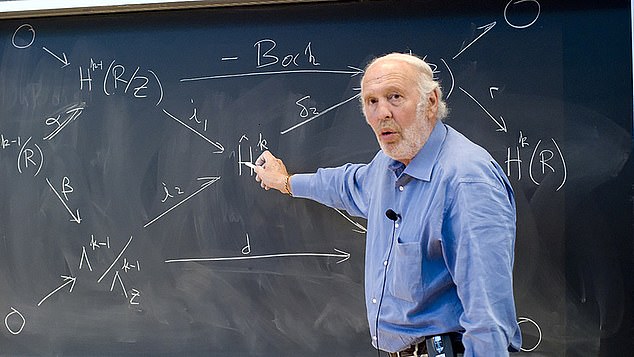

Jim Simons dead at 86: Billionaire math genius passes away at Manhattan home

- He was known as a genius mathematician and one of the richest men in the world

- Simons died on Friday in New York City at the age of 86

Legendary Wall Street financier and mathematician Jim Simons died on Friday at the age of 86.

One of the richest men in the world with a net worth of over $30 billion, Simons revolutionized investing in the financial markets with his mathematical and data-driven approach.

Before Simons’ lucrative investing career, he was a celebrated mathematician who published groundbreaking research in string theory, quantum field theory and pattern recognition.

At age 40, he used his genius IQ to build his wealth, starting with a small trading office on Long Island that generated more than $100 billion in trading profits over 30 years.

Legendary Wall Street financier and mathematician Jim Simons has died at the age of 86

Before investing, Simons was a celebrated mathematician who published groundbreaking research in string theory, quantum field theory and pattern recognition.

Simons’ largest hedge fund, Medallion, was the envy of Wall Street because it delivered an average annual return of 66 percent between 1988 and 2018, eclipsing other prodigious investors like Warren Buffett.

By bringing his algorithm-based approach to the financial markets, Simons was credited with forever changing the way traders work.

Born in 1938 in Brookline, Massachusetts, Simons was considered a mathematical prodigy from an early age and received his PhD at the age of 23.

He worked as a teacher and researcher at Harvard University and MIT in his early career, while also using his brains to crack 1964 Soviet codes for the Institute for Defense Analysis.

Simons was later fired for his outspoken opposition to the Vietnam War.

He continued to work in education for more than a decade – winning prestigious mathematics awards along the way – before founding his first investment company in 1978.

The company, Monemetrics, operated out of a shopping center in Setauket, Long Island, and Simons had never taken a financial trading course before starting, the newspaper reported. New York Times.

While many in the financial world at the time relied on business contacts and trading instincts, he hired fellow mathematicians and scientists because he believed that financial markets were a mathematical problem waiting to be solved.

‘I developed the view that markets are not random, and [were] predictable to a certain extent,” he said in an interview with The Wall Street Journal. “There were statistical anomalies that could be exploited.”

Although he said fundamental trading “gave me stomach ulcers” and made him “feel like a loser,” Simons focused his experience in mathematics on developing a trading algorithm that paid off enormously.

“I want models who make money while I sleep,” he reportedly told a friend while developing his formula, which he described as “a pure system without human intervention.”

He later renamed his company Renaissance Technologies, of which Medallion was a branch, which grew into one of the largest and most influential companies in America.

He retired as CEO in 2010 and the end of his career was marked by significant philanthropic efforts.