M&S shares soar 45% in 3 months: What should investors do?

>

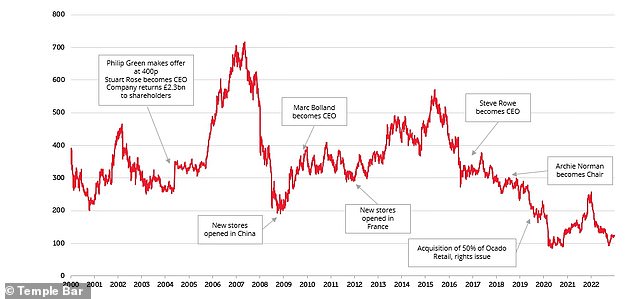

M&S stocks have nearly halved in value by 2022 against a tough market environment as consumers have been forced to cut spending due to high cost pressures.

Shares of the high street giant have been on a downward trajectory since 2015 as investors mourned declining sales before bottoming out at the height of the pandemic in May 2020.

Since then, the retail giant has been forced to reconfigure its strategy, leading to a serious comeback for its falling share price.

An M&S turnaround of sorts: The retailer’s shares are up 17% this year as its five-year strategy begins to bear fruit

M&S shares are now up nearly 17 percent since the start of 2023 following a string of strong post-Christmas results.

It’s the kind of turnaround co-chief executives Stuart Machin and Katie Bickerstaffe had hoped for when they took over last year.

But is this the start of a sustained comeback for the 139-year-old retailer or is the recent rally destined to be short-lived?

Why have M&S shares fallen so much?

In 2019, M&S fell out of the FTSE 100 for the first time, a clear sign of the retailer’s waning fortunes.

It suffered slowing growth in its all-important apparel business, while its food division also started to show signs of weakness.

Just a year earlier, former boss Steve Rowe and chairman Archie Norman outlined their five-year strategy to “repair the groundwork.”

This included simplifying the corporate structure, closing distribution centers and some stores, and cutting jobs. It also began a radical overhaul of M&S clothing offerings to challenge online-only retailers and appeal to a younger audience.

“We thought M&S was a respected brand name that had lost its way strategically under previous management,” said Ian Lance, manager of Temple Bar Investment Trust, which holds M&S among its top 10.

‘In particular, they had expanded their retail offerings at a time when most of the rival firms were moving to online, for example NEXT Directory. This not only meant that sales suffered, but that costs were too high and therefore made a lower profit margin than their peers.’

A pandemic and cost-of-living crisis later, M&S stocks continued to struggle, with shares falling from 214 pence at the start of 2020 to 123.3 pence at the end of 2022.

They fell dramatically last October after M&S warned energy costs were rising £40m more than expected, sparking a potential headwind of more than £100m by 2023.

In a presentation to institutional investors, the retailer said it would reduce the number of clothing and homeware stores by 67 to bring the total to 180 by 2028.

While the market reacted as expected, Jefferies raised its target price on the stock from 115p to 125p before the third quarter trading update was released earlier this month.

In a note, they said: “Early days, but M&S is showing encouraging endurance against a volatile backdrop.”

Has the new strategy paid off for M&S?

Evidence of the success of the new strategy appeared in this month’s trading update, which covered the third quarter and the Christmas period.

Total UK M&S sales rose 9.87 per cent, beating market expectations of 4.9 per cent. Within that, food sales rose 10.2 percent, nearly doubling analyst expectations and reaching their highest-ever market share.

Sales of clothing and homes, which were central to the new strategy, grew by 8.8 percent and achieved a market share of more than 10 percent for the first time since 2015.

It has also started to catch up with its rivals when it comes to online sales.

Monthly active app users reached 5 million in the third quarter and the link with Ocado Retail has led to its products representing 30 percent of the average shopping cart on Ocado.com during Christmas.

“Management has formulated a strategy to increase market share by 1 percent in both the food retail, clothing and housing markets and to bring margins to 4 percent and 11 percent respectively. This should mean the company can generate somewhere between 25 and 30 pence in earnings per share,” said Lance.

Even if the shares were only valued at 10x earnings, that would equate to 250p to 300p compared to the current price of 150p. It is worth noting that the share price had recovered to over 250p by the start of 2022, before the advent of the war in Ukraine.”

Peel Hunt analysts have updated the price target from 120p to 150p after the update. It is currently trading at 148p.

In a note, they said, “We had exaggerated our gloom, which is why we are upgrading back to the pack. This isn’t to say that M&S (or any retailer, for that matter) is already out of the woods and it’s hard to call the consumer.

“But in these challenging times, M&S has taken shape a bit and our numbers now reflect that. The valuation suggests life will last and the shares are not must-haves, but they are inexpensive and have decent yield support.”

What are the challenges for M&S?

Retailers and supermarkets received an unexpected boost over the Christmas period, with forecasters expecting a tough economic outlook to weigh on consumer spending.

Next raised its profit forecast after a better-than-expected holiday period that saw full-price sales jump 4.8 percent.

Other retailers are also performing strongly, so what makes M&S stand out?

Lance of Temple Bar says M&S is a “long-term fundamental recovery story, not just a cyclical recovery story.”

While M&S may have turned around, consumer resilience over the Christmas period could begin to slip in 2024.

“Inflation reached record highs in 2022, driving up costs and forcing many retailers to pass on price increases,” said Simon Underwood, business recovery partner at accounting firm Menzies.

“The fact that consumers have had to pay more for their purchases has helped retailers increase sales in the run-up to the holiday season, despite growing concerns about the cost of living.”

But margins will soon begin to be eroded by inflationary pressures, especially utility bills, as M&S experienced last October.

In its latest update, M&S referred to inflationary pressures and cited clear headwinds with underlying cost pressures.

It’s hard to say what the future holds for the retail sector in 2023, but with rising costs and continued uncertainty there is bound to be some impact on consumer confidence.

“Retailers will need to remain alert to market changes, monitor costs closely and protect margins to weather the uncertainty ahead,” said Menzies.

Inflation will be a major challenge for M&S, as will the growing dominance of discount retailers such as Lidl and Asda.

But the retailer said it had set aside around £150 million to offset rising prices and tougher conditions in the coming months.

Peel Hunt analysts said: “The shares have more or less participated in the sector’s rally and may have been expecting more today, but we think there are signs of real progress here.

“Valuation remains low and while consumers are not out of the woods, this is one worth watching if the odd macro signal turns more positive.”

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and use it for free. We do not write articles to promote products. We do not allow any commercial relationship to compromise our editorial independence.