Millions of Americans must check their credit cards now or risk ruining their next vacation

Capital One’s acquisition of rival Discover spells trouble for Americans using their credit cards abroad, experts warn.

Regulators quietly approved the $35.3 billion takeover just before Christmas, which will create the US’s largest card issuer.

In addition to increasing its customer base, Capital One also wanted to gain control of Discover’s payment processing network, a competitor to services offered by Visa, Mastercard and American Express.

Payment processors act as an intermediary between merchants and card issuers and receive a small portion of each purchase.

Until now, Capital One has relied on Visa and MasterCard networks, which are widely accepted worldwide. Because it will own Discover’s payments network once the deal closes early this year, it will no longer have to rely on it.

But once the cards transition to the Discover network — which is less common outside the U.S. — travelers could face limited payment options, experts warn.

“In most cases, Discover is more or less universally accepted in the U.S., as are Visa, MasterCard and American Express,” said Matt Schulz, chief credit analyst at LendingTree. Fortune.

“Where you might run into more problems is with international travel, because Discover may not be as widely accepted.”

By acquiring Discover, Capital One will own one of the nation’s largest payment processing networks, joining Visa, MasterCard and American Express.

Travelers are advised to remain alert to these potential changes and consider backup options for international expenses.

Capital One said it plans to move all of its debit cards and some credit cards to Discover’s network starting in the second quarter of this year.

“Over time, we will move a growing portion of the credit card business to the Discover network,” Capital One CEO Richard Fairbank said during an investor presentation last February.

“In total, we expect to add more than 25 million Capital One cardholders and more than $175 billion in Capital One purchasing volume by 2027, on both a debit and credit basis.

“This injection and volume into the network will help Discover be competitive with the leading network.”

Capital One is the nation’s ninth largest bank by total assets, with 259 physical branch locations, 55 “Capital One Cafés” nationwide and a major online banking business.

Discover Financial, meanwhile, is a primarily online bank with one physical branch in Delaware.

Capital One’s acquisition of credit card company Discover could cause problems for Americans using cards abroad, experts warn

If the merger goes through, Capital One would be the nation’s largest card issuer by outstanding credit card loans, becoming even larger than JPMorgan Chase

Another key element of the merger is how it could impact competition within the payment network space.

It’s possible that the merger will reduce competition among issuers, and progressive Democratic lawmakers have long fought against bank consolidation, arguing that it increases systemic risk and harms consumers by reducing lending.

New research from the Consumer Financial Protection Bureau (CFPB) found that larger credit card issuers charged higher interest rates and annual fees than smaller banks due to a lack of competition.

If the merger goes through, Capital One would be the nation’s largest card issuer based on outstanding credit card loans, becoming even larger than JPMorgan Chase.

“Anytime there’s more consolidation and less competition, there’s always the possibility of rates and fees going up, but I don’t see that as a big problem,” Schulz said.

However, he argues that the deal could actually make the payment processing space more competitive, challenging the dominance of MasterCard and Visa.

This could lead to better rewards on credit cards for consumers as issuers compete for customers.

“One thing that will be interesting to see is how the credit card rewards programs combine together,” Schulz added.

“Capital One will have to decide how to handle Discover Miles and whether to keep these two rewards programs separate or bring them together, and that decision will impact consumers.”

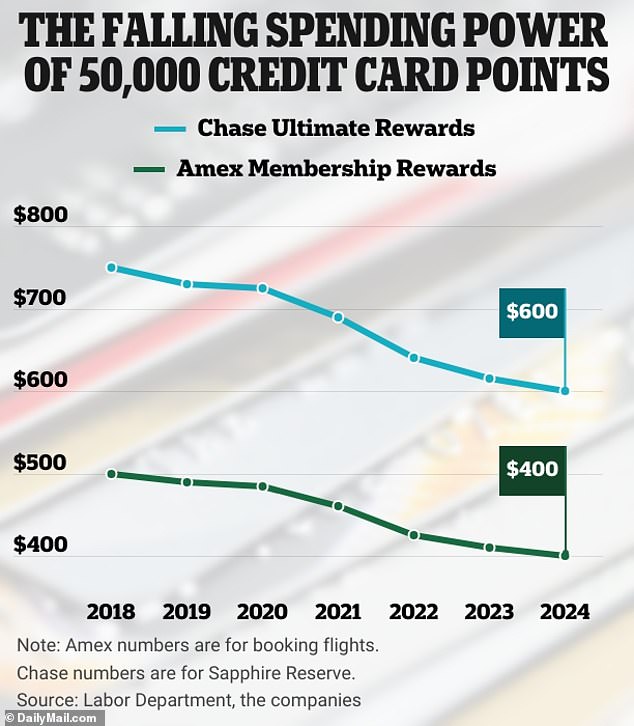

Inflation begins to erode the value of points as users redeem them directly through a bank’s portal or online app

Meanwhile, a recent report showed how the value of credit card reward points has gradually declined as inflation has taken hold.

A rewards point has long been worth about one cent when used to cover other purchases.

But according to the Bureau of Labor Statistics, one penny has lost about 20 percent of its purchasing power since 2018.

This means that a point has also decreased in value by approximately the same amount. If you accrued 50,000 points with a major credit card issuer in 2020 and still haven’t spent them, they are now worth about 41,300.