Motorist’s 60 cent mistake lands him $18,000 in debt after his car was rammed by another driver and deemed a total loss

A car insurance company has left an Arizona motorist thousands of dollars in debt after he refused to pay a claim because he paid 60 cents less than he should have for his $60,000 car.

Peoria salesman Manny Munoz overspent on his BMW X5 in 2020 when he needed a new car for work at the height of the pandemic.

Cars traded for thousands of dollars more than normal as international supply chains collapsed, and Munoz agreed to pay $60,517.86 for the then two-year-old vehicle.

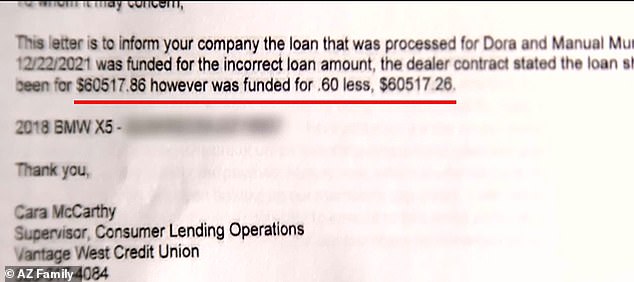

His credit union accidentally sent the dealer a check for $60,517.26, or 60 cents less, but this went unnoticed until last November when his car was totaled and his insurer Safe-Guard Products used the difference as an excuse not to pay.

“The claim was recovered because the loan amount did not match the contract amount,” Munoz said azfamily.com. “There was a difference of 60 cents.”

Manny Munoz was $18,000 in debt due to an unnoticed 60 cent difference

His BMW suffered a rear-end collision during a prank last November and although the damage appeared relatively minor, his insurance company insisted the car had been written off.

The grandfather paid for the car through a finance deal and took out gap insurance to cover the full amount, especially as its value was likely to depreciate rapidly from the height of the pandemic.

And he found himself filing a claim when he fell behind on a trip late last year.

The damage seemed relatively superficial, but Safe-Guard considered his car a total write-off.

“I think there are so many sensors on the car and cameras,” he speculated.

He still owed $45,000 on the car, but the insurance company sent him a check for only $26,709 which the car would have been worth at the time of the crash.

They told him that the amount charged for the car, and the amount paid, had to match down to the cent for the gap policy to be valid, leaving him without a car and an outstanding debt of $18,651 .

Seven months of wrangling failed to move the Atlanta-based insurance company, so he contacted AZfamily’s consumer show On Your Side and its host Gary Harper.

The discrepancy only came to light more than three years later when he filed a claim

Munoz, pictured with his wife Dora, has now received a letter from the insurance company suggesting his claim is ‘pending’

“I was sitting there thinking about what to do and so I went online and I said let me find Gary Harper and here we are,” he told the program.

And after contacting the company, Munoz received a promising letter suggesting his claim is now being “processed.”

But he refuses to get his hopes up until he receives a check – for the right amount.

“I don’t have a problem with being patient because I think I’ve been more than just patient,” he said.