LV’s new boss says: ‘It’s time for mutuals to rise again’

>

Role: David Hynam says mutual relationships have never been more relevant

David Hynam, who became CEO of insurance company LV in September, vows to lead the 180-year-old mutual into “a new era” — and he could, given the mess he’s inherited.

In his first interview since taking over, Hynam presents himself as a champion of reciprocity. That’s a stark contrast to his predecessor, an ex-army colonel with an eye for the most important opportunity named Mark Hartigan.

The latter sought to sacrifice LV’s mutual status on the altar of a £530 million sale to US private equity barons in Bain Capital.

After a campaign by the Daily Mail and Mail on Sunday, the deal failed to gain enough support from LV’s 1.2 million members and collapsed at the end of 2021.

Understandably, Hynam would rather not dwell on the catastrophe of the recent past, but there’s no denying that he has major damage to repair. He and the chairman Simon Moore are “absolutely committed to being part of the mutual sector.”

Hynam supports a bill passing through parliament to protect mutuals from wealth strippers, carpetbaggers and predators. The Co-operatives, Mutuals and Friendly Societies Bill, introduced by Labor MP Sir Mark Hendrick, has the backing of the Treasury and will provide safeguards for LV and other mutual societies. The industry is bigger than many would think, with about 7,000 organizations serving about 30 million people.

Currently, organizations may be under pressure to demutualize as it is difficult for them to raise capital from major investors. There will also be protection, so that assets built up over generations are used for the long-term benefit of members.

“We strongly support the bill,” says Hynam.

His motto, according to his post on LinkedIn, is always to leave things better than you found them, which a cynic might say wouldn’t be difficult at LV.

After being brought in to clean up the mess left behind by previous bosses, he faces some tough questions.

As the Bain debacle unfolded, several confusing and contradictory claims were made. Members were first told that ‘business as usual doesn’t work’ and that LV therefore had to be taken over by a new owner with big pockets.

When the Bain deal was voted down, Hartigan and co made a U-turn and claimed it had a great future as a mutual after all. So what is it? Is LV sustainable as an independent mutuality or not?

“All I can talk about is how I see it now, and I think it’s sustainable. We see ourselves in the mutual sector and have no intention of being anywhere else.”

In the immediate aftermath of the failed bid, LV entered merger talks with fellow mutual insurer Royal London. Hynam says these have not been resurrected and he has no plans to merge with anyone. On the soundness of LV’s finances, he says, “Someone once said to me years ago that it is more important for mutuals to have good financial discipline than it is for public companies. It is members’ money and you should take care of it as if it were your own.

“Personally, I don’t think debt is the biggest story of the past, I think investing is the bigger challenge. Major strategic investments will be made over the next five years. We invest a lot in data, service and IT,’ he says.

LV’s capital, measured according to the so-called Solvency II rules, has weakened slightly. Does he feel comfortable with it? ‘Yes that’s me. The big question with capital is whether you can absorb shocks and whether you have early warning indicators. It’s not things I’m worried about here. The volatility in the markets has been a problem, not just for us, but for everyone. We’re not exactly a high-risk company, but we’ve had an eventful year.’

LV has, he says, “no exposure” to the pension collapse that followed the Kwarteng-Truss mini-Budget. ‘We shouldn’t beat around the bush. It’s been a tough time at LV for the past two years, but we’re on a nice stable footing now.” Had the deal gone through it would have marked an abrupt break with more than a century of tradition since the company was founded in 1843 to help the poor of Liverpool pay for funerals.

Saving LV from the clutches of private equity came at a high price. More than £30 million in membership money was wasted on the deal, millions of which went to advisers.

Mark Hartigan came out significantly richer. He received a bonus of £511,000 on top of his salary of £435,000 in 2021, and he could still bag a hefty payout for 2022. Does Hynam think it is right that the members of LV have paid these sums – and should the board try to get some back?

“I don’t have an opinion on those things because I don’t know Mark other than the transfer,” he says. “I’ve had a very good and constructive transfer with Mark, so that’s the only thing I can judge him on. I am confident that our remuneration committee is concerned with executive compensation, rewards and bonuses. It’s a matter of judgment for them.’

Does he understand why people find the payouts shocking?

“I’ve always had a strong opinion that I don’t want to comment on a pastor because I wouldn’t want anyone to do it to me.”

Is it more important for a mutual insurer than for a plc to be sensitive to executive compensation as it is membership money? “Yes, it’s members’ money,” he agrees, and any increases above “normal wage rations” in the future “would be in line with members’ best interests.” ‘I want the organization to move forward. There is a risk that a transaction that never took place will become stuck in a permanent cycle, which is not good for the members or the organization,” he adds.

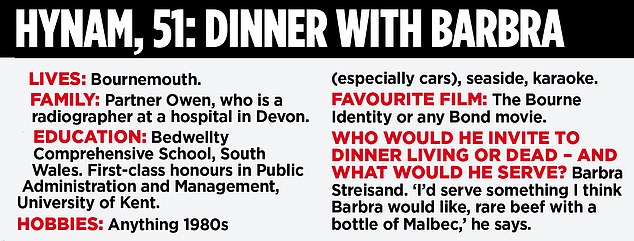

Hynam, 51, doesn’t like being described as an industry veteran – ‘I sound so old’. His previous positions include chairman of home insurance group Homeserve and CEO of health insurance company Bupa, where he achieved record growth and launched a range of digital services. He has won awards as one of the UK’s leading LGBT leaders and is a champion of diversity.

While the failed deal was costly and traumatic, there were also positives he can build on. It has reminded people of the value of reciprocity and has shown bosses that member power is a real force that they should respect. What does Hynam think mutuals can offer right now in the midst of a cost of living crisis? ‘We can really look at the longer term, because we don’t have shareholders breathing down our necks.

‘The second is that most mutual funds are very focused. We don’t try to do everything for everyone and we don’t have many products on the market. We try not to stretch the envelope everywhere. With so many distractions, that’s actually quite helpful.

“Our members clearly told us during a vote that they wanted to be a mutual association. That’s the mandate they gave me. I think there is an opportunity to revitalize. We want a modern mutual sector.’

He adds: “I would like a new era of reciprocity. It’s never been more relevant than now, because if we don’t shake hands right now, when will we?”

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and use it for free. We do not write articles to promote products. We do not allow any commercial relationship to compromise our editorial independence.