Judgement day for Sam Bankman-Fried: FTX fraudster is set to be sentenced today for duping thousands of crypto investors out of $8billion as prosecutors seek 50 years

Sam Bankman-Fried’s spectacular downfall will be complete today as the fraudster is convicted of committing one of the biggest white-collar crimes in history.

The 32-year-old will be sentenced today in the Southern District of New York for defrauding thousands of crypto investors out of $8 billion through his now-defunct trading platform FTX.

A Manhattan jury convicted him last year of defrauding FTX customers and stealing the money with the help of his inner circle in the Bahamas, including his ex-girlfriend and Alameda Research CEO Caroline Ellison.

Federal prosecutors want Bankman-Fried to do that Spending 40 to 50 years in prison. His team insists he deserves no more than six.

The sentencing hearing – more than a year in the making – will feature statements from the victims, as well as those closest to the disgraced financial whiz.

Here’s how Bankman-Fried started as a multi-billionaire with a promising future and ended up as a convicted felon now known as the modern-day Bernie Madoff.

How it started

The son of two Stanford professors, Bankman-Fried had a charmed upbringing in California.

In April 2019, after a six-year career at various trading firms, the then 27-year-old founded FTX amid a crypto boom.

He told the world he planned to give away his quickly amassed fortune by the time the bubble burst, touting global praise that he would become the richest billionaire under 30.

In April 2019, after a six-year career at various trading firms, the then 27-year-old founded FTX amid a cryptocurrency boom.

Venture capitalists lined up to invest in the booming platform and SBF, as he has become known, became a poster boy of the crypto world.

The company’s logo became ubiquitous in pop culture.

Then the “crypto winter” of 2022 arrived, with accounts wiped out as the unpredictable and largely unregulated market collapsed.

Behind the scenes, SBF’s parent company, Alameda Research, began borrowing to invest in companies in an effort to keep the market afloat.

Sam Bankman-Fried pictured at the 2022 Super Bowl with singer Katy Perry (far left), actor Orlando Bloom, actress Kate Hudson (far right) and Hollywood agent turned investor Michael Kives

Bundchen looked glamorous on stage with Sam Bankman-Fried at the Crypto Bahamas event. The FTX chief looked uncomfortable as he opted for his usual outfit of scruffy shorts and a T-shirt

FTX was fine… until it wasn’t

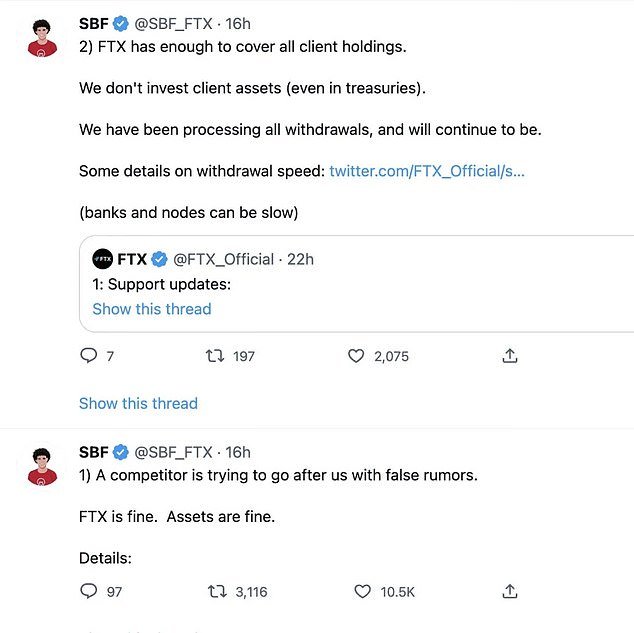

In November 2022, as the walls closed in, SBF tried to reassure investors.

Bankman-Fried’s tweet of November 7 would come back to haunt him countless times during his trial.

‘FTX is fine. The assets are fine,” he wrote.

Less than a year later, FTX co-founder Gary Wang would say the exact opposite on the stand.

“FTX did not have enough assets to cover all customer withdrawals,” Wang testified in October 2023. “FTX did not, in fact, have enough assets to cover all customer assets… because Alameda had withdrawn a lot of it.”

Alameda is a name you will hear a lot. Bankman-Fried founded Alameda Research in 2017 as a crypto trading firm. Prosecutors argued that Alameda was the vehicle for stealing FTX customer deposits.

The first sign of trouble came on November 2, when crypto news site CoinDesk published an Alameda balance sheet.

In November 2022, SBF tried to reassure the world that its FTX was immune to the market collapse

The FTX exchange was located in the penthouse in the Bahamas, which was put up for sale in November 2022 after the company filed for bankruptcy

The balance sheet showed that a significant portion of Alameda’s assets were held in FTT, FTX’s native token. According to avid crypto industry observers, this seemed incredibly risky because the FTT was essentially a made-up currency by Bankman-Fried, yet served as collateral for many of the hefty loans made to Alameda for trading purposes.

Bankman-Fried and Ellison’s subsequent attempts to downplay the CoinDesk story proved fruitless, as a classic bank run was in full swing around November 8. FTX processed billions of dollars in panic withdrawals.

As the chaos continued, rival crypto exchange Binance offered to buy out FTX. FTX users were happy.

