Finance guru Mark Bouris’ chilling three-word warning to Australia ahead of Christmas

Australian businessman Mark Bouris has made dire predictions for the Australian economy, despite indications that a rate cut is coming soon.

The financial guru has warned Australia is heading towards a “full recession” due to high interest rates and their crippling impact on household budgets.

The founder of Wizard Home Loans started his op-ed for news.com.au by maintaining the Reserve Bank of Australia’s decision on Tuesday to leave interest rates unchanged at 4.35 percent.

“But this time the RBA made a huge U-turn,” Bouris wrote.

‘For the first time in years, the Reserve Bank hinted at an upcoming interest rate cut.’

Mr Bouris wrote in the RBA statement that output growth has been weak, wage pressures have eased and incomes and consumption have recovered more slowly than forecast.

“More importantly, the RBA said inflation has eased and is moving towards the target,” Bouris continued.

“This is code for a coming rate cut, and honestly, it’s about time.”

Mark Bouris (pictured) warned Australia could be heading for ‘full recession’

Mr Bouris wrote that Australia was heading towards a recession due to high interest rates and their crippling impact on household budgets. Shoppers are pictured at Pitt St Mall in Sydney

Mr Bouris called on the RBA to consider cutting interest rates to avoid a recession at its next meeting in February.

He argued that maintaining high interest rates could worsen economic conditions and lead to an outright recession.

Mr Bouris writes that high interest rates indeed served a purpose and had to be increased because inflation was too high for a long time.

“But now the negative consequences of high interest rates outweigh the benefits,” Bouris argued.

“High interest rates have slowed the economy so much that we are on the brink of a full-blown recession.”

Mr Bouris argued that high interest rates are destroying household budgets due to rising mortgages and as a result, Aussies are spending less.

He warned this could have a knock-on effect on businesses as sales fall and costs rise.

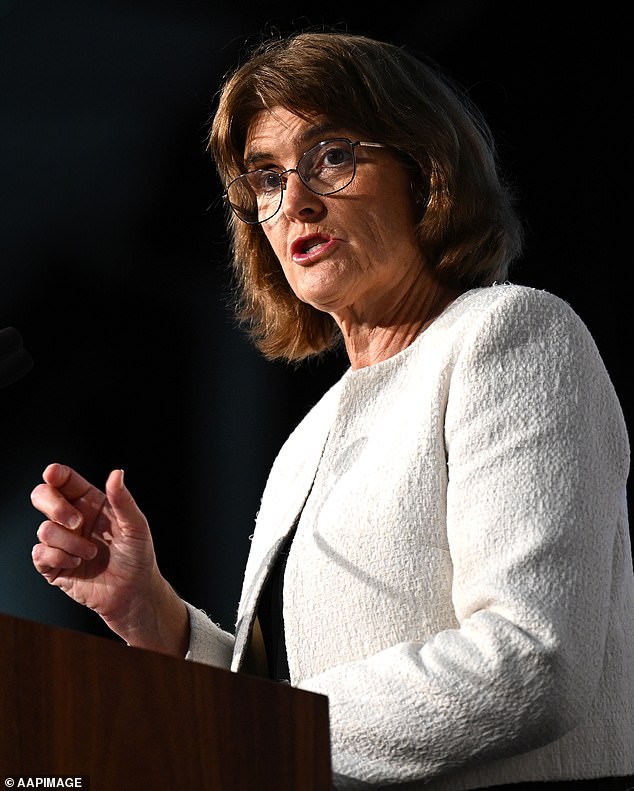

Mr Bouris called on the RBA to cut rates at its next meeting in February. Reserve Bank of Australia Governor Michele Bullock is pictured

This will lead to companies cutting jobs, which will increase unemployment.

“This is a recipe for disaster, and the Reserve Bank cannot let this happen as a result of its one-dimensional crusade against inflation,” Bouris wrote.

He argued that the view that the only way to slow inflation is to raise interest rates is wrong.

‘But that’s not true. “One of the main drivers of inflation right now is electricity bills,” he wrote.

“But high interest rates will not lower energy prices.”

He suggested that the same goes for food prices, and that interest rates will fail to stimulate competition in the supermarket sector.

‘One of the reasons food prices are so high is because the supermarket system in Australia is a duopoly. Woolworths and Coles control the majority of the market,” Bouris wrote.

He said interest rates would not make any difference to the duopoly and that this was a job for the Australian Competition and Consumer Commission.

Mr Bouris concluded the piece by noting that other countries, including New Zealand, the US, Canada, the UK and the EU, have started cutting interest rates in response to economic conditions.

“Let’s hope the Reserve Bank follows suit in February,” Bouris wrote.

“Because if they don’t, we’ll be trading high inflation for a recession.”