More than a million Brits will face a £1,800 increase in mortgage costs by 2024, think tank says

- The poorest half of households are facing the end of cost-of-living support and tax changes

- The first households were poorer at the end of a parliament than at the beginning

A 'mixed picture' of falling inflation, interest rate cuts and tax changes will leave the richest half of Britons better off by 2024, while poorer people face even more income shrinkage, a think tank has claimed.

The Resolution Foundation warned that 1.5 million mortgage holders will face an average increase in annual bills of £1,800 over the next 12 months, while the poorest 50 per cent of households will see the end of living cost support and possibly even will have to endure higher tax bills.

And as Britain heads into a general election year, the group says 2024 will be the first time British households will be poorer at the end of a parliament than they were at the beginning.

Lower-income households will come under pressure next year, a new report shows

The Bank of England's base rate increases and the resulting impact on mortgage rates made headlines throughout 2023 amid increasing pressure on households and businesses.

But in a report published today, the centre-left think tank calculated that households would be better off in 2023 due to higher interest rates.

The interest rate rises resulted in 'higher returns on savings (which) outweighed higher mortgage costs', boosting household incomes by £19 billion, the report said.

> What next with the mortgage interest and should you solve this?

The report added: 'For UK households as a whole, real savings interest income has actually risen £35 billion annually since the Bank of England started raising rates, more than double the £16 billion increase from the interest costs on debts.

'This £19 billion increase in net interest income equates to 1 per cent of household disposable income. This is not normal (or even remotely shared); in fact this is unprecedented in the recent history of UK rate hike cycles.”

However, the Resolution Foundation warned that 'the reverse will be true by 2024' as rate cuts fail to quell the 'big hits to housing costs'.

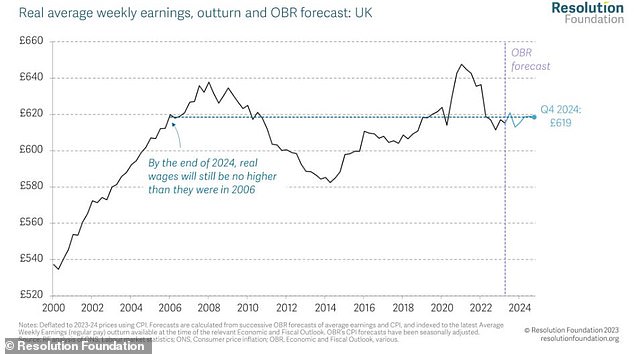

At the end of 2024, real wages will not be higher than in 2006

The UK base rate is currently 5.25 percent after several consecutive increases, but rates are now expected to fall, with 1.34 percentage points of cuts priced in for next year.

While this means the increase in people's mortgage costs “will not be as painful as it would otherwise have been”, the report said, the 1.5 million households looking to remortgage are still facing a significant jump .

The BoE has halted base rate increases as inflation continues to moderate, with the CPI falling from a peak of 11.1 percent in October 2022 to 3.9 percent last month.

But consumers still have to pay much higher prices for some basic necessities.

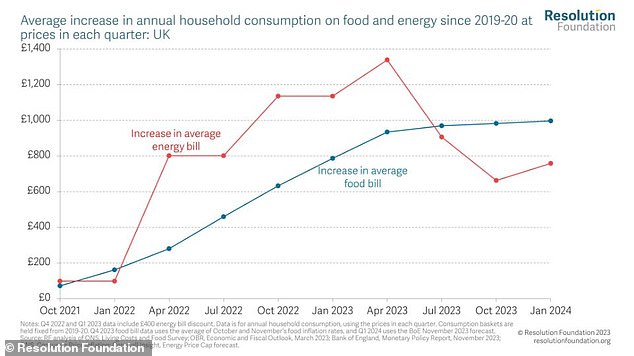

Energy costs have fallen, but food prices are only just beginning to moderate

The Resolution Foundation said: 'As we enter 2024, the average annual food bill will remain £1,000, and the average energy bill £760, higher than before the pandemic.

'Everyone needs to heat their homes and put food on the table, so the bottom line on the cost of living has hit us all – although poorer households, who spend a larger share of their budgets on basic needs, have been hit hardest.'

And poorer households' incomes are also likely to take a hit from the end of February due to the cost of living for pensioners and families on means-tested or disability benefits.

The report says 2024 will be worse for poorer Britons 'than the last two years', with the average household in the poorest quarter of the working population on course for a 2 per cent fall in income next year.

It added: 'The immediate backdrop to the 2024 general election is highly variable and uncertain – but the big picture from Parliament as a whole is clear: Britain is poorer.

'Of course, the recent past has shown us that there is great uncertainty about this. If inflation continues to fall rapidly and wages hold up, things would look much better.”

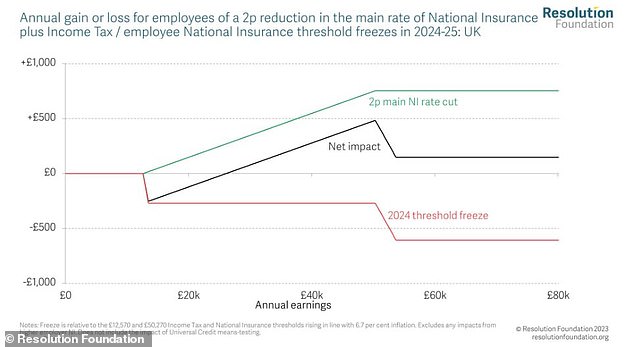

Lower earners will be worse off under the new tax rules