Midwestern state seeking to create its own cryptocurrency is the nation’s first plan to take on big tech companies

Wyoming is on track to become the first state to offer a state-backed cryptocurrency, according to Governor Mark Gordon.

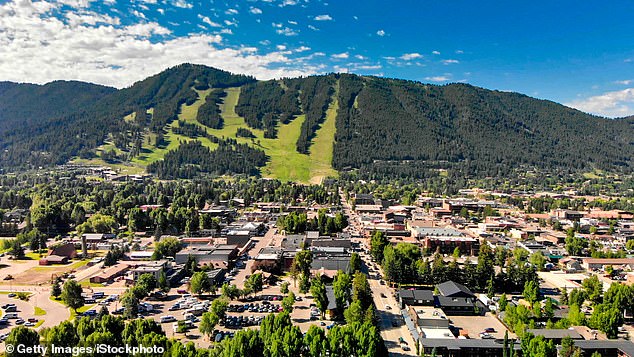

Gordon told a conference in Jackson Hole on Thursday that the state is working on its own stablecoin, which is slated to launch next year.

According to Cowboy State Dailyhe said, “We want to do it right. We want to find the right methodology to implement it. We’ve done a lot of that work.”

In May, the state passed the Wyoming Stable Token Act, which created a commission to study the issue and offer stable tokens, which are typically pegged to another asset, such as the dollar.

Wyoming is one of the first states in the country to explore its own cryptocurrency, which Gordon said underscores the state’s commitment to innovation.

Governor Gordon, pictured here, spoke at a conference in Jackson Hole on Thursday and revealed that the state is working on its own stablecoin, or stable token, to launch next year.

In May, the state passed the Wyoming Stable Token Act, which created a commission to study the issue and issue stable tokens, which are typically pegged to another asset, such as the dollar.

He added, “For the state, it’s a great way to diversify our economy. It’s exciting to see that, now that a lot of trust companies have moved here, financial companies that are looking at Wyoming understand that we have the ability to be first movers fairly quickly and intelligently.”

“Innovation is in our DNA. That’s why Wyoming was the first to have the LLC law. (Digital) innovation has really evolved across multiple laws, and it’s really remarkable where we are now.

“I’m glad that we in Wyoming can continue to work hard to ensure that this is a favorable environment for business, that taxes are low and that we can encourage innovation.”

According to CNBCThe state is currently exploring potential partners who can help build the stablecoin.

An exchange and wallet providers (Coinbase and Kraken both offer them) are required to purchase and store the token.

The state plans to issue the token to an exchange so that it can then be distributed to private users.

According to Flavia Naves, commissioner of the Stable Token Commission, it would simply be a payment method for everyday purchases.

She told the medium: ‘If you walk into Cowboy Coffee in Jackson, Wyoming, and you want to buy a latte, their wallet is right there in Solana. You can use it to buy your coffee with your Wyoming token.’

The state plans to issue the token to an exchange so that they can then issue it to the retail user

Naves also said the commission plans to invest the reserves that back each token in circulation and use the interest to invest in public schools.

Despite the governor’s enthusiasm for the project, not everyone in the state is convinced the tokens offer enough to take on the risks.

Scott W. Meier, president/CEO of the Wyoming Banking Association, told Cowboy State Daily: “Right now, I think we’re dealing with a lot of unknowns.

“I wouldn’t say your Wyoming community banks are necessarily against it, but they’re not necessarily supportive of it either. They’re all just watching how this is affecting our industry.”

He worries about how stable the token would actually be. Customers would come and buy tokens, which the government would then buy in tokenized U.S. Treasuries to back that token, and also keep cash in reserve.

Meier suggested that the problem lies in what happens to the value of those notes when interest rates rise and someone wants to exchange their token for money.

Despite the governor’s enthusiasm for the project, not everyone in the state is convinced the tokens offer enough to warrant taking the risks

As long as cash is available, the government must sell the Treasury bonds to complete the transaction.

He added: ‘But if you had a Treasury note with 2% interest and interest rates suddenly went up, you couldn’t sell it because nobody wanted to buy it. Those are the things the market would do strange things with.’

Meier also fears that money will be taken out of the system, which could cause scarcity with all the consequences for the economy.

He added: “Let’s say a bank in Wyoming has a customer who wants to put $100,000 into a Wyoming stable token.”

“That money is now out of our system. And maybe that’s good or maybe that’s bad, depending on how you look at it, but from a banking standpoint, that’s $100,000 that’s not in the bank. That’s $100,000 that the bank can’t lend out.”

The decision to move forward with crypto has already had consequences. Gordon has conducted stress tests and federal agencies have imposed barriers on smaller banks.

He added: ‘The Fed now poses more of a barrier to innovation than an opportunity to put America first and ensure the dollar remains the standard we all want to see.

“But it’s also the CFPB, the SEC and the FDIC that are interested in ‘debanking’ the relationships between digital assets and banks. That’s a big part of what we’re trying to accomplish here in Wyoming.”

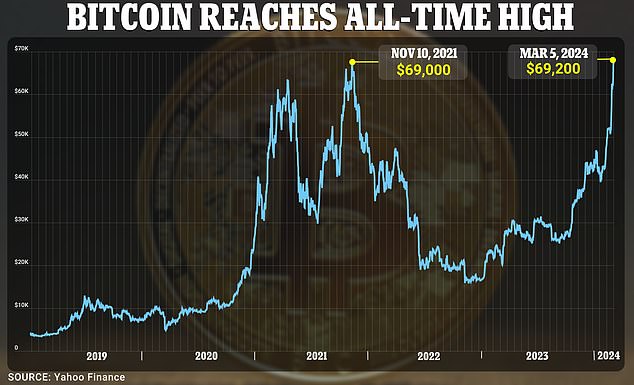

In March of this yearBitcoin’s price hit a record high of $69,000 as people continued to pour their savings into the currency.

The currency’s price surpassed its previous peak from $69,202 in November 2021 and made a huge recovery after the crash in mid-2022, which saw its value fall by almost two-thirds.

The record came after the US securities regulator approved 11 Bitcoin Exchange Trade Funds (ETFs), allowing Bitcoin to be bought and sold like stocks.

While corporate investors and young people using smartphone apps have been able to invest in Bitcoin for years, the adoption of EFT has given the company access to a new goldmine of investors: investors between the ages of 60 and 78.

It gave less tech-savvy baby boomers, born between 1946 and 1964, greater access to buy and track crypto. Instead of investing pension funds on more traditional exchanges, retirees bought Bitcoin.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free. We do not write articles to promote products. We do not allow commercial relationships to influence our editorial independence.