Man Utd takeover: Sheikh Jassim pledged to make bid despite Sir Jim Ratcliffe considering buying minority stake

Sheikh Jassim still wants to complete a takeover of Manchester United and is committed to his bid, despite Sir Jim Ratcliffe considering acquiring a minority stake.

Qatari banker Sheikh Jassim and British industrialist Ratcliffe have submitted bids valuing United at around £5 billion, but the Glazers continue to wait for higher bids.

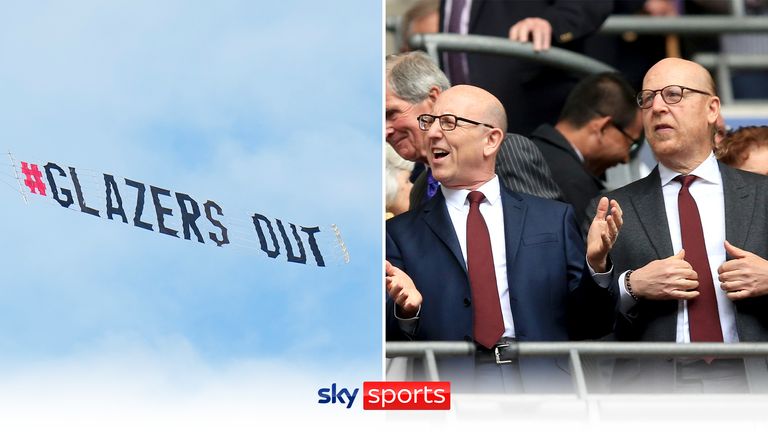

The Glazers announced a strategic review in November last year, which they said could lead to a sale. United chief executive Richard Arnold confirmed at a staff meeting in September that the process was underway.

Ratcliffe considers minority stake in Man Utd

Sheikh Jassim is backing his bid, but Ratcliffe, the petrochemical billionaire, is considering buying a minority stake in Manchester United rather than seeking full control, in a bid to end a nearly ten-month process to find a solution for the future ownership of the club.

Sky News has learned that Sir Jim’s Ineos Sports vehicle has proposed a deal to the controlling Glazer family that would see them acquire equal shares of both their shares and those publicly traded on the New York Stock Exchange.

That offer would involve a bid at the same price for both sets of shares, with a suggestion on Monday evening that Sir Jim could pursue a stake of around 25 per cent in the Red Devils as part of his latest proposal.

It should be pitched at a valuation that the Glazers would accept, implying that Ineos Sports could spend around £1.5 billion if it acquired a quarter of United’s shares – based on previous reports that they were looking to a minimum rating. of £6 billion.

However, if such a deal were to go through, the Glazers would almost certainly retain control of Old Trafford, having taken control of the club in 2005.

That would anger United supporters, who have spoken out against the family’s continued existence, and would in turn raise a series of new questions about the club’s future.

On the pitch, the men’s team have had an indifferent start to the 2023/24 season after being defeated at home by Crystal Palace in the Premier League last weekend and losing their first Champions League match of the season.

One uncertainty on Monday evening related to the extent to which the Glazers and their advisers at Raine Group were engaged with Sir Jim over his minority stake proposal.

The family, who paid just under £800 million in 2005, have remained inscrutable throughout the process and have said nothing of substance to the NYSE since the process of contacting potential buyers began last November.

Another question would be whether an offer to bring in Sir Jim as a major shareholder would provide new capital to invest in the club, which is working on a major renovation of Old Trafford.

The structure of a bid to acquire a minority stake is also unclear, with one analyst suggesting this could be done through a process known as a tender offer.

Bloomberg News reported last week that Ineos wanted to restructure its bid without specifying details of how this would be achieved.

Some holders of the listed shares – called A shares – have raised concerns about Sir Jim’s previous proposals, which aimed to acquire a majority stake in the club by buying shares from the six Glazer siblings who own are of the class B shares that carry disproportionate shares. voting rights.

Another uncertainty would center on whether a minority deal, if agreed and executed, would ultimately give Ineos Sports a path to full control of Manchester United.

Sky News revealed in May that the offer at the time included put-and-call arrangements that would become exercisable three years after a takeover, allowing Sir Jim to acquire the remainder of the club’s shares.

The Monaco-based billionaire, who owns Ligue 1 club Nice, has been focused on gaining control of Manchester United, meaning converting his offer to a minority deal would represent a significant shift.

He is still believed to want to buy a majority stake but has agreed to a restructured deal in a bid to break the ongoing impasse over United’s future.

An Ineos spokesperson declined to comment on Monday, citing the terms of the non-disclosure agreement the bidders had signed as part of the process.

For months, Ineos has been locked in a two-sided battle for control of Manchester United against Sheikh Jassim bin Hamad al-Thani, a Qatari businessman who is chairman of the Gulf state’s Qatar Islamic Bank.

Sheikh Jassim’s offer remains on the table, and the complicated nature of the strategic review initiated by the Glazers late last year means that a revised proposal from the Middle East cannot be completely ruled out.

It has been reported that the club’s executive co-presidents, Avram and Joel Glazer, were more reluctant to sell than their siblings during the process.

In addition to the competing bids from Sir Jim and Sheikh Jassim, the Glazers received several credible offers for minority stakes or financing to finance investments in the club.

These include a bid from giant US financial investor Carlyle; Elliott Management, the American hedge fund that until recently owned AC Milan; Ares Management Corporation, a US-based alternative investment group; and Sixth Street, which recently bought a 25 percent stake in the long-term LaLiga broadcast rights for FC Barcelona.

These were intended to provide capital to repair United’s aging physical infrastructure.

Part of the Glazers’ justification for assigning such a huge valuation to the club lies in the possibility that the club will gain greater control over its lucrative broadcasting rights in the future, in addition to the belief that perhaps the world’s most famous sports brand could commercially can be exploited more effectively.

United’s New York-listed shares have swung wildly in recent months as reports have suggested that either a deal is close or the Glazers were close to formally canceling the sale process.

On Monday they were trading at around $19.43, giving the club a market value of $3.25 billion.

Earlier this year, Manchester United’s largest fan group, the Manchester United Supporters Trust, called for the auction to be completed “without further delay”.

The Glazers’ tenure has been dogged by controversy and protests, with the failure to win a Premier League title since Sir Alex Ferguson’s retirement as manager in 2013 fueling fans’ anger over the debt-ridden nature of their takeover.

Anger over their participation in the ill-fated European Super League reinforced supporters’ desire for new owners to replace the Glazers.

Confirming the launch of the strategic review in November, Avram and Joel Glazer said: “Manchester United’s strength rests on the passion and loyalty of our global community of 1.1 billion fans and followers.

“We will evaluate all options to ensure we can best serve our fans and that Manchester United maximizes the significant growth opportunities the club offers today and into the future.”

The Glazers listed a minority stake in the New York company in 2012 but retained overwhelming control through a dual-class share structure, meaning they own nearly all the voting rights.

“Love United, Hate Glazers” has become a common refrain during their tenure, with supporters critical of a perceived lack of investment in the club, even as the owners have reaped large dividends as a result of continued profitability.

A Manchester United spokesperson declined to comment on Monday.