Most landlords will pay more capital gains tax when they sell, despite the ‘reduction’ announced in the Budget

Landlords who sell are likely to face a higher tax bill than two years ago, despite Jeremy Hunt’s Budget cuts to capital gains tax on the sale of second homes, new data shows.

Analysis from estate agent Hamptons shows that successive cuts to the personal allowance on capital gains tax (CGT) will mean the average landlord will generally be worse off when they sell.

The typical landlord on a higher tax rate could pay £454 more than before April 2022, while a regular rate taxpayer could pay £1,674 more.

The CGT annual personal allowance was reduced from £12,300 to £6,000 from April 6 last year and will be further reduced to £3,000 from April 6 this year.

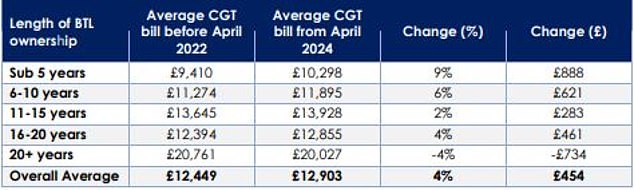

Higher capital gains taxes before April 22 vs. April 24: This chart shows how Hunt’s tax cut will actually feel more like a tax increase for many landlords selling from April 6

In the Budget earlier this month, Jeremy Hunt announced that the Government will reduce the CGT rate for higher rate taxpayers from 28 per cent to 24 per cent, with the rate for basic rate taxpayers remaining unchanged at 18 per cent.

CGT is levied on the profit that landlords and second home owners make on a property that has increased in value when they come to sell it.

> What is capital gains tax and how much do I have to pay?

Hunt alluded to the ‘Laffer curve’ after announcing the CGT cut in the Budget, claiming the lower rate would result in more tax revenue.

The Laffer curve refers to the idea that raising tax rates beyond a certain point is counterproductive and actually results in less tax revenue.

He joked during his Budget speech: ‘Perhaps for the first time in history, both the Treasury and the OBR have discovered their inner Laffer curve.’

But Hamptons’ analysis suggests the opposite could be true, as the majority of landlords won’t feel like they’re getting a tax cut at all.

Why most landlords are worse off when selling

Taken alone, the reduction in the CGT rate from 28 per cent to 24 per cent will save the average higher tax-paying landlord £3,800 when they sell, Hamptons said.

This is based on the fact that the average landlord sells their property for £110,000 more than they paid for it last year, before any allowable costs are deducted.

However, when this reduction to a higher CGT rate is combined with the reduction in the annual CGT personal allowance, it will add £454 or around 4 per cent to the average CGT bill.

This table shows the average CGT bill for senior taxpayers, broken down by the duration of the buy-to-let property

Hamptons found that 89 per cent of higher tax-paying landlords who sell will see their CGT bill rise in April, by an average of £454.

The change to personal allowances also means that all lower tax rate landlords will see their CGT bill rise from April, by an average of £1,674.

Aneisha Beveridge, head of research at Hamptons, said whether a landlord will gain or lose from the changes will depend on their overall wealth.

The lower personal allowance combined with lower tax rates means that landlords paying higher taxes and reporting profits of less than £68,000 will be worse off.

Meanwhile, those who report bigger profits will be better off.

Given that the average landlord who sold in 2023 (after buying since 1995) reported a gross profit of £110,000, this means that almost all landlords (whether lower or higher rate taxpayers) will have to pay more tax when they sell .

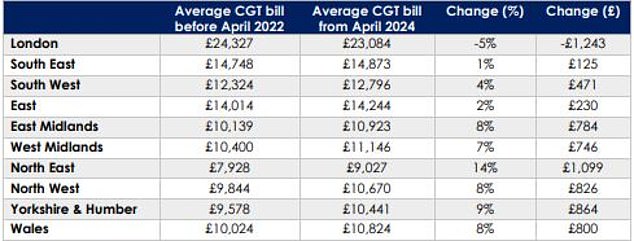

“Recent changes to CGT will hit landlords who make the smallest profits the hardest,” Beveridge said.

“Typically, these will be newer millennial investors who have seen less price growth, or those selling cheaper homes in cheaper parts of the country.

‘Meanwhile, older investors, who have been landlords for longer and have built up larger profits, are much more likely to benefit from the tax cut.’

Beveridge also pointed out that many serious landlords will not be affected by the CGT changes because they own their properties through a limited company, rather than in their own name.

A record 50,004 limited buy-to-let businesses were established across Britain in 2023, surpassing the previous record of 48,540 set in 2022 by 3 percent.

“The Chancellor’s changes to CGT rates only apply to taxpaying landlords with houses in their own names,” she added.

‘Meanwhile, more and more investors with homes in companies pay corporate tax on the sales proceeds after deduction of costs.

‘While tax efficiency has been the biggest attraction of a corporate structure, increasingly it is also the security and stability it provides.

“Chancellors are generally less likely to tinker with corporate tax rules than individuals.”

Average higher taxpayer CGT bill by region: Investors selling into cheaper markets are more likely to be negatively affected by the changes

Hunt said the change to CGT was made to support the housing market.

He believes this will encourage more landlords and second home owners to sell their properties, making more properties available to buyers, including those looking to get on the property ladder for the first time.

However, Beveridge said the CGT personal allowance would have the opposite effect.

She said: ‘While the Chancellor made it clear that he hoped to encourage landlords to sell up and add new homes to the first-time buyer market, the reality is that, on the whole, the changes to capital gains tax are likely to act as such. a discouragement.

“Most landlords leaving the market this year will end up paying more in taxes than they did two years ago, not less.”

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.