But that wasn’t the intention, as after one look at FTX’s books, then-Binance CEO Changpeng Zhao pulled out of the deal on November 9, just one day after announcing the potential buyout.

The mold was ready on November 11. FTX went bankrupt and Bankman-Fried stepped aside as CEO, leaving John J. Ray to take over liquidating the company.

The arrest and pre-trial detention of Bankman-Fried

Bahamian authorities did not arrest Bankman-Fried until December 12, 2022, a month after the implosion of the FTX. According to many legal professionals, this gave him plenty of time to incriminate himself by conducting interviews with anyone who would listen.

One of his most recognizable interviews was with ABC’s George Stephanopoulos, so much so that excerpts of it were played during the trial. He told Stephanopoulos that he was unaware that FTX customer money was being used to pay off Alameda’s loan obligations.

Exclusive photos from DailyMail.com show disgraced FTX boss Sam Bankman-Fried looking stressed on the balcony of his $40 million penthouse in the Bahamas

Bankman-Fried’s parents are among many awaiting sentencing for their son

About a week after that interview, Bankman-Fried was arrested in the Bahamas. He was briefly held at Fox Hill Prison, the only government detention center on the island. He was then extradited to the US, where he was kept under house arrest in the comfortable home of his parents in Palo Alto, California.

That lasted until August 11, 2023, when Judge Kaplan ruled that Bankman-Fried violated his $250 million bail by leaking letters from his ex-girlfriend Caroline Ellison to the New York Times. Prosecutors accused Bankman-Fried of this, and the court viewed the leak as an attempt by him to intimidate Ellison and put her in a bad light before she would testify against him.

Since then, Bankman-Fried has been incarcerated in the Metropolitan Detention Center in Brooklyn.

Highlights from the process

Bankman-Fried’s trial in October lasted a month, with the government calling more than a dozen witnesses from the three defense witnesses. The most explosive testimony came from other FTX executives, including his ex-girlfriend Caroline Ellison.

The government alleged that billions in customer money was funneled from FTX to Alameda to repay eye-watering loans it took out from crypto lenders.

As CEO of Alameda, Caroline Ellison naturally had some of the most explosive testimonials.

Sam Bankman-Fried stands as the jury foreman reads out the verdict in his fraud trial on Thursday

Caroline Ellison, pictured Oct. 10 at Manhattan Federal Court in Manhattan, New York City, said she committed fraud and that Bankman-Fried “directed” her to do so

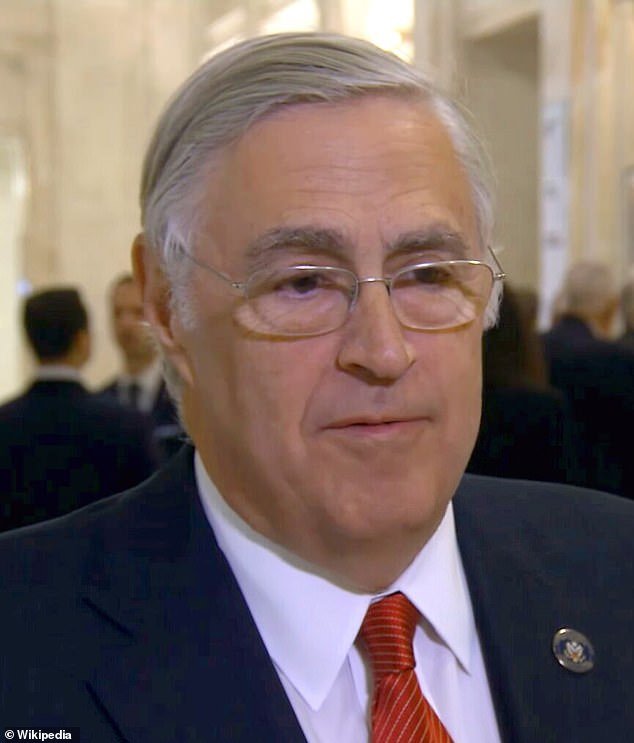

His fate now rests in the hands of U.S. District Judge Lewis Kaplan, the no-nonsense judge who presided over Donald Trump’s E. Jean Carroll case

Ellison testified in October that Alameda took FTX deposits for “whatever” and that Bankman-Fried “directed me to commit these crimes.”

Part of what Ellison said Bankman-Fried instructed her to do was prepare seven different balance sheets to send to Genesis, one of Alameda’s main lenders, when it called back its $500 million loan to Alameda.

He and Ellison agreed to send a falsified balance sheet that understated Alameda’s liabilities and omitted any mention of borrowing money from the FTX exchange, known as customers, Ellison testified.

All told, Ellison said Alameda has taken about $14 billion from FTX customers over the company’s lifetime.

Pleas for mercy

Since his arrest and conviction, SBF’s lawyers have repeatedly appealed for leniency.

From his veganism to the calls from his parents and mysterious friends who wanted to vouch for his bail, the once impenetrable crypto king has abandoned his remorse and begged for his freedom.

His fate now rests in the hands of U.S. District Judge Lewis Kaplan, the no-nonsense judge who presided over Donald Trump’s E. Jean Carroll case.