‘Many AIM companies question the future of the market,’ warns director of energy supplier

The future of London’s AIM market is in a “fragile balance” as “many” companies consider delisting, the CEO of energy supplier Yu Group has warned.

Bobby Kalar told shareholders Tuesday he was disappointed by the lack of involvement from major institutional investors and frustrated by the “lack of recognition” for the company’s financial performance.

It follows a sustained period of weak AIM returns, a surge in listings and a decline in new entrants, which has damaged the market’s credibility as an effective growth driver for small businesses.

Kalar said: ‘Many AIM companies are questioning the future of the market and the desirability of listed companies.’

Exodus: CEOs voted with their feet and leave LSEG’s AIM market

London’s attractiveness as a listing destination has come under pressure in recent years, with opponents pointing to evidence of undervaluation, poor performance and weak liquidity.

The result is that London has been ignored by large companies seeking to go public, companies have been bought up by private equity and corporations are moving their listings to competing markets or delisting altogether.

Industry and government have worked together to improve the attractiveness of London’s capital markets. However, reforms have generally focused on the FTSE 100 and FTSE 250 indices.

According to the London Stock Exchange Group, AIM is “the world’s most successful and established market for dynamic, high-growth companies”. These companies benefit from access to “a diverse group of investors and a supportive advisory community who understand the needs of entrepreneurial businesses”.

But a lack of liquidity in the market has led to lacklustre share price growth for many AIM-listed companies, and excessive price swings in response to corporate updates.

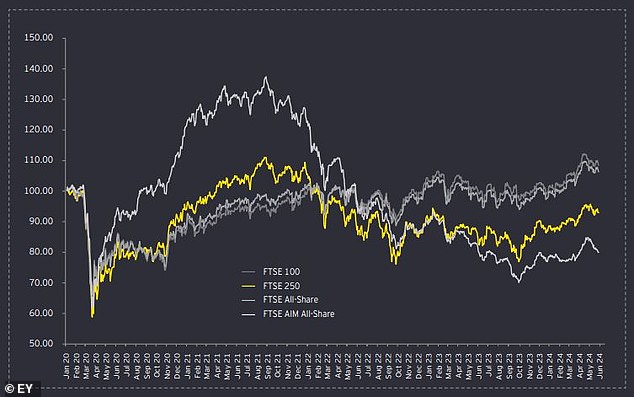

The FTSE AIM 100 – which includes the 100 largest companies on the AIM market – is up just 3 per cent over the past year and is around 30 per cent below pre-Covid levels. A similar pattern can be seen in the AIM All-Share index.

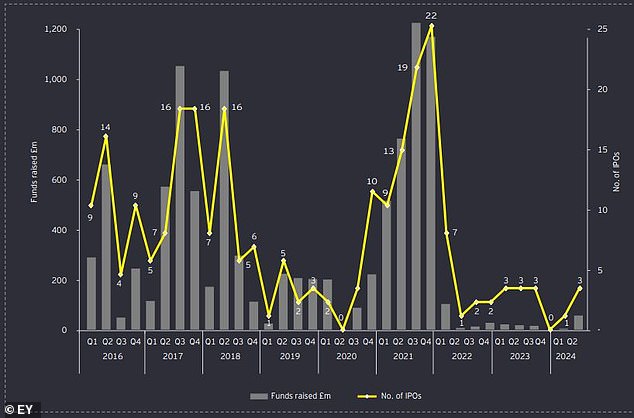

New IPOs on AIM have yet to recover to their pre-corona levels, after an initial post-lockdown peak in 2021.

EY data shows that four companies will list on AIM in early 2024, after nine companies listed last year. This compares to 16 new companies entering the market in a single quarter, three times from 2017 to 2018.

Separate data from accounting group UHY Hacker Young shows that fewer IPOs are taking place and more companies are being delisted, pushing the number of companies on the index down to its lowest level in more than 20 years.

Decline: IPOs and money raised on AIM have fallen sharply in recent years

According to Kalar of Yu Group, the decline reflects companies’ dissatisfaction with the market.

The group, which specialises in energy and utilities solutions for UK businesses, saw revenue rise 60 per cent year-on-year to £312.7m in the first six months of 2024.

Adjusted profit before negative impacts rose 49 per cent to £20.4m, driven by demand for smart metering solutions.

It is one of the fastest growing suppliers in the business-to-business sector, with a market share rising from 1.4 percent at the beginning of this year to 1.8 percent.

Kalar said: “The lack of institutional commitment is disappointing despite management delivering tremendous value year after year.

‘Many AIM companies are questioning the future of the market and the desirability of remaining listed. This is reflected in the decline in listed companies.

Bobby Kalar owns 51.6% of the shares of Yu Group

‘The future of the AIM market is fragile and will not improve if the current government continues to punish and discourage high-growth companies.’

Kalar has a major stake in Yu Group

Yu Group shares have added an eye-watering 1,667 per cent to 1,590.5p over the past five years. Shares are up more than 30 per cent since the start of the year, but management believes the company is still undervalued.

According to the company’s website, CEO Kalar is also by far the company’s largest shareholder with a 51.6 percent stake.

Yu Group’s second and third largest shareholders, Jamieson Principal Pension Fund and Premier Miton, own 6.6 and 6.3 percent respectively.

Analysts at SP Angel maintain a buy rating on Yu Group shares with a price target of 2,100p – around 32 per cent above current levels.

The analysts wrote in July: ‘We continue to see opportunities for Yu Group to grow its revenue base to over £1.4bn within a few years.

‘With the shares now trading at a FY24E price/earnings ratio of

The rearguard: AIM market performance lags major UK indices

DIY INVESTMENT PLATFORMS

AJ-Bel

AJ-Bel

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive investor

interactive investor

Fixed investment costs from £4.99 per month

Saxo

Saxo

Get £200 back on trading fees

Trading 212

Trading 212

Free trading and no account fees

Affiliate links: If you purchase a product, This is Money may earn a commission. These deals are chosen by our editorial team because we think they are worth highlighting. This does not affect our editorial independence.