Is your 401(K) funding the Chinese MILITARY? Wall Street investment firms accused of financing ‘red flag’ companies that manufacture fighter jets and navy ships in China – as Biden comes under fire for weak crackdown

Tensions between America and China are reaching a boiling point amid President Biden’s crackdown on U.S. investment in companies in Beijing.

The escalation has shed new light on an uneasy question for most Americans: Would you be happy if your 401(K) funded Chinese military operations?

For many, this is a reality, as leading Wall Street investment firms have been exposed to both direct and indirect funding from Chinese companies that have been blacklisted by the US government.

In July, Republican Representative Mike Gallagher, chairman of the Chinese Communist Party’s House Select Committee, wrote to the leaders of major investment groups BlackRock and MSCI expressing concerns about their ties to certain Chinese companies.

The letter – which was co-signed by the Democrat and fellow committee member Raja Krishnamoorthi – accused both companies of “fostering the military advancement of the People’s Republic of China” and “facilitating human rights abuses by the Chinese Communist Party.”

Last month, President Bident signed an executive order banning new US investment in technology industries that could boost Beijing’s military capabilities. Pictured: Biden with Chinese President Xi Jinping at the G20 summit in November 2022

US investment firms have been associated with red flag companies, such as those that produce Chinese fighter jets. Pictured: A Chinese J-11 military fighter jet

BlackRock is one of the country’s largest asset managers, with approximately $9 trillion in funds, while MSCI is an investment research firm that provides stock indices, portfolio risk and performance analysis to investors. Approximately $13.7 trillion in assets are invested in funds benchmarked against MSCI indices.

Millions of Americans have invested their personal and retirement savings in funds benchmarked by BlackRock and MSCI.

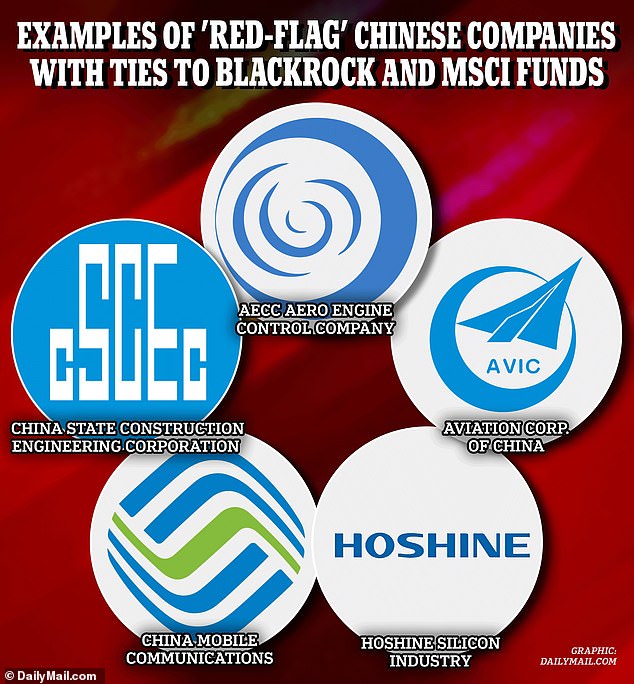

Gallagher and Krishnamoorthi conducted an “initial investigation” of both companies and identified dozens of “red flag” Chinese companies that were part of BlackRock and MSCI’s funds — either directly or through their grants.

The term “red flag” refers to those who appear on the US government’s blacklist. Such activities are technically legal for the Wall Street companies.

But examples of Chinese companies covered by their funds include the Aviation Industry Corp. of China (AVIC), which produces advanced combat aircraft of the Chinese Air Force, the Washington Post.

They were also connected to the China State Shipbuilding Corp, which manufactures warships of the Chinese Navy.

CGN Power Co. — a company accused of trying to send US nuclear technology to the Chinese ministry — also has ties to BlackRock and MSCI, according to Gallagher and Krishnamoorthi’s letters.

Early last month, President Biden signed an executive order barring US venture capital and private equity firms from investing in technology industries that could augment Beijing’s military capabilities.

China hit back, saying it was “deeply disappointed” by the order and hinting at retaliation.

But critics argue that this does not go far enough. Biden’s order only covered US investment to help China develop artificial intelligence, quantum mechanics and semiconductor technology.

Examples of Chinese companies with ties to both BlackRock and MSCI were outlined in a letter from Representative Mike Gallagher and Democrat Raja Krishnamoorthi, both of whom are members of the Chinese Communist Party’s House Select Committee.

Gallagher, pictured, told the Washington Post that it made “no sense” to allow Wall Street to fund Chinese companies developing technologies with “obvious military applications.”

Still, it left a loophole for companies to invest in other sensitive areas, such as biotechnology and energy technology.

Representative Gallagher told the Washington Post“It makes no sense for us to limit the export of sensitive technologies to China, but allow Wall Street to finance Chinese companies that are trying to catch up with us in the same technologies with obvious military applications.”

Similarly, Michael McCaul, chairman of the House Foreign Affairs Committee, accused the White House of “pursuing only half measures that take too long to develop and take effect.”

And the order only covered direct investment in such companies, creating another loophole that allows U.S. investment in Chinese military-related companies through index funds offered by both MSCI and BlackRock.

Krishnamoorthi told the AfterIt is very important that we do things to ensure that we do not knowingly or unknowingly fund military capabilities that could be used against us.

“It doesn’t get enough attention, but it’s vital.”

In recent decades, US investors have been encouraged to strengthen their ties with China – to unite the two economic powerhouses.

But recent government analysis has shown that such investments fueled China’s military capabilities and intelligence gathering.

An MSCI spokesperson told DailyMail.com, “MSCI indices measure the performance of the stock markets available to international investors and comply with all applicable U.S. laws. MSCI does not manage, advise or facilitate investments in any country.

“MSCI is working constructively with the House Select Committee.”

Meanwhile, BlackRock said, “Like many global asset managers, BlackRock offers our clients a number of strategies for investing in or excluding China from their portfolios.

“The majority of our clients’ investments in China are through index funds, and we are one of 16 asset managers currently offering US index funds that invest in Chinese companies.

BlackRock complies with all applicable U.S. government laws in all investments in China and markets around the world. We will continue to work directly with the Special Committee on the issues raised.”