Millions would still pay income tax on their state pension under ‘triple lock plus’, study finds

The triple lock: This means that the state pension increases every year with the highest inflation, average income growth or 2.5%

Millions of older people pay income tax on their state pensions and would continue to do so under a ‘triple lock plus’ proposal, new research has found.

An estimated 2.5 million pensioners, or just over one in five of all UK residents, receive a state pension in excess of the personal allowance of £12,570.

This is the level at which income tax comes into effect, and it has been frozen since 2021, prompting the Conservatives to include a ‘triple lock plus’ pledge in their manifesto.

The party has pledged that the state pension will never be taxed as it will always keep the nominal rate, which currently stands at £11,500 a year, below the personal allowance.

But new research from pensions adviser LCP shows there is huge diversity in the amount of state pension people receive, and says focusing on a single figure of the standard new state pension is missing a significant group of retirees who receive more than that.

‘The reality is that the amounts pensioners receive vary enormously, from a few pounds a week to hundreds of pounds a week,’ says Steve Webb, partner at LCP and This is Money’s pensions columnist.

‘But much of the discussion has assumed that pensioners will typically receive a standard pension rate, such as the new flat rate of around £11,500 per year.’

What does the average retiree get today?

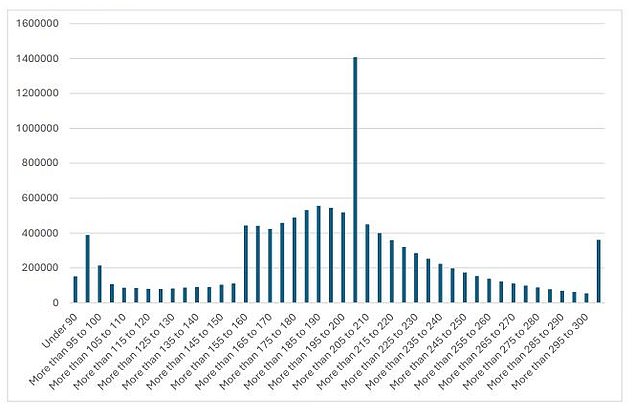

The spike between £200 and £205 reflects the fact that the standard rate of the new state pension in 2023/2024 was £203.85 per week, LCP says. The graph shows the highly variable outcomes of the basic and supplementary state pension under the old state pension system, from which most retirees still benefit

LCP analyzed government data and found that about 2.5 million retirees currently have state pensions above the income tax threshold.

Of these, around 2.1 million people reached state pension age under the old pre-2016 system, earning enough of the second state pension, known as SERPS, to build up more generous payments in retirement.

The rest retired under the post-2016 lump sum system, but transitional arrangements to protect people from losses mean they also receive larger payments.

In total, in 2023/24 there were 8.4 million pensioners who reached state pension age before April 6, 2016 under the ‘old’ state pension system, and 3.2 million who reached pension age after this date under the ‘new’ AOW system.

Pensioners on the ‘old’ AOW

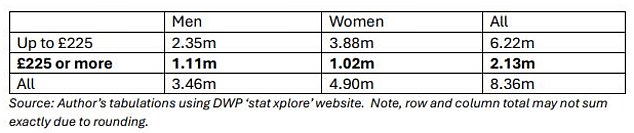

Number receiving a weekly pension above/below £225 per week, by gender, 2023/24. Many of the women with higher pensions will be older widows who inherited payments from their late husbands, LCP says

Pensioners about the ‘new’ AOW

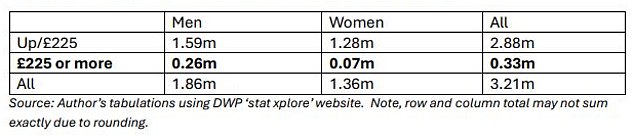

Number receiving a weekly pension above/below £225 per week, by gender, 2023/24. About a third of a million people received amounts that would put them above the tax threshold in 2024/2025, and the vast majority are male, says LCP

What is triple lock plus?

The Conservatives promised that the state pension would never be taxed under the plans they called ‘triple lock plus’.

The triple lock promise means the state pension will rise every year at the highest rate of inflation, average income growth or 2.5 per cent – both the Tories and Labor have pledged to stick to this through the next parliament.

But under the Tories’ ‘plus’ policy, the £12,570 personal allowance would also be increased in line with the triple lock, to keep it above the full state pension.

The Tories promise to only do this for people who have reached state pension age, in effect creating a new preferential personal allowance for the older generation.

STEVE WEBB ANSWERS YOUR PENSION QUESTIONS

The working-age population will keep less of their income because income tax will impose a lower personal deduction threshold for them.

For practical reasons, it is likely that Labor, if elected, would also have to tackle this problem in the coming years, to keep the nominal state pension below the level of the personal allowance.

This is due to the abnormal situation where the Department for Work and Pensions pays millions of people a state pension, some of which is then reclaimed in income tax by the Treasury, potentially forcing an increasing number of people to submit annual tax returns to the HMRC.

Because millions of elderly people receive private pensions in addition to the state pension, and many also have savings that have to pay tax on the interest, they would have to continue paying income tax anyway.

About 2.5 million people have to pay income tax on their state pension alone

Cuts to the fair value of income tax exemptions and large increases in state pensions have led to a rise in the number of over-65s paying income tax since 2010. This trend will continue with the current policy according to Steve Webb.

He says the ‘triple lock plus’ policy would mean a lower tax burden for millions of pensioners than if the government continued to freeze personal allowances for them.

But the figures above suggest that many would still not benefit from the stated target of making the state pension completely free from income tax, he adds.

“We estimate that around 2.5 million retirees, or more than one in five of all retirees, have a state pension in excess of the income tax threshold,” Webb says.

“These retirees would largely remain taxpayers even if future policy were to link the income tax deduction to increases in the nominal rate of the state pension.”

A Conservative Party spokesman said: ‘Under the triple lock plus, the tax-free amount for pensioners will rise in line with the fastest prices, earnings or 2.5 per cent – just like the state pension.

‘Because Labor opposes it, it means that a pensioner whose only income comes from the new state pension will have to pay income tax for the first time in the history of our country.

‘Millions of pensioners will pay more tax under Labour’s pension tax – with the average pensioner in the next Parliament paying around £1,000 more in tax under Labor than under the Conservatives.’

The PvdA was approached for comment.

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.