MARKET REPORT: Oil stocks, insurers brace for Hurricane Beryl

An early start to hurricane season has implications for financial markets.

The devastating Hurricane Beryl sent oil prices soaring to a two-month high of over $87 a barrel on fears of a production drop.

This saw BP rise 1.3 percent, or 6.2p, to 484.7p and Shell 0.4 percent, or 12p, to 2,869.5p.

The increase came after Shell announced it wanted to halt construction of a biofuel plant in Rotterdam (Netherlands).

The decision is part of a broader strategy to simplify operations and increase returns.

Hurricane Beryl hits Bridgetown, Barbados. Oil prices rose to a two-month high above $87 a barrel amid fears of a hit to production

Concerns about Hurricane Beryl also played a role for London-listed insurers, as investors worried about potential payouts.

Beazley fell 5.2 percent, or 36p, to 650.5p, Hiscox fell 2.3 percent, or 26p, to 1,108p and Lancashire Holdings fell 3.8 percent, or 23p, to 578p.

Tryfonas Spyrou, an analyst at investment bank Berenberg, said this year’s hurricane season is “expected to be very active”.

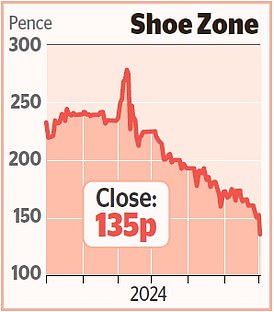

On the broader market, the FTSE 100 was down 0.56 percent or 45.56 points to 8,121.2 and the FTSE 250 was down slightly by 0.14 percent or 27.61 points to 20,194.47.

Major European indices also fell on continued concerns over the French elections.

Marine Le Pen’s right-wing Rassemblement National party won the first round of voting, much to the chagrin of President Emmanuel Macron.

It is not yet clear whether she will win a majority in the second round on Sunday, but the uncertainty is enough to undermine confidence in the financial markets.

The Cac 40 fell 0.3 percent in Paris, Germany’s main benchmark lost 0.7 percent and Spain’s largest market fell 1.3 percent.

Investors also studied the latest inflation figures from the eurozone. While the headline rate fell to 2.5 percent in June from 2.6 percent in May, prices in the services sector continued to rise sharply, raising fresh doubts about the outlook for interest rates.

Back in London, GSK suffered another setback when a US judge rejected GSK’s request in connection with the Zantac lawsuits.

The British pharmaceutical giant plans to appeal a ruling last month that paved the way for more than 70,000 lawsuits claiming its heartburn drug caused cancer.

However, a Delaware judge has denied that request, meaning GSK and other pharmaceutical companies are likely to face a flood of legal action.

GSK said: ‘The scientific consensus remains that there is no consistent or reliable evidence that ranitidine increases the risk of cancer.’

But the company’s latest setback comes just a week after the FTSE 100 group lost out to Pfizer in a deal that will see the US group supply millions of respiratory jabs in England and Northern Ireland. Shares fell 1.5 percent, or 22.5p, to 1,503.5p.

Wizz Air also came under pressure after the airline carried slightly fewer passengers last month compared to the same period a year earlier. Its shares fell 3.9 percent, or 84p, to 2,066p.

But IAG, owner of British Airways, was also among the risers, rising 0.2 percent, or 0.4p, to 164.3p.

DIY INVESTMENT PLATFORMS

AJ-Bel

AJ-Bel

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive investor

interactive investor

Fixed investment costs from £4.99 per month

eToro

eToro

Stock Investing: 30+ Million Community

Trading 212

Trading 212

Free stock trading and no account fees

Affiliate links: If you purchase a product, This is Money may earn a commission. These deals are chosen by our editorial team because we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investment account for you