Mortgage rates below 4% are disappearing: why do they go up when interest rates fall?

Mortgage rates continue to rise despite the Bank of England cutting rates last week.

Today, the last fixed interest rates below 4 percent that major banks and building societies offer have been withdrawn from the market.

So far this week, seven major lenders have increased their mortgage rates.

This may have come as a surprise to mortgaged households, especially given that the Bank of England voted last Thursday to cut its base rate from 5 percent to 4.75 percent.

As expected, many banks responded by lowering interest rates on savings products. In the immediate aftermath, major banks including Chase and Monzo reduced available rates through their easy-to-access deals.

As of Monday, at least 27 easy-to-access deals have been scrapped or withdrawn since the base rate cut.

Banks are also cutting rates on mortgage trackers that track base rates, as well as on standard variable mortgage rates – the rate borrowers return to after their fixed rate expires. About 1.4 million borrowers could benefit from this.

However, fixed-rate mortgages, the favorite product of seven million households, are being overhauled.

Rising: Mortgage rates are rising as markets now believe rates will remain higher for longer, while inflation is also expected to remain higher than previously expected

Just a few months ago, there were more than a dozen banks offering rates below 4 percent.

Now only Allied Irish Bank is currently offering interest rates below 4 percent – and that is expected to be withdrawn soon.

David Hollingworth, deputy director at mortgage broker L&C Mortgages, said: ‘The slew of interest rate changes in recent weeks has pushed rates further higher, reflecting higher costs for lenders, as the market outlook for rates moves towards a ” have been pushed to a higher level for longer. expectation.

‘Now fixed interest rates from all major UK lenders have risen above 4 per cent again.’

Why are fixed mortgage rates rising?

Market expectations about how quickly and how low interest rates will fall in the future have changed recently – and this has a direct impact on fixed mortgage rates.

The Bank of England’s base rate is still expected to fall over time, but markets are now wondering whether this pace will be as rapid.

Last year, predictions about where base rates would ultimately peak fell from a high of 6.5 percent to 5.25 percent, and mortgage rates shifted with them.

Early this year, markets had priced in six or seven cuts to the base rate in 2024, with investors betting on a rate cut to 3.75 percent or 3.5 percent by Christmas.

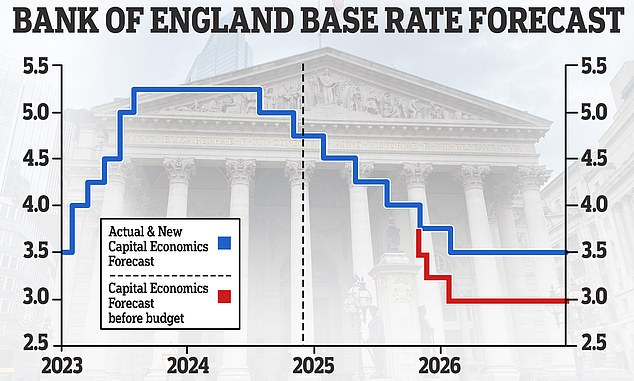

New forecast: Capital Economics has changed its interest rate forecast as it now thinks the Bank of England will cut rates more slowly

But this has not happened and markets now expect only three or four rate cuts between now and the end of 2025, meaning the base rate would fall to 4 percent or 3.75 percent.

This has changed especially in the last few weeks as Labor’s budget plan to borrow and spend more has put government bond markets in some trouble, pushing up interest rate expectations and government bond yields.

There are also fears that Donald Trump’s return to the White House could have an inflationary effect on Britain. This could lead to the Bank of England keeping interest rates high for longer.

Jack Tutton, director at estate agent SJ Mortgages, told news agency Newspage: ‘The Budget has been a disaster for the mortgage market. It came just as we were seeing the green shoots of recovery.

“The cost of borrowing has increased significantly for lenders compared to what it was before the budget.

‘This has left lenders little choice but to pass on these increases and increase mortgage rates.’

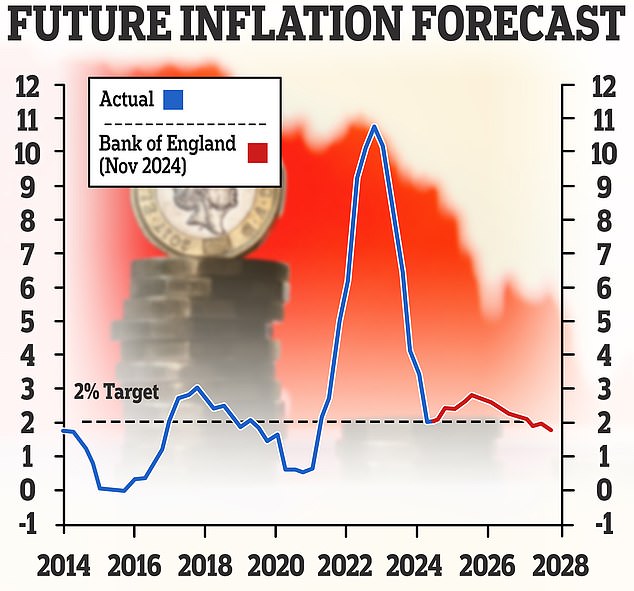

Tutton believes this is driven by concerns that inflation will rise again, above the Bank of England’s target of 2 percent. Currently this is 1.7 percent.

The Chancellor’s budget policy to increase employers’ national insurance contributions could drive up inflation, he says.

Inflation forecast: The Bank of England expects inflation to hover just above 2% until 2027

“They will leave many companies with little choice but to raise prices to help cover these additional costs,” he added.

‘These increases are likely to push up inflation once they come into effect, meaning interest rates will stay higher for longer. This is to the detriment of mortgage holders.’

The expectations of the mortgage market are reflected in something known as the Sonia swap rate.

These are agreements where two counterparties, for example banks, agree to exchange a stream of future fixed interest payments for a stream of future variable payments.

Simply put, swap rates show what financial institutions think the future holds in terms of interest rates.

On November 12, the five-year swaps were 4.05 percent and the two-year swaps were 4.26 percent, both a trend that is well below the current base rate.

Five-year swaps have risen from 3.87 percent on October 29, the day before the Budget. They are up from 3.7 percent on October 24.

Emma Cox, director of real estate at Shawbrook bank, said: ‘Fixed rate mortgages are priced based on a range of factors beyond just the current BoE base rate, including swap rates and general economic risks.

‘These factors take into account the expected cost of funds over the life of the mortgage.

‘It is possible that the Bank of England’s base rate will fall today, but at the same time the market may adjust its expectations based on the pace and size of future rate cuts.

“This shift could lead to higher fixed-rate prices over the longer term, as we have seen recently.”

What should I do if I need to take out a new mortgage?

The forecasts change regularly, but for the time being the advice to borrowers who have to take out a new mortgage in the coming months is to fix a new interest rate now.

Normally, borrowers can still change their mind and switch to a different rate – with their existing lender or a new one – if a cheaper rate becomes available before their new mortgage takes effect.

On the other hand, acting early means they won’t miss out if interest rates rise.

“For customers nearing the end of their fixed rate period, it is essential not to wait too long in the hope that interest rates return to the levels seen weeks ago,” said Nicholas Mendes of mortgage broker John Charcol.

‘Securing a deal now offers certainty in an uncertain market. There is always the opportunity to review and adapt as circumstances change, but acting quickly will minimize exposure to further rate increases.

“I cannot emphasize enough the importance of staying informed and proactive when managing mortgage obligations in today’s rapidly changing financial environment.”

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.