Lloyds Bank faces setback due to dumping of savings accounts

I trust Lloyds Banking Group is prepared for a customer response to the discontinuation of its more than three million savings accounts – a story my colleague Patrick Tooher told seven days ago.

While many banks and building societies have already done away with these books, they still remain popular among savers who prefer to use a branch rather than go online.

They are especially loved by the elderly, who are comforted by the fact that the book gives them hard evidence of how much they have in their accounts.

The withdrawal of most Lloyds passes will take place between October and the end of the year.

Deactivated: The withdrawal of most Lloyds cards will take place between October and the end of the year

But some are already being deactivated as part of a “soft launch,” causing a stir. Passbooks are disappearing from all of the company’s major savings brands – Halifax and Bank of Scotland, as well as Lloyds.

A few days ago I spoke to John Oddy about his son’s experience of being told he could no longer use his Halifax passbook at the branch in Birkenhead, Merseyside.

Anthony Oddy, now in his early fifties, has Asperger’s Syndrome. He lives in assisted living, but leads a fairly independent life by cooking and cleaning himself.

Yet he is dependent on cash, with which he can pay his large bills (rent, heating and food). It means a weekly visit to his branch in Halifax to withdraw money.

“The staff knows and cares for him,” says John. “Anthony likes the passbook because it tells him week after week how much money he has in his account.” Anthony, says his father, has never embraced the internet.

Recently, Anthony arrived at his branch to withdraw his usual amount of cash only to be told that the passbook was no longer valid. He left without the money he needed to pay his bills, which led to John lending him money when they met the next day.

Whether Anthony was told by the branch that he could still withdraw cash from his account without using the passbook is disputed. Halifax says in a letter to John that this is possible; Anthony begs to differ.

But what is indisputable is that Anthony received no prior notice of his bankbook being deactivated – a point the manager confirmed to John when he visited the Birkenhead branch to seek an explanation of what had happened.

Internal banking documents seen by The Mail on Sunday indicate that customers must be given two months’ notice of the change.

John, 84, complained to Halifax that his son’s account had changed from passbook to card-based.

Although his complaint was rejected, he was paid £20 in compensation for the time he had consumed and the travel expenses incurred in finding out why his son’s passbook had been scrapped.

Rather insensitively, the letter from Halifax referred to Anthony’s branch in Maidstone, Kent, rather than Birkenhead – branches 260 miles apart.

Anthony has now received a card with which he can withdraw money in his branch. So he’s happy, even though there’s no guarantee that the Birkenhead branch will last forever.

One of the main goals behind Lloyds’ removal of passbooks is to reduce branch usage so that the company can “streamline” its network.

As for John, a regular churchgoer, he is disturbed by the gradual depersonalization of banking, resulting in branch closures and more automated services.

“Human kindness was once something you could expect from a bank,” he says. “But by closing branches and forcing us to bank online, there is a shortage of supply. Now some of my fellow churchgoers have to take a taxi if they want to visit a branch of the bank where they have an account. Is that progress?’

Of course it isn’t.

If you had a bad experience as a result of your passbook being deleted, please let me know. Email jeff.prestridge@mailonsunday.co.uk – or write me on: The Mail on Sunday, 9 Derry Street, Kensington, London W8 5HY.

Rock on the city that kept its banks!

Some residents of Llandudno in Conwy, North Wales, remain dissatisfied with the council’s decision nine years ago to dump 50,000 tonnes of stones on the main beach – to protect the coastline from erosion.

More than 10,000 people have so far signed a petition to the Welsh Parliament calling for the rocks to be removed and a sandy beach restored.

But one thing residents (and tourists) can’t complain about is the banking industry’s support for the city – a point noted a few days ago by reader Peter Rowlands.

Sky: Residents (and tourists) can’t fault the banking sector’s support for Llandudno

The 63-year-old recently enjoyed a three-day holiday in Llandudno with wife Gaynor and daughter Emily.

Though he was aware of the hoo-ha above the rocks, what struck Peter most of all was the abundance of banks and building societies in town. ‘I was pleasantly surprised,’ says Peter, ‘and they were all busy too.’

A contrast, he says, with his birthplace of Bromborough, Merseyside (five miles south of Birkenhead – see main story). The closure of the HSBC branch in July means that the city now only has Nationwide on the main street.

“It’s good to see Llandudno bucking the trend,” he says. “So kudos to this charming seaside town.”

Definitely Peter, although I’d bet £1 on the last bank (not the building company) to close in Llandudno before the council returns the main beach to its former glory.

Fantastic campaign

How fantastic that The Daily Mail has relaunched the ‘End Nodeless Prostate Deaths’ campaign to ensure more men with symptoms get checked as soon as possible. The earlier the cancer is detected, the better the chance of overcoming it.

While I have not defeated this killer, my cancer is under constant surveillance. Not by the Chinese, but by advisor Christopher Ogden. An MRI scan is waiting.

So please have it checked. And once it’s all clear, make a donation to the charity Prostate Cancer UK, and if possible, help boost it with Gift Aid.

Baffled by Barclaycard? Join the club

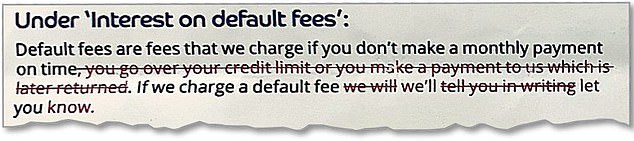

Barclaycard is pretty good at customer communication. But the latest announcement explaining changes to the terms and conditions has left some customers rather perplexed.

In detailing the changes, one has resorted to deleting superfluous words and coloring words in dark pink and red depending on whether they are new or existing respectively. All contractions are red.

You may disagree, but it took me a while to figure out that it was made clear in the above that standard charges are charges that we charge if you fail to make the monthly payment on time. If we charge standard fees, we’ll let you know.’ One reader suggests that if this document is the result of artificial intelligence, heaven help us. AI or no AI, it’s mind-boggling and headache-inducing.

NS&I is changing course

Government-backed savings giant NS&I always talks about offering products that are attractive to customers, not too expensive for taxpayers and not so sexy as to make it impossible for banks to compete with them.

But with the launch of two one-year fixed-rate bonds reaching the market’s top and displacing an equivalent offering, things have changed. It has sent a loud message to the rest of the market that many savers deserve a much better deal than they are currently getting.

It is no coincidence that the launch of NS&I’s one-year guaranteed growth and income bonds (paying monthly interest) was accompanied by words from Andrew Griffith, Secretary of the Treasury for Economic Affairs.

Point by point, he said: “It is crucial that savers can take advantage of the recent interest rate hikes.” In other words: if NS&I can play fair, so can the banks and building societies.

I’m waiting for depositors to launch one-year bonds that are better than the gross interest rates of 6.2 and 6.03 offered by the NS&I growth and income bonds.

I also hope NS&I, by being so bold, doesn’t suffer an intermittent customer service slump. Let me know if you have any problems dealing with it.

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.