Mortgaged over-55s say cost of living will make it hard to pay off before they retire

>

Nearly one in three over-55s with a mortgage say their repayment plans have been affected by the cost-of-living crisis.

In total there are 3.3 million over 55s in the UK who have an outstanding balance on their mortgage. Of them, 16 percent say the rising cost of living will make it more difficult to meet their goal of paying off the loan before retirement, according to advisor Key.

And 13 percent of the group say current economic conditions will make it take them longer to fully own their property.

Rising costs: More people over 55 are struggling to pay off their mortgage before retirement

The situation has deteriorated rapidly over the past 12 months. In the second quarter of 2022, 44 percent of over-55s with a mortgage said the current environment had no impact on their repayment plans. Now that figure has dropped significantly to 28 percent.

Rising interest rates on mortgages have limited people’s ability to get better terms when remortgaging and have increased the overall cost of each outstanding balance.

>> Will mortgage rates go down in 2023?

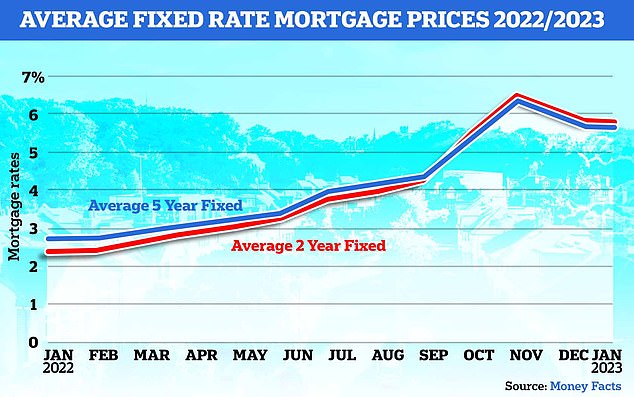

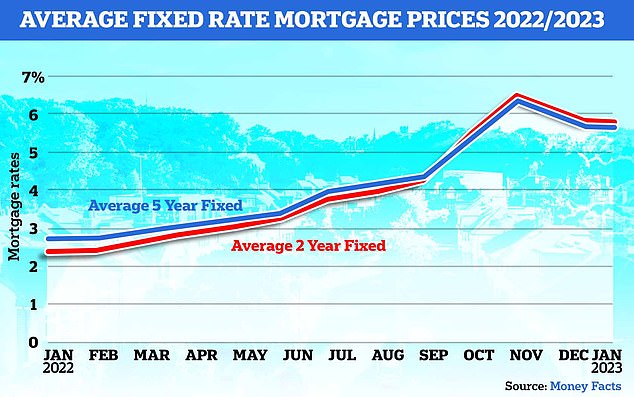

On August 1, 2022, the average two-year fixed mortgage rate for all deposits was 2.52 percent, according to data from Moneyfacts.

The figure peaked at 6.65 percent on October 20, and the five-year fixed rate peaked at 6.51 percent on the same day.

There has been some slowdown recently as the average fixed rate for both two and five year mortgages has been falling steadily despite a series of key interest rate hikes from the Bank of England in an attempt to tackle the high level of inflation.

However, average fixed-rate mortgages are still much higher than they were six months ago at 5.75 percent and 5.57 percent over two and five years, respectively.

You can check how much a mortgage deal would cost you every month with our real cost mortgage calculator.

The rise in mortgage rates has affected those who want to repay their loan before retirement

Two out of five (40 percent) of the over-55s have already paid off their mortgage. Last week, data from the 2021 Census showed that 32.8 percent of households (8.1 million) owned the property they lived in, up from 30.8 percent (7.2 million) in 2011 .

Will Hale, CEO of equity release advisor Key, said: “It is extremely concerning that nearly 900,000 people over 55 will find it more difficult to repay their loan as they work hard to cope with rising household bills in addition to the need to save enough. to enjoy a safe and satisfying retirement.

‘While homeowners should always seek specialist advice before choosing to access home equity, this option should be carefully considered – especially given the flexible nature of products such as home equity releases.’

>> What to do if you are having trouble paying your mortgage payments

‘I sold my childhood home because the costs were too high – now I’m mortgage-free 11 years earlier’

Products such as equity release are not for everyone, and many will opt for downsizing instead.

Last year, Fiona Moore, a 55-year-old social worker from Blackburn, decided to downsize her childhood home after the combination of mortgage payments and necessary repairs became unsustainable.

“It was the childhood home where I raised my kids, so I did everything I could to keep it,” she told This is Money.

“I took a mortgage break, but ended up getting into debt with other things so I could keep the mortgage. I put the weekly groceries on a credit card because keeping house was more important.’

However, last year she decided that the situation could not continue because she had negative net worth and the situation was damaging her health. The property also needed £44,000 worth of repairs, which would have required her to take out a loan.

Fiona, 55, decided to downsize her property after mortgage payments became prohibitive

If she were to renew the mortgage on her original property it would have taken her until she was 71 to pay off the mortgage, but in her new home she will have repaid the £32,000 loan in 5 years; by the time she is 60.

“I hope to travel and do more interesting things,” she says.

However, it also suffered from the sharp rise in mortgage rates last year. Fiona had originally hoped to sell her property in March, which would allow her to get a 2.9 percent rate on her new home, but the buyer fell through, meaning she had to wait longer and pay a much higher rate of 4.9 percent. percent had to accept. .

Though she considered releasing the property, the experience of selling her father’s home after he did the same made her reluctant to go down that route.

>> Downsizing or Equity Release: Which Option is Best for You?

Data from equity release advisor Age Partnership shows that 37 percent of homeowners used the equity release to pay off their mortgage in 2022.

Equity release allows homeowners age 55 and older to release a percentage of their property value as tax-free money while still retaining ownership of their home.

According to figures from the Equity Release Council, the product has grown in popularity in recent years, with £1.7 billion being released from property between July and September 2022.

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and use it for free. We do not write articles to promote products. We do not allow any commercial relationship to compromise our editorial independence.