Mortgage rates FALL for third consecutive week to 7.44% offering hope to homebuyers – after property sales tanked to 13-year low

Mortgage rates fell for the third week in a row to the lowest level in more than a month, offering some respite for overburdened homebuyers.

Figures from government-backed lender Freddie Mac show that the average interest rate on a 30-year loan has fallen from 7.5 percent to 7.44 percent from last week.

The market has calmed down after the Federal Reserve appeared to stop its aggressive interest rate hike campaign. Fed officials voted last month to keep interest rates steady at a 22-year high of between 5.25 and 5.5 percent.

Experts are now hopeful that the news will breathe life back into the US real estate landscape, which has been plagued by rising interest rates.

Sam Khater, chief economist at Freddie Mac, said in a statement: “The combination of continued economic strength, lower inflation and lower mortgage rates should likely bring more potential homebuyers into the market.”

Mortgage rates fell for the third week in a row to the lowest level in more than a month, providing some respite for overburdened homebuyers

Buyers are currently facing one of the least affordable housing markets in recent memory.

Two years ago, home loan rates hovered at 3.10 percent – less than half of where they are today.

In real terms, this means that someone buying a €400,000 house in November 2021 would pay around €1,623 per month for their mortgage. This analysis assumes a 5 percent down payment.

But the same buyer today faces monthly payments of $2,641 – more than $1,000 extra.

It’s no wonder that sales of previously occupied U.S. homes fell at the slowest pace in more than thirteen years in October.

Sales of existing homes fell 4.1% last month from September to a seasonally adjusted annual rate of 3.79 million, the National Association of Realtors said Tuesday. That’s weaker than the pace of 3.90 million sales that economists had expected, according to FactSet.

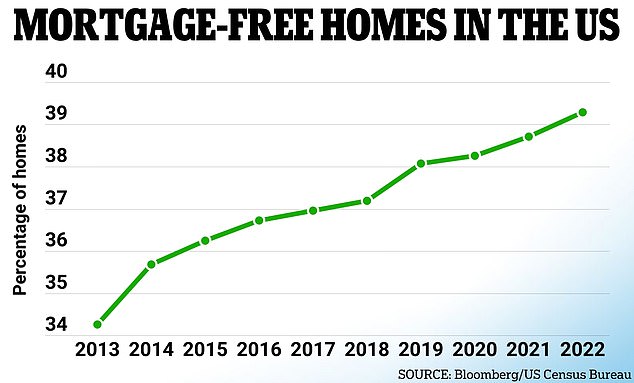

Between 2013 and 2022, the percentage of Americans with full ownership of their home will increase by about 5 percent

The number of mortgage-free single-family homes increased by 7.9 million between 2012 and 2022

The last time sales fell this hard was in August 2010, when the housing market was recovering from a serious crash.

Despite the drop in sales, home prices continue to rise compared to this time last year, boosted by a lack of available homes on the market.

The national average sales price rose 3.4 percent from October last year to $391,800.

“The lack of inventory and higher mortgage rates are really holding back home sales,” said Lawrence Yun, NAR’s chief economist.

It comes after separate data showed the share of U.S. homes owned outright rose 5 percent in a decade to a record high.

Last year, nearly 40 percent of Americans owned their own home, but a decade earlier, in 2013, that number was just 34 percent, according to U.S. Census Bureau data cited by Bloomberg.

The trend is driven by an aging population that has had relatively low mortgage rates and has had options to refinance them as they get older, the outlet reported.