JPMorgan CEO Jamie Dimon warns interest rates could rise to SEVEN percent – the highest level since 1990 – after claiming the global economy is ‘unprepared’ for further rate hikes

JPMorgan CEO Jamie Dimon warns interest rates could rise to SEVEN percent – the highest level since 1990 – after claiming the global economy is ‘unprepared’ for further rate hikes

Jamie Dimon, CEO of JPMorgan Chase, has warned that Americans could soon face interest rates of 7 percent – the highest level since 1990.

In a new interview, Dimon said the US should prepare for further rate hikes – adding that his own bank was prepared to raise them to 8 percent.

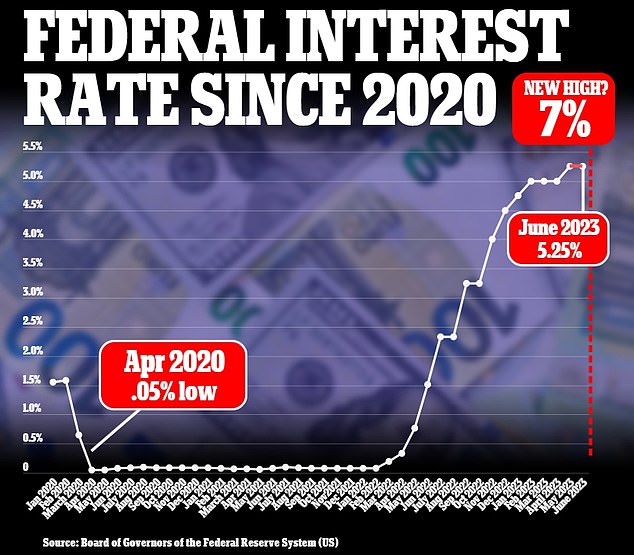

The stark warning is at odds with most analysts’ predictions that the Federal Reserve is likely to raise interest rates only once more by 0.25 percentage points this year. Currently, the Fed rate fluctuates between 5.25 and 5.5 percent.

When asked if it could reach 7 percent, Dimon said Bloomberg TV: ‘Yes, it is possible. When I talk to my board, I say: ‘Can it go to 7%?’ Yes.

“Are there factors that could drive it higher than it is now? Yes.’

JPMorgan Chase CEO Jamie Dimon, pictured, has warned that Americans could soon face interest rates of 7 percent – the highest level since 1990

The stark warning is at odds with most analysts’ predictions that the Federal Reserve is likely to raise interest rates only once more by 0.25 percentage points this year. Currently, the Fed rate fluctuates between 5.25 and 5.5 percent

He added, “I’m just saying be prepared for it. I’m not worried about JPMorgan. We are prepared, we can handle 7 percent, we can handle 2 percent again.’

When asked if the company could handle an increase of as much as 8 percent, he said: “Yes.”

Dimon appeared to be following up on an interview he gave to the Times of India last week, in which he warned that the world is not prepared for 7 percent interest rates.

Speculating what that meant in real terms, he said it could mean a mild recession or even a “harder recession,” adding that there are “a lot of potential bad outcomes.”

The Federal Reserve has begun an aggressive hiking regime to curb inflation and rampant consumer spending. As a result, interest rates have risen from between 0.25 and 0.5 percent in March 2022 to 5.25 to 5.5 percent now.

Rates have not been as high as 7 percent since December 1990.

The fund rate is essentially the rate at which companies borrow and lend money to each other overnight.

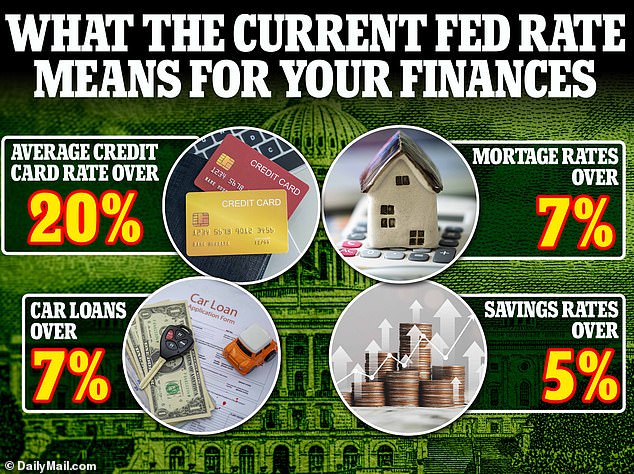

It doesn’t directly determine the interest rates consumers pay, but fluctuations do have a knock-on effect on mortgage payments, credit card loans and savings returns.

For example, the interest rate on a typical 30-year mortgage has skyrocketed from about 2 percent in 2021 to 7.31 percent, according to data from government-backed lender Freddie Mac.

It means a homeowner with a $400,000 property now faces monthly payments of about $2,608, assuming a five percent down payment.

By comparison, if the same buyer settled in September 2021 – when rates were 3 percent – their monthly payments would be $1,000 cheaper at $1,602.

Fed interest rates don’t directly determine the interest rates consumers pay, but fluctuations do have a knock-on effect on mortgage payments, credit card loans and savings rates

Meanwhile, the average credit card interest rate is 20.71 percent Bank rate.

Dimon’s comments come after the Fed decided to keep interest rates steady during its two-day meeting last month.

Projections released with the decision show another increase is likely this year, followed by two cuts in 2024 – two fewer than indicated during the last update in June.

At a news conference after the announcement, Fed Chairman Jerome Powell said, “We are in a position to be careful in determining the extent of additional policy strengthening.”

Inflation accelerated for the second month in a row to an annual rate of 3.7 percent in August – up from 3.2 percent in July – and still significantly above the Fed’s 2 percent target.