Melbourne aged care worker loses $40,000 after scammers gain access to her IGN account

An aged care worker preparing to transition into retirement has been left in limbo after ‘sophisticated’ scammers stole almost $40,000 of her savings.

60-year-old Marylynne Desveaux from Melbourne fell victim to a scam in October in which fraudsters gained access to her ING bank account.

They managed to access the contact list of the beneficiaries of her ING account and change the bank details of one of her contacts to another account.

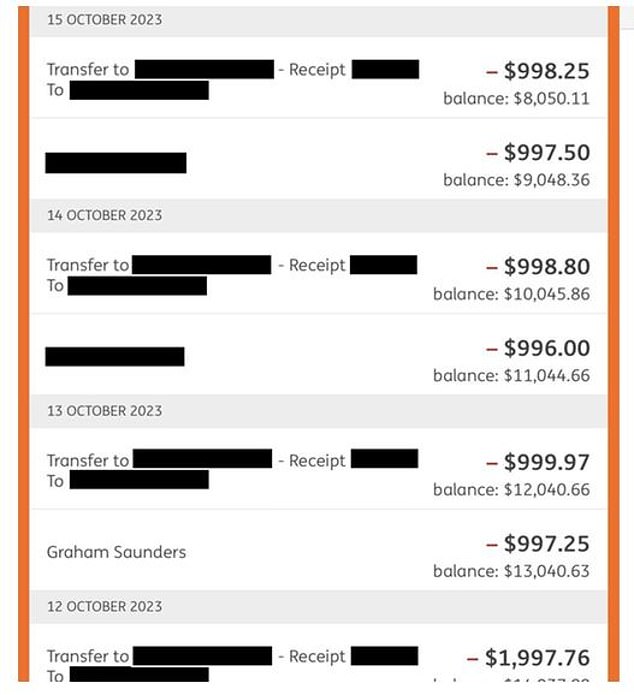

They made up to 16 transfers under her friend Graham’s name to a scammer’s account over a five-day period, causing the loss of tens of thousands of dollars.

Ms Desveaux is the latest Australian to be hit by fraudsters who are using more sophisticated methods to deceive both banks and customers.

Marylynne Desveaux (left), an elderly care worker preparing for retirement, was scammed out of $40,000 of her savings after scammers gained access to her bank account

She only noticed the abnormal transactions when she checked her mortgage account after the RBA hiked cash rates for the 13th time in 18 months on Tuesday.

Ms Desveaux called Graham shortly after finding the transactions and asked if he had received any money from her as her transactions showed that.

However, they both realized something was terribly wrong when she and Graham realized that the bank details under Graham’s name were wrong.

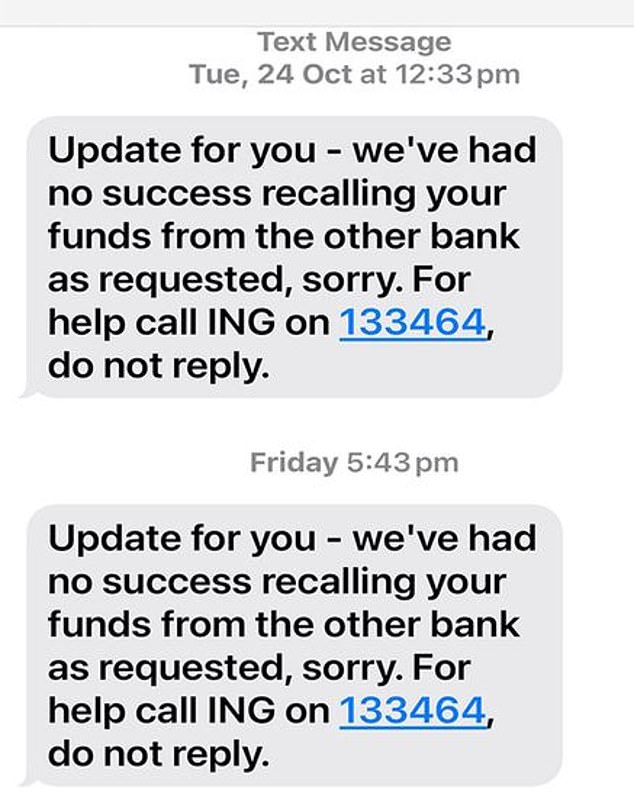

She quickly notified ING, which was able to lock her accounts but not get her money back.

The money would be used to help Ms Desveaux retire after she lost her job during the Covid-19 pandemic and started working in aged care.

“I haven’t slept in two weeks since all this has been going on… I don’t know what to do,” Ms. Desveaux said. 9News.

“I’m trying every way I can to get back, but mentally it’s really affected me and it’s affecting my health because I’ve probably lost three or four kilos in the last few weeks just from stressing about it.”

She has since reported the incident to both police and the Australian Financial Complaints Authority.

While unable to comment on individual cases, an ING spokesperson assured that the bank “thoroughly investigates” each reported scam and “attempts to recover funds where possible.”

“We know that the scams deployed by criminal gangs are becoming increasingly sophisticated, targeting multiple sectors and increasing in frequency,” he said.

The fraudsters changed the bank details of a friend of hers, Graham, to their chosen bank account and over the course of five days her account was emptied (pictured)

Her bank, ING, was able to lock her accounts and prevent the scammers from stealing any more money, but could not get her money back (pictured)

‘We regularly review and improve our security measures to provide our customers with a safe banking experience.

“We also want to educate our customers about the different types of scams and how they can protect themselves.”

ING customers who believe they have been scammed are urged to call their dedicated scam line on 1800 052 743.

Impersonation scams are believed to be a widespread problem in Australian banking, with 14,603 reports to the ACCC in just 2022.

“We are incredibly concerned about banking impersonation scams because they can be so convincing that they are very difficult to detect,” ACCC deputy chair Catriona Lowe said in March.

“What is equally worrying about this particular scam is that every last cent is being drained from victims’ savings accounts, with losses averaging $22,000 and more than 90 reports of losses between $40,000 and $800,000. This is causing both financial and emotional devastation.”