MPs launch Lifetime Isa review to ask whether savings account is still ‘fit for purpose’

- The committee will consider increasing the contribution limit above £4,000

A group of MPs has launched an investigation into the popular Lifetime Isa, to assess whether the savings account is still ‘fit for purpose’.

The Treasury committee will ask questions including whether the annual contribution limit of £4,000 should be increased, whether the penalty for withdrawing money in certain circumstances should be abolished, or whether the accounts should be abolished altogether.

Savers under the age of 40 can open a Lifetime Isa (Lisa) and until they turn 50, the government will put in £1 for every £4 they save, with a £1,000 bonus given on the maximum £4,000 per year you can save.

That money can be used for a down payment on a first home, or withdrawn from age 60 to help fund retirement.

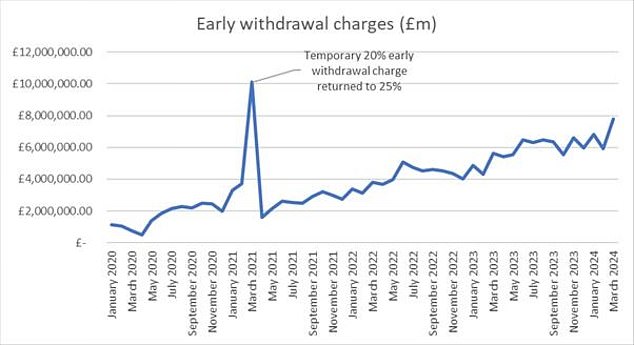

But if savers withdraw their money for any reason (except because they are terminally ill, for which an exception is granted), they will be charged a 25 percent surcharge.

This could end up costing someone more than he or she put into it. For example, if someone paid $1,000 and received the $250 government bonus, they would have collected $1,250, assuming investments did not grow.

Savings boost: People under 40 can open a Lisa and contribute up to £4,000 every year until they are 50. At the end of each tax year this is supplemented with a bonus of 25% of

But if they were to then withdraw the money without using it towards a suitable deposit for their home, the 25 per cent penalty would apply to the £1,250, leaving them with £937.50 – and £62.50 out of pocket. bag.

MPs will also try to determine whether the £450,000 price limit for homes bought with Lisa money should be increased with inflation or abolished.

Since the introduction of the Lisa, the average house price has risen by 40 percent, according to the latest figures from the Land Registry.

The £4,000 per year limit that savers can put into their Lisa is also seen by some as too restrictive given higher house prices.

The committee will also consider whether this ceiling should be increased.

The aim is to gather views from the financial sector, consumers and experts.

Former Chancellor George Osborne introduced the Lisa in the 2016 Budget, aiming to provide an alternative method of tax-free saving for retirement while encouraging people to save for a property.

Reforms to early withdrawal fees and the maximum purchase price of a property could boost Lisa’s appeal, said Tom Selby, director of public policy at AJ Bell.

‘AJ Bell has long campaigned for an end to the early withdrawal penalty, but has instead returned to the system used during the pandemic, when the penalty only matched the original bonus received into the account,’ he said.

‘Similarly, raising the property purchase price limit, which has remained fixed since the introduction of the Lifetime Isa, would be an obvious quick win.

‘Our analysis shows that in many areas the average flats and terraced houses – the type of properties that could appeal to aspiring homeowners – now exceed the £450,000 limit.’

Warning: The thing to be aware of with the Lifetime Isa is that money that doesn’t qualify as a deposit for a first home will be heavily penalized if withdrawn before the age of 60.