Medicare and Social Security are both in crisis as underfunding hits $175 TRILLION – almost double the economic output of every country on Earth

Medicare and Social Security are in crisis and face significant challenges according to a U.S. Treasury Department report, which indicates the programs are both underfunded to the tune of $175 trillion.

The report suggests that if current trends continue, the programs may not exist when the current generation of American children reach retirement age unless substantial changes are made.

Projections indicate that Medicare and Social Security will struggle to meet full benefit obligations over the next decade, with factors such as inflation and economic output increasing pressure due to insufficient money coming in to support these programs.

“If you consider the entire economic output of every country on planet Earth, that amounts to about $100 trillion. The unfunded liability facing American taxpayers over the next 75 years is $175 trillion,” said Adam Andrezejewski of openthebooks.com declared.

To demonstrate the magnitude of the situation, Andrezejewski compared the unfunded liability to the entirety of federal expenditures since the founding of the United States in 1787.

Medicare and Social Security are facing a significant underfunding crisis, which a recent U.S. Treasury Department report puts at $175 trillion

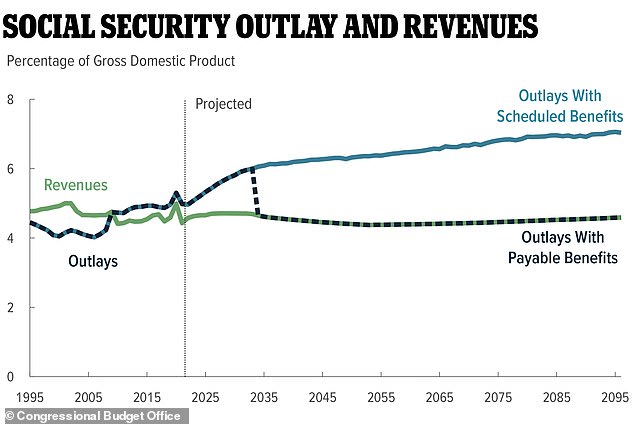

In a recent forecast, the Congressional Budget Office said the gap between spending and revenue meant that cash reserves would be depleted within a decade, forcing a reduction in payments to levels that matched the money coming in.

The CBO’s latest forecasts show that the current gap between fund expenditures and revenues received – if continued over the next decade – will officially bring the fund to zero.

“Here’s another way to look at it. “If you look at all the federal spending since the beginning of our country, when the Constitution was written in 1787, and if you add it all up, this number rivals all the federal spending since the beginning of our country,” Andrzejewski said. “So it’s a huge, unfunded liability and it threatens to bankrupt our country.”

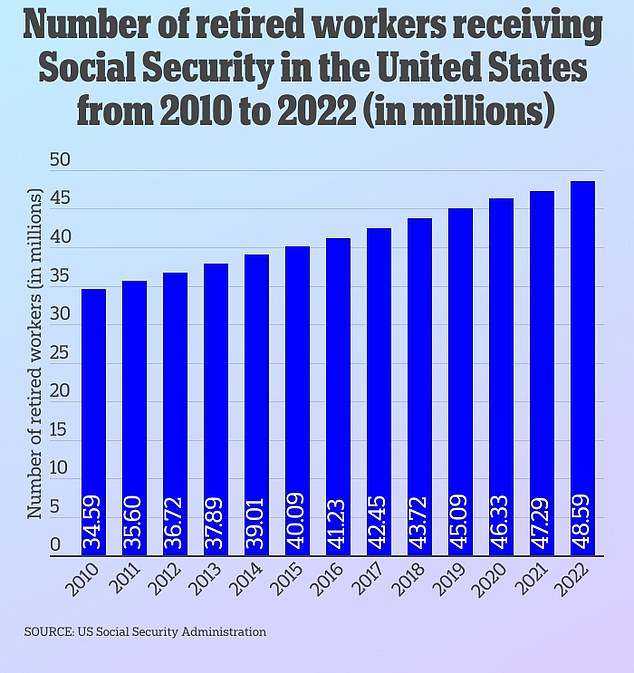

Social Security spending has been rising as more Americans reach retirement age and leave the workforce, relying solely on the fund’s benefits.

The Congressional Budget Office (CBO) says Social Security’s cash reserves will run out in 2033 and without reforms will no longer be able to pay full benefits.

Experts have warned that if that happens, payments won’t disappear completely, but will likely be cut by about 25 percent.

The Bureau has outlined the problem of the steady-as-she-goes approach in its most recent forecasts.

“Under these projections, Social Security spending will rise rapidly relative to gross domestic product (GDP) over the next decade as the large baby boom generation retires,” the report concluded in a December analysis.

The number of retired workers receiving Social Security benefits in the US is steadily increasing. Meanwhile, the group of people who contribute to social security is declining

“That growth then slows as members of that generation die, but spending continues to rise over the 75-year projection period due to increases in life expectancy.”

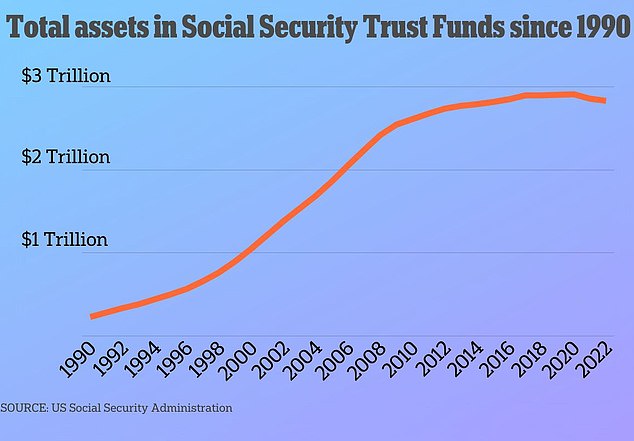

But tax revenues remain stable, the report said. That means that by 2033, cash reserves – in Social Security trust funds – will be depleted and payments will have to equal the money coming in from taxes, which means cuts.

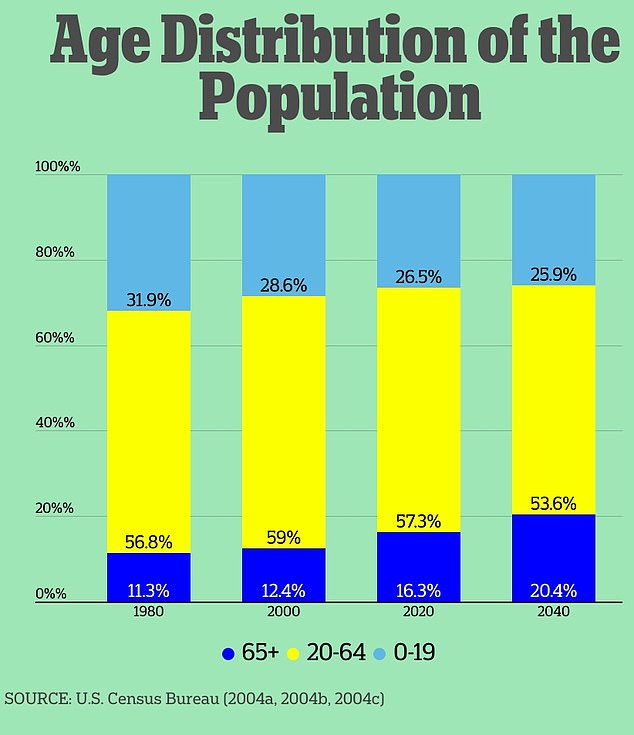

Making matters worse is the reality that the group of working-age people, between the ages of 20 and 64, who share the costs of supporting Social Security beneficiaries is also shrinking.

According to the latest Social Security Administration projections, there will be 2.1 workers per Social Security beneficiary in 2040, up from 3.7 in 1970. Urban Institute.

Another report from the Administration on aging found that more than one in six Americans were 65 or older in 2020 – a 35 percent increase from a decade earlier.

The projections come as Social Security recipients saw a big increase in their payments in early 2023.

The Social Security Administration’s most recent projections show that by 2040 there will be 2.1 workers per Social Security beneficiary. The percentage of the population over 65 is expected to increase by about 4 percent over the next twenty years.

The CBO also predicts that the fund will continue to spend five percent of the United States’ gross domestic product. The fund will eventually increase to seven percent in 2096

Social Security has increased benefits by 8.7 percent from January 2023 to combat record inflation. The increase marks the highest increase in the cost of living since 1981.

In January, benefits increased by another 3.2 percent. Inflation currently stands at 3.09 percent.

The CBO’s latest forecasts show that the current gap between fund expenditures and revenues received – if continued over the next decade – will officially bring the fund to zero.

If that were to happen, the Social Security Administration would be unable to pay full retirement benefits to retirees once they become eligible.

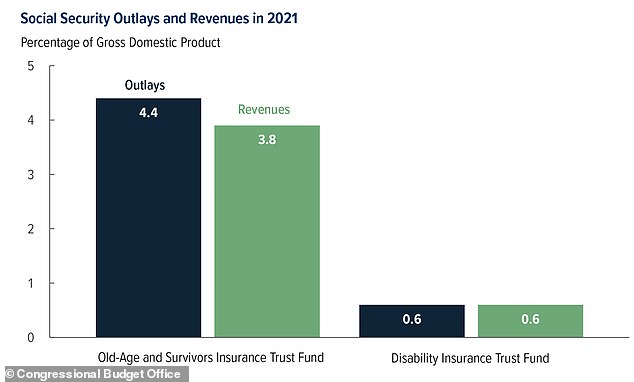

Even if the disability insurance trust fund and the old-age and survivor’s insurance trust fund were merged, the fund would still be empty in 2033.

The funds have also come under pressure because they have been used to pay out payroll tax revenues to retirees.

The CBO also predicts that the fund will continue to spend five percent of United States GDP. The fund will eventually increase to seven percent in 2096.

The actuarial deficit is projected to reach 1.7 percent of GDP or 4.9 percent of taxable payroll over the next 75 years.

The forecast means that the balance in the funds could be preserved if there were an immediate increase in payroll taxes of almost 5 percent.

Social Security funds could also be maintained if overall benefits for retirees were reduced.