Michele Bullock: The one glaring word missing from Reserve Bank boss’ speech as she says inflation crisis is ‘homegrown’ – and issues a grim warning about interest rates to Australians

Reserve Bank Governor Michele Bullock has warned that Australia’s skyrocketing inflation is a homegrown problem, but did not address concerns that increased immigration is worsening the crisis.

Speaking to the Australian Business Economists network in Sydney on Wednesday evening, the RBA governor said local inflation was the dominant driver of the country’s cost of living crisis, pushing back against the perception that inflation was purely caused by supply side constraints.

Ms Bullock’s statement comes as the RBA considers the need for further monetary tightening to slow the economy and return inflation – currently at 5.4 per cent – to the target range of 2 to 3 per cent .

“An important implication of this domestic and demand-driven component of inflation is that it will take time to bring inflation back to target,” Bullock said.

“This shift from primarily supply-driven to primarily demand-driven inflation has been part of our inflation outlook for some time.”

Reserve Bank Governor Michele Bullock (above) admitted Australia’s skyrocketing inflation is a homegrown problem

The RBA is considering ways to reduce Australian inflation, which currently stands at 5.4 percent, to its target range of 2 to 3 percent.

Ms Bullock’s comments appear to contradict claims made by some members of the Albanian government, who have consistently referred to the impact of global price pressures on the Australian economy.

“The world is putting price pressure on Australians and we are doing our best to alleviate it,” Treasurer Jim Chalmers said a few weeks ago.

Her speech was also not based on the suggestion by a number of economists, including ABC finance guru Alan Kohler, that immigration increases pressure on already stressed markets.

More than 400,000 migrants moved to Australia in the year to August, with almost 1.5 million expected to arrive in the next five years.

“How can the Reserve Bank be expected to slow demand when there are still half a million mouths to feed?” Kohler asked in the New Daily last month.

Noting that prices for labour-intensive services, including trips to the dentist, hairdresser or restaurant, continued to rise sharply, Ms Bullock said national demand for goods and services continued to outstrip supply.

“The cost of these services is also generally determined by the price of domestic inputs,” Ms Bullock said.

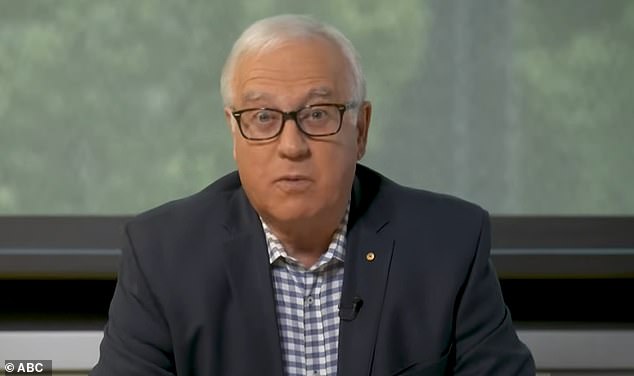

ABC finance guru Alan Kohler (pictured) warned that growing immigration numbers will worsen inflation

Referring to the country’s wage costs, Ms Bullock contrasted this with anemic productivity growth, which could cause further inflationary pressures if productivity did not improve.

“Labor costs have risen, especially if we include the effect of weak productivity growth.”

New data released last week showed annual wage growth rose to a fourteen-year high of 4 per cent in September as wage earners and aged care workers received one-off pay rises following decisions by the Fair Work Commission.

At the same time, productivity growth has fallen to the lowest level since May 2016, according to recent GDP figures.

For businesses, utility bills, rents and insurance had also “noticeably increased,” she added.

Governor Bullock also sought to counter the narrative that price pressures were broad-based, rather than reflecting excessive increases for a few items.

“Inflation is much broader than just rising prices for gasoline, electricity and rents,” she said, adding that “prices are rising sharply for the majority of the goods and services we all consume.

Ms Bullock said that for businesses, energy bills, rents and insurance have also ‘noticeably risen’

Minutes for the RBA’s Melbourne Cup Day meeting released on Tuesday, where the bank’s eight-member board raised the cash rate to 4.35 per cent for the 13th time since May 2022, cited the continued strength of the local economy as the reason for the increase.

“High inflation was underpinned by above-average price increases for a wide range of consumer goods and services,” the minutes said.

“There was clear evidence – particularly for service price inflation, which was quite high – that it was the result of domestically generated pressures associated with aggregate demand exceeding aggregate supply.”

Despite Ms. Bullock’s concerns that inflation will remain persistent, money markets rate only a one in twenty chance that the central bank will raise rates at its next meeting on December 5. However, this chance increases to almost 40 percent in March next year.