Maine’s $1.35 billion Mega Millions winner would have been $55 million richer had he gotten a ticket a mile away

>

The winner of the $1.35 billion Mega Millions jackpot, the fourth-biggest in US history, would have been about $52 million richer had he bought his lottery ticket just a mile away in New Hampshire .

The currently unnamed winner purchased his ticket at a gas station in the quaint Maine town of Lebanon, which is 1.2 miles from New Hampshire, a state that does not tax lottery winnings.

The way things are in Maine, if the winner claims the prize money in a single lump sum, as almost everyone tends to do, they will walk away with $404 million after state lottery and income taxes are deducted.

In New Hampshire, which has none of those taxes, that sum would have been about $456 million.

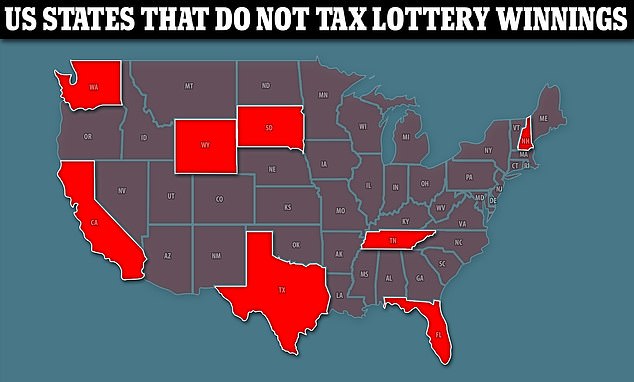

New Hampshire is one of eight such states in the country; others include California, Florida, South Dakota, Tennessee, Texas, Washington, and Wyoming.

However, one potential advantage of winning the Maine lottery is that the winner retains the right to remain anonymous.

The winner of the $1.35 billion Mega Millions jackpot would have been about $52 million richer if he had bought his lottery ticket just 1.2 miles down the road in New Hampshire.

Hometown Gas & Grill owner Fred Cotreau (pictured) said he serves a tight-knit community and hopes the winner will be local.

The Mega Millions jackpot win was announced on Saturday just before 9 a.m. according to state lottery officials.

Hometown Gas & Grill owner Fred Cotreau said he serves a close-knit community and hopes the winner will be local.

We are a small community. We are a small store. We just hope it’s someone local’, Comeau told WMUR. When they called him Saturday morning and told him he had sold the winning ticket, he initially thought he was being scammed, he told CNN.

Local resident Brian Comeau echoed the same sentiment, saying, “We hope it’s one of us locals so it’s a story we have forever, you know?”

New Hampshire Gov. Chris Sununu took the opportunity to mock Maine Gov. Janet Mills, congratulating her on the paycheck but assuring her own state’s population that she won’t pay income taxes.

When Cotreau was called Saturday morning and told he had sold the winning ticket, he initially thought he was being ripped off.

New Hampshire is one of eight states in the country that does not tax lottery winnings; others include California, Florida, South Dakota, Tennessee, Texas, Washington, and Wyoming.

New Hampshire Governor Chris Sununu (pictured) commented on the ‘expensive mile’ and assured people in New Hampshire that they would stay without income taxes.

‘Sold in Lebanon, ME only 1 mile from NH… Talk about an expensive mile!’ Sununu wrote in a tweet on Sunday.

He added: ‘If the winning numbers had been played in NH, the winner would have saved $40 MILLION in taxes.

‘Congratulations on the windfall, @GovJanetMills… but we won’t be paying any income tax.’

The amount of taxes incurred at the federal and state level can only be approximate and would vary based on specific circumstances and tax strategies. Therefore, Sununu’s estimate of $40 million is only approximate.

Maine has a tax that takes 5 percent of all lottery winnings and a 7.15 percent income tax for those in the highest tier, which the winner would fall into.

An analyst with the Maine Economic Policy Center, James Myall, said on Twitter that, in his estimate, the $52 million in taxes would cover the cost of about two years of free school meals for Maine students.

By opting to receive prize money in the form of a lump sum, winners are already taking a hit, in this case reducing it from $1.35 billion to $724.6 million.

By opting to receive their prize money in the form of a lump sum, winners take a hit, in this case reducing it from $1.35 billion to $724.6 million. Then on top of that, federal taxes reduce the profit to $455.8 million.

But the winner was at least better off buying the ticket in Maine than in Massachusetts, some 35 miles away, where high taxes would have reduced the winnings to around $390 million. according to Bangor Daily News.