JEFF PRESTRIDGE: Don’t let a ruthless American fund manager destroy your confidence

The end of the month isn’t just an opportunity to say goodbye to the January blues – or to meet the deadline for filing tax returns and paying any taxes due.

Except for a few days, it is also a crucial date for shareholders of seven listed investment funds that the American hedge fund manager Saba Capital Management keeps a close eye on.

Unless these trust investors want their money to be managed by Saba in the future – and for me I cannot understand why any right-thinking investor would want such an outcome – they should vote against the proposals of this business opportunist. .

By building up significant stakes in these trusts over the past year, Saba has put itself in a position where it can call for an overhaul of their governance. And this is exactly what it has done.

As a result, shareholders of each of the seven are being asked to vote on expelling the existing directors – and appointing two Saba representatives in their place.

The results will then be unveiled at ‘advanced’ meetings, starting with the smaller companies investment trust Herald a week on Wednesday and ending with Edinburgh Worldwide (managed by Baillie Gifford) early next month.

Facts and Figures: Unless these trust investors want their money to be managed by Saba in the future, they should vote against this business opportunist’s proposals.

In between are the votes for Baillie Gifford US Growth and Baillie Gifford Keystone Positive Growth (both on February 3); CQS Natural Resources Growth & Income and Henderson Opportunities (both a day later); and European smaller companies on February 5.

The votes are part of a pincer movement by Saba. If it gets its people on the board, it will try to remove the incumbent investment managers and combine the trusts to create one amorphous fund.

If Saba is successful, it could try the same maneuver with other trusts in which it has built up stakes.

Investment trusts are far from perfect and have experienced a number of self-induced crises – most recently the split-capital trust crisis of the 1990s.

But as James Budden, head of global marketing at Ballie Gifford, reminded me a few days ago, the investment trust industry is a super illustration of financial Darwinism in action.

Since the 1860s, the industry has evolved. Trusts that no longer served a purpose have been closed down or acquired, while funds have been launched exploring new investment themes (e.g. infrastructure or energy).

They also continue to support companies large and small, both here in Britain and abroad – listed companies and sometimes unlisted companies.

Importantly, corporate governance has improved, with trust boards much more willing to jettison underperforming investment managers than they were a decade ago. Annual charges for some of the larger trusts have also been reduced for the benefit of shareholders.

If Saba has its way, we will lose funds that contribute to the rich bounty of the mutual fund industry – funds that in some cases have delivered excellent long-term returns to shareholders.

For example, Herald, a £1.2 billion global trust of smaller companies, has been managed by Katie Potts of Herald Investment Management since its launch almost 31 years ago. To say that she – and her team – have done an excellent job is an understatement.

Potts has generated a share price return for investors of more than 2,800 percent since launch.

To put this figure into some perspective, the Russell 2000 Technology Index (small cap) and the Deutsche Numis Smaller Companies plus AIM Index have delivered returns of 792 and 620 percent respectively. Potts lives and breathes smaller companies – especially listed technology, media and telecom stocks.

She offers investors the opportunity to make money with skills that few in the city – let alone Saba – possess.

The trusts under attack are fighting back. Budden says Ballie Gifford is taking a “multi-pronged” approach, writing directly to shareholders of the three trusts, managing to warn them of the big, bad investment wolf waiting on their doorstep.

It also uses social media and advertising to spread its message.

But ultimately the future of the seven lies in the hands of the shareholders. Shareholder involvement has never been more crucial. If you are one of them, you have two choices. You can watch from the sidelines to see if Saba gets his way. An approach I don’t recommend, especially if you are happy with the way your money is managed.

Saba only needs a majority of voting shareholders to support its resolutions to achieve its goal.

Alternatively, you can demonstrate shareholder voting rights by casting your vote against any Saba proposal. A vote for long-term investment opportunities over corporate opportunism.

The Association of Investment Companies has put together useful information on how to vote: https://www.theaic.co.uk/how-to-vote-your-shares.

Careful driver punished with app for careful drivers

A huge thank you to the readers who contacted me over the holidays to tell me about their car insurance woes – and in some cases, their joys.

In the coming weeks, I’ll be reporting extensively on their trials and successes in dealing with sky-high renewal announcements.

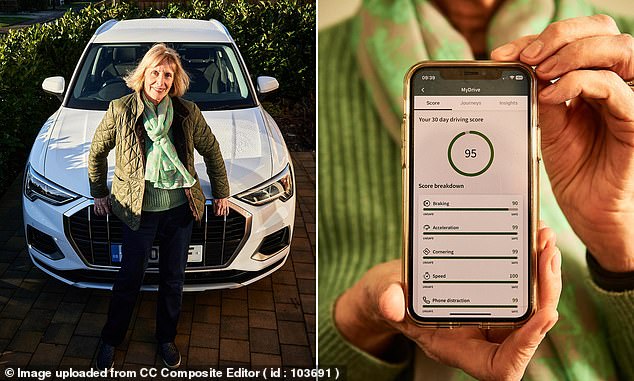

But as a juicy teaser, I’d like to tell you about the recent experience of Catherine Ferrell, 75, a retired medical research administrator from Dunmow, Essex.

Catherine drives a four-year-old Audi Q3 – and travels a modest 9,000 kilometers per year. She has been insured with Aviva since January 2022.

Six months into her 2023 coverage, she was asked if she wanted to add the MyAviva app to her phone. This would monitor her driving behavior and possibly lower her premiums. Being a careful driver, she grabbed this opportunity with both hands.

“I could see every journey I made,” says Catherine, “with the app scoring me on five aspects: cornering, braking, speeding, mobile phone use and acceleration.

‘By the end of 2023 I was regularly achieving scores in the 90s out of 100.’

Top marks, top prize: Catherine Ferrell and her MyAviva app

When Catherine’s 2024 renewal bonus came to almost £369 – 23 per cent higher than the year before – she thought it might have been lower if she had used the app all year. So she decided to go through with it. She wished she hadn’t.

Despite an average of 96 across all five scores for 2024, her 2025 renewal premium came to a whopping £537 – an increase of around 46 per cent. The only way she could contact Aviva was to ask if she had done an excellent job

what was actually taken into account was done via a bot. As is the case with bots, it didn’t understand her question.

Frustrated, she found alternative cover with RIAS for just over £383 – a four per cent increase on what she paid a year ago.

Catherine says: ‘In theory, MyAviva is a great idea, and I like that it is available for older drivers. We can demonstrate that we are roadworthy and suitable to get behind the wheel.

‘But there must be something in return in the form of a lower premium for good driving behavior.’

To put a 46 percent increase into perspective, consultant Pearson Ham says auto premiums were down 16 percent annually at the end of last year.

As Jim Royle of BBC’s The Royle Family might say: ‘MyAviva? My a**e!’

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.