500 Index has an average higher weighting in largecaps (70%+); followed by Midcaps (about 10% to 15%); and in small caps (5% to 10%) or thereabouts.

Most actively managed Flexicap funds also have a similar exposure, i.e. higher exposure to large caps, but with variation in stock selection and allocation.

In the case of the Nifty 500 Multicap Index, it has an exposure of 50% to largecaps and 25% each to midcaps and smallcaps.

“Compared to Nifty 500 index, Nifty 500 Multicap index has higher exposure to Mid and small caps. Flexicap funds are compared to Nifty 500 index TRI (or equivalent in BSE) and Multicap funds are compared to Nifty 500 Multicap 50:25 :25 Index TRI (here the ratio represents the allocation in Largecap: Midcap: Smallcap),” said Sriram BKR, Senior Investment Strategist at Geojit Financial Services.

Risk:

“Between multi-cap and flexi-cap funds, multi-caps are riskier and have higher return potential as they have a mandatory allocation of 25% each to small-caps and mid-caps, unlike flexi-cap funds that are free to determine their allocation percentage to each market capitalization segment,” said Mayank Bhatnagar, Chief Operating Officer of FinEdge.

Most flexi-cap funds today have a 70-75% allocation to blue chip stocks, so are just large-cap funds with a ‘twist’ in a sense.

“Over the long term, flexi-cap funds can deliver returns in line with large-cap indices – so a CAGR of 11% would be a reasonable assumption. Multi-cap funds have the potential to deliver slightly higher returns in the long term, so one can expect a CAGR of around 13% from both categories,” said Bhatnagar.

Inconstancy

Because Flexicap funds hold more large-cap stocks, they tend to have lower volatility, especially during market downturns or declines. On the other hand, since Multicap funds have a higher exposure to the Mid and Small Cap segment, they experience higher volatility in most cases, especially during market downturns.

“Examples where Nifty 500 Multicap Index saw higher decline (also call it underperformance) versus Nifty 500 Index: December 2011; September-October 2013; 2018 to 2020 for most of the period,” said Sriram BKR.

Average market capitalization exposure of Active Flexicap & Multicap Funds – as of July 23 and August 23 portfolios, according to Geojit Financial Services

Performance

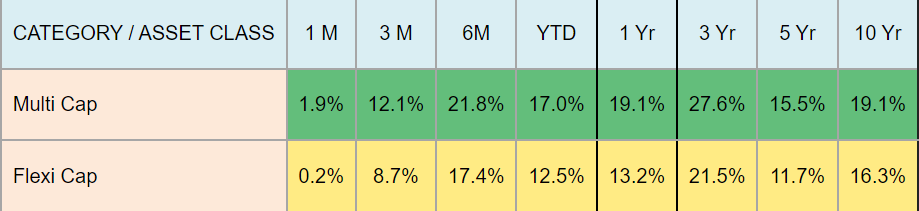

The trends over the past one to two years show that multi-cap funds have generated returns of 15-20 percent, while flexi-caps have delivered average annual returns of 15-17 percent. Some top funds saw returns much higher, while some funds also underperformed. When we compare the returns of the top-ranked multi- and flexicap funds, there is a difference of about 5-7 percentage points. However, these trends may change in the future and you should take that into account when deciding to invest in mutual funds.

According to Geojit Financial Services, returns will lag in August 2023

“The performance of multi-cap funds and flexi-caps show a big difference due to differences in their underlying assets. AMFI’s data shows that while flexi-cap funds are up 15% in the past year, multi-cap funds are up. 20%, resulting in greater investor interest in the latter category. However, a careful look shows that the higher returns of multi-asset funds are mainly the result of a prolonged bull run in the small and mid-cap stocks. These stocks are very volatile. On the other hand, flexicap funds tend to focus more on large cap stocks, which are relatively more stable,” said Ajinkya Kulkarni, co-founder and CEO, Wint Wealth.

Some of the best performing multicap funds are Quant, Nippon, ICICI, Mahindra etc. The best performing Flexicap funds are HDFC, SBI Flexicap, JM Flexicap, Franklin India, Quant, Edelweiss and Kotak Flexi cap fund etc.

Who should invest in multi-cap and flexi-cap funds?

Investors looking for diversification should choose the funds.”

If we look at an actively managed diversified fund that covers the large, mid and small cap space of the listed universe, but with relatively less volatility, we can consider Flexicap funds as they hold more large caps, followed by mid caps and small caps . Investors looking for a similar diversified fund but with higher exposure to the mid and small cap universe can choose from the Multicap funds,” said Sriraram BKR.

At the benchmark level, the Nifty 500 Multicap index had delivered higher returns than the Nifty 500 index over longer periods of time.

How to decide between the two?

Investing in a multi-cap or a flexi-cap fund depends on an investor’s overall portfolio.

Suppose the investor already has a relatively large allocation to large caps (via ETFs, index funds or actively managed large cap schemes). In that case, it is better to opt for multi-cap funds for diversification, says Kulkarni. However, starting with a flexi-cap would be a good idea for a novice investor to gain meaningful exposure to all market cap stocks.

“If you prefer a well-balanced approach, a Multi-Cap Fund may be a suitable choice. On the other hand, if you are comfortable taking on more risk in pursuit of potentially higher returns, a Flexi Cap Fund, known for its adaptability to market conditions could be a more suitable option,” Shetty said.

“Investors need to be aware of the non-linear nature of equity returns (whether flexi cap, multi-cap or any other category) – meaning you may have a few years of negative returns followed by a year of supernormal growth Furthermore, these are expected long-term investment returns and not speculative short-term returns based on market timing. It is always advisable to invest in equity funds systematically, and with clearly defined financial objectives in mind. Ad hoc, return-oriented investing can completely derail your investment journey and lead to losses in your portfolio, so make sure you start with the right expectations before investing in either of these two funds,” advises Bhatnagar.