Keir Starmer’s wealth tax grab will force me to flee Britain, says SIR PETER WOOD

Patriotic: Sir Peter Wood has always willingly paid British tax on his self-acquired wealth

Sir Peter Wood, one of Britain’s most successful entrepreneurs, is unhappy. He speaks from his Palm Beach villa, a short distance from Donald Trump’s Mar-a-Lago, where he is relaxing in the US for a few days after attending a board meeting at an insurance company in Boston.

He then returns to Britain to vote with a sense of dread, fearing that Sir Keir Starmer’s Labour government will force him to leave the country, even though he has always willingly paid British taxes on his self-made wealth.

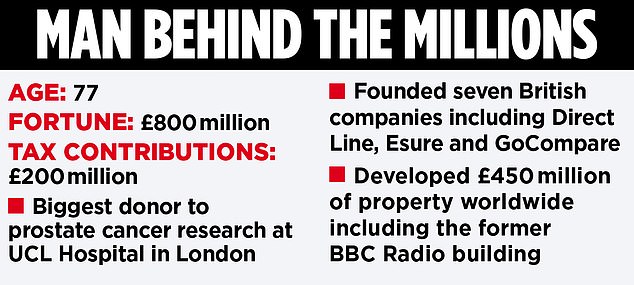

Wood has founded three companies that were all FTSE 350 companies in their day – insurance companies Direct Line, Esure and GoCompare – and is proud that he has always paid his taxes in his home country. He has been high on the list of Britain’s biggest taxpayers for years. His accounts were in excess of £200 million when he sold companies.

“I’ve been in the top ten for years,” Wood says. “I’m the kind of person who always pays my British taxes. It’s a patriotic thing to do.”

Wood knows his estate, which includes shares in funeral firm Dignity and stamp auctioneer Stanley Gibbons, will face 40 percent inheritance tax. But he fears that Labour, in a desperate grab for tax revenue, will once again target the rich.

So the entrepreneur, who spent five months in his homes in the US and Spain, is now considering protecting his wealth abroad. Paradoxically, chemical billionaire and Manchester United shareholder Jim Ratcliffe, one of the rich who voted for Labor ahead of the elections, chose several years ago to move his personal tax status to Monaco.

Wood sees this as the height of hypocrisy: ‘Jim Ratcliffe doesn’t pay income tax in the UK. His companies do, but he himself doesn’t want to pay tax. Now he supports Labour. That’s a bit of an exaggeration.’

Wood is not alone in his fears about Labour’s wealth tax. A friend who is still hard at work in the textile industry in his late 70s tells me that his son-in-law, a billionaire property magnate, decided a few months ago – amid expected increases in taxes on capital and wealth – to move his family and his tax domicile from Britain to Monaco. He was unprepared for an empire that owns some of the country’s most recognisable properties to be broken up to pay British taxes.

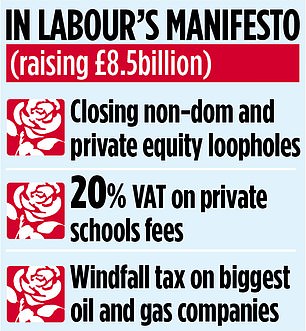

Starmer and shadow Chancellor of the Exchequer Rachel Reeves often talk about closing tax loopholes. This is a byword for imposing new levies. Fear of what lies ahead is already driving fortunes abroad. The Thatcher revolution, which saw Britain’s exiled rich return to spend and invest, is in danger of being reversed. Labour’s election promises of “wealth creation” are about to fail before they have even come to power.

British entrepreneurs and the super-rich fear the attack. It is tempting to say: well done. But – if Labor is serious about fueling growth and restoring stability to economic policy – attacks on the wealthy can only dampen spending, savings and investment.

Labour has publicly targeted what it sees as privilege with a 20 percent VAT on school fees. And North Sea oil exploration has been halted by plans to plug perceived investment gaps in an industry that already pays a 75 percent tax rate.

But much more could come from Labor if the vulnerability of the costs in its manifesto and the big hole in the public finances are exposed. The independent Institute for Fiscal Studies describes a ‘toxic mix’ in public finances. Labour’s triple tax lock, which bans increases in VAT, income tax and national insurance contributions, requires Reeves to find other targets.

Pre-announced plans to target non-doms and private equity barons. Other goals are likely on her unannounced agenda. In 1997, when Labor inherited much more stable public finances, it financed new spending by taxing dividends paid to pension funds and utilities.

This time, a popular suggestion is to tax capital at the same rate as income. Tax deductions on pension fund contributions could also be jeopardized, which discourages already inadequate savings.

Changes to the non-domicile regime initiated by Jeremy Hunt have already seen many super-rich packing their bags.

One source told me that in three years they will all be gone, and that a huge amount of money spent and invested in Britain will be gone forever.

Entrepreneurs like Wood are irritated.

“I paid British taxes because I could afford it,” he says. One of Wood’s daughters is a top interior designer, and he adds, “Her business is drying up as non-doms and top salespeople flee the country.”

Britain is suffering from a lack of public and private investment, which is essential for growth. Chasing away our brightest business people can only hamper the recovery.