Is the City listening to Johnson Matthey boss Liam Condon?

Since the Industrial Revolution, Johnson Matthey has prided itself on being a pioneering chemical and industrial company. But CEO Liam Condon is the first to admit it has lost sight of the winning formula in recent years. Too much emphasis was placed on science and not enough on business.

“There was a feeling that Johnson Matthey had a university feel to it,” he says. ‘Scientifically it was very exciting, but commercially it was not very strong and a bit sleepy.’

The disconnect came to a head in November 2021 when the electric car battery division hit the rocks.

Former boss Robert MacLeod issued a three-pronged announcement: talking about his own exit, a warning about profits and the bombshell that it was scrapping the battery project it had been working on since 2012 and into which it had plowed the best part of £1. billion.

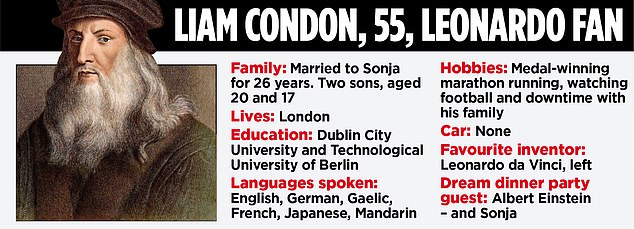

Shares sank and within months Condon, 55, was parachuted in to revive the ailing metals group.

Strategist: Liam Condon isn’t afraid to order fundamental changes

The Irish businessman and ultramarathon fanatic stormed into the company, which has 13,000 employees, with great enthusiasm. He had been approached by a headhunter and happened to know and get along well with chairman Patrick Thomas.

“One of the most important things that has to work is the relationship between the CEO and the chairman,” says Condon. ‘There has to be real trust, otherwise your life will be miserable.’

The shutdown of the battery sector was also a decisive factor.

“The decision is one of the reasons why I said I would get involved, because it was quite clear from the outside – to me at least – that Johnson Matthey would never make money from batteries,” he says.

‘We had no customers. And if you look at the larger context of the time – with places like China and Korea already very advanced and the factories operational – you’re always going to fall behind.

‘Leaving meant I essentially had a clean slate when I came in, rather than being shackled to the past.’

He stood for a new start in more than one respect.

Condon came from the chemical company Bayer and knew little or nothing about precious metals, which had been Johnson Matthey’s bread and butter for two centuries. The company, which opened its doors in 1817, started out as an inspector who tested the purity of valuable metals.

Scientific advances later took a number of different directions, including the supply of electrocatalysts to the space agency NASA. It became a crucial manufacturer of catalytic converters, which filter the exhaust emissions of petrol and diesel cars.

It is believed that about a third of cars worldwide have one of the inverters connected.

For Condon, there was a lot to learn very quickly, but this was nothing new.

He has a reputation for being able to dive into new environments with enthusiasm.

The Dubliner, whose brogue has survived a globe-trotting career, studied languages and international marketing before winning a scholarship from the West German government. In the last years before the fall of the wall he studied in Berlin.

His first job after graduating was at the pharmaceutical group Schering, where he marketed the contraceptive pill for many years. The company was later acquired by Bayer.

Schering sent him to Japan and he lived for six months with a family who did not speak English so he could learn the language.

The natural polyglot similarly learned Mandarin when he was transferred to China. Its language offering also includes Irish, French and German.

The fundamental change he has introduced to Johnson Matthey is so alarmingly simple that it is shocking to think it even needs to be pointed out. He has ruled that the company should only invest large amounts of energy in research and projects where they know there is a customer.

“We probably have the best platinum group chemists and metal chemists in the world,” he says. ‘These are really brilliant people. I don’t think it’s necessarily their job to think about how we can generate value, but someone has to think about it.

‘Now, early in the entire research and development phase, before we get completely carried away with developing something new, let’s be very clear about the customer needs we are trying to meet. As opposed to taking a purely scientific view, where it could be a very intellectually stimulating challenge, but it might not go beyond getting some articles in some famous scientific journals.”

We meet at a site in North London dedicated to separating precious metals from recycled and raw materials. Millions of pounds worth of metal pieces lie on the floor before they pass through Johnson Matthey’s machines.

The site is one of twelve in Britain. There are dozens of them worldwide, including in the US, Poland, Japan, Malaysia, Germany and the Caribbean islands of Trinidad and Tobago.

But the crucial question – especially for investors – remains. Does this new strategy work?

In May, the company reported an annual profit of £344 million – more than the total of £224 million before spinning off the battery business in 2021.

However, it seems like traders didn’t get the memo. The share price, which took a nosedive on the battery news, has fallen to £14.62 from £18.45 when Condon joined. Its market value now stands at £2.7 billion.

Long a stalwart of the FTSE 100, it has since fallen in and out of the index, including during the most recent rebalance in September, which pushed it down to the FTSE 250.

Fortunately, despite Johnson Matthey’s focus on green technologies, Condon doesn’t think Prime Minister Rishi Sunak’s recent rethink of net-zero targets will hit the company or even UK environmental pressures as a whole.

He says: ‘The reactions were probably a bit exaggerated. All Rishi said is that we have super ambitious net zero targets, so we are now adjusting them slightly to be more in line with European peers.

‘These are still ambitious targets, just not as strong as before. I don’t think it will have a big impact. Although