Is this the death knell for the shopping mall? Macy’s ramps up expansion of slimmed-down suburban stores to entice more customers amidst downtown retail apocalypse

Is this the death knell for the mall? Macy’s ramps up expansion of pared-down stores in suburbs to lure more customers amid downtown shopping apocalypse

- Macy’s is expanding the opening of small stores outside of malls and downtowns

- It will open 30 stores in the US between January 2024 and fall 2025

- Several retailers are struggling to maintain profitable physical stores

As American consumers continue to spend more online and less in malls, retailers are scrambling to make brick-and-mortar stores work for their bottom lines.

This week, Macy’s said it will accelerate the opening of “small format” stores outside city centers – with another 30 to open by 2025.

In 2020, the retailer – known for its larger stores in urban malls – began opening smaller locations, about one-fifth the size, as part of a new business model that would see it shift its footprint from cities to suburban malls.

Macy’s currently has eleven small stores in Dallas-Fort Worth, Atlanta, Chicago, St. Louis, Boston and Las Vegas. It will open a new one in San Diego in November, the company said in a news release.

The original small stores were renamed Macy’s Market, but the company said in August that new small stores would simply be called Macy’s.

The new stores range in size from 30,000 to 50,000 square feet, about one-fifth the size of regular department stores. Pictured is the flagship location in Manhattan

The original stores were renamed Macy’s Market, but the company said in August that new small stores would simply be called Macy’s.

Small format stores, as the company calls them, are between 30,000 and 50,000 square feet in size and are found in “off-mall” locations – free-standing stores, far away from traditional enclosed shopping centers.

Macy’s CEO Adrian Mitchell said in a news release Tuesday that the smaller stores were “efficient to operate” and allowed the retailer to focus on “busy shopping centers.”

Liza Amlani, director and co-founder of Retail Strategy Group, told Retail Dive in July that Macy’s new model marks a move away from the increasingly unprofitable “mall-anchor” approach to retailing.

“It’s positive because this is the right move for any flagship, to move away from an anchor store and open smaller concepts with a curated product range that is localized with the consumer in mind,” she told the outlet.

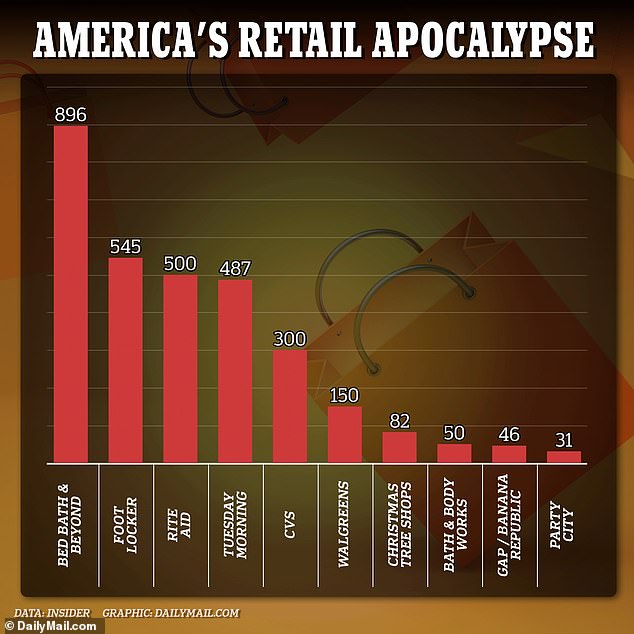

Bankrupt brands like Bed, Bath & Beyond, Rite Aid Pharmacy and Tuesday Morning are closing hundreds of branches, while household names like Gap, Target and CVS are closing major city stores as part of “restructuring projects.”

The retail industry continues to struggle as consumers reject malls in favor of online shopping, leading to the collapse of stores like Payless and Toys R Us and tens of thousands of layoffs.

This comes despite a gradual increase in US retail sales overall – with the sector raking in $7 trillion in 2022 – compared to $6.58 trillion in 2021 and $5.58 trillion in 2020, according to Statista.

At least 20 major brands have announced closures that will take effect by the end of 2023, at a total of 3,193 locations. Insider.