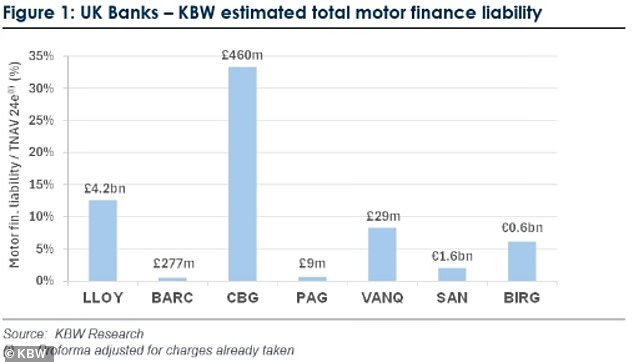

Lloyds faces ‘conservative’ £4.2bn car finance compensation payout, says investment bank

- KBW now predicts that Close Brothers Group will pay £460m, up from £350m

Car finance providers could be left with £28 billion in damages linked to historic loan mis-selling, according to the latest forecasts from an investment bank.

Keefe, Bruyette & Woods (KBW), owned by Stifel, has increased estimates of the liabilities facing numerous lenders in the wake of the Court of Appeal’s recent Hopcraft decision.

It now predicts that Close Brothers Group will pay £460m, up from £350m, while Vanquis Banking Group will be hit with a £29m repayment bill instead of nothing.

KBW has also more than doubled the expected liabilities facing Black Horse owner Lloyds Banking Group from £2 billion to a ‘conservative’ £4.2 billion.

In total, the New York-based company expects the car finance industry to ultimately spend around £28 billion on compensation.

In October, the court ruled that it was illegal for lenders to give car sellers a commission on financing deals if the car buyer had not given “fully informed consent” to the payment.

Big payouts: Car finance companies could walk away from £28bn in damages over historic loan mis-selling

The landmark decision could pave the way for the auto finance industry to pay tens of billions in damages to motorists.

KBW believes this figure could be around £28 billion, just below ratings agency Moody’s forecast of up to £30 billion.

A senior lawyer at the Financial Conduct Authority has even said that the total compensation amount could be higher than the PPI scandal, which cost British banks £50 billion.

However, the Supreme Court last month allowed Close Brothers and MotoNovo owner FirstRand to appeal the October ruling.

Barclays had previously failed to overturn a January decision by the Financial Ombudsman Service (FOS) to rule against the bank in a car finance case.

The FCA welcomed the “additional clarity” brought by the High Court’s ruling, but Barclays said it would appeal.

Analysts at KBW said it was ‘perhaps unsurprising that UK banks have uniformly expressed disbelief at the findings of both the Financial Ombudsman and the Court of Appeal regarding sales practices in the car finance market’.

Last April, the FCA urged car finance groups to ensure they had ‘sufficient funds at all times’ to cover the costs of paying the fees.

Close Brothers had already suspended dividend payments at the time, but a few months later agreed to transfer its asset unit to investment company Oaktree Capital Management to strengthen its capital position.

The FCA launched an investigation into the car finance sector in January 2024 after complaints from consumers claiming their compensation for so-called ‘discretionary commission schemes’ had been wrongly rejected by lenders.

Until they were banned in January 2021, DCAs allowed car dealers and brokers to choose the interest rate on a car buyer’s financing agreement, regardless of factors such as the value of the loan or a customer’s credit score.

Regulators have given car finance companies until December 4 to provide a final response to complaints about commission payments.

KBW’s estimates of damages claims faced by lenders, as a percentage of their tangible net asset value

DIY INVESTMENT PLATFORMS

A. J. Bell

A. J. Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund trading and investment ideas

interactive investor

interactive investor

Invest for a fixed amount from € 4.99 per month

Sax

Sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account fees

Affiliate links: If you purchase a product, This is Money may earn a commission. These deals have been chosen by our editors because we believe they are worth highlighting. This does not affect our editorial independence.