Luxury furniture companies report huge losses as experts say stalling housing market means nobody is buying new sofas

Luxury furniture companies are reporting huge losses as experts say the stagnant housing market means no one is buying new sofas

- Furniture companies RH and Hooker Furnishings reported losses last week

- It comes as high mortgage rates have slowed the US housing market

- READ MORE: Housing affordability is worse now than in 2006

Furniture retailers are seeing sales slow as experts say America’s cooling housing market is causing fewer consumers to buy sofas.

Two luxury US companies last week reported a decline in their second-quarter sales, with California-based RH posting a 19 percent decline, while Hooker Furnishings said sales fell 36 percent.

Their stock prices fell 16 and 17 percent respectively on Friday, CNN reports this.

“We continue to expect the luxury housing market and the broader economy to remain challenging throughout fiscal 2023 and into next year as mortgage rates continue to trend at 20-year highs,” RH CEO Gary Friedman said Thursday during an earnings call.

Last month, Williams-Sonoma, owner of West Elm and Pottery Barn, reported that the two brands have seen their respective revenues decline by 20 and 10 percent.

Virginia-based Hooker Furnishings said last week it experienced a 36 percent drop in sales in the second quarter amid a stagnant housing market

California-based furniture brand RH, formerly Restoration Hardware, reported a 19 percent sales decline in the second quarter

Brad Thomas, a retail analyst at KeyBanc Capital Markets, told CNN that the furniture sector’s decline started with the pandemic.

“When the pandemic broke out, we all stayed home. Consumers moved away from spending on travel and leisure experiences and spent more on items,” he told the outlet.

“The furniture category was one of many categories that saw major upside in late 2020 through 2021. That ended in 2022 and early 2023,” he added.

“Due to high mortgage rates and low inventory levels, we are not seeing many home purchases,” he says.

Similarly, Wayfair, an online furniture retailer, saw its revenue drop 3.4% in the second quarter, CNN noted. Another furniture manufacturer, La-Z-Boy, reported a 20 percent decline in sales in August.

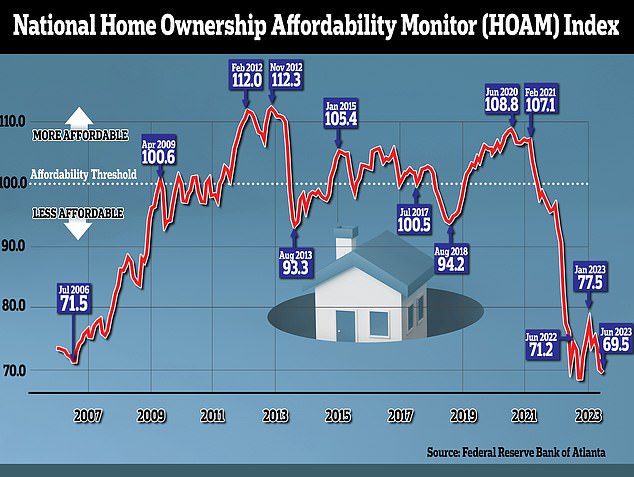

Homebuyers have faced the least affordable market since 2006, according to figures from the Atlanta Federal Reserve

It comes at a time when homebuyers are facing the least affordable market since 2006, as mortgages skyrocket and property prices remain high.

Buyers are facing a perfect storm of high mortgage rates that are keeping homeowners from moving. Many contracts had a term of thirty years while the interest rate was around 2 percent, so they were effectively stuck in their current home.

Figures from the Atlanta Federal Reserve showed in August that affordability has fallen below levels seen at the housing bubble peak in the run-up to the 2008 financial crisis.

The Atlanta Fed uses home prices, mortgage rates and average incomes to calculate an “affordability” score each month. The latest figures, from June 2023, show that the score has fallen to 69.5 – almost 40 points lower than in June 2020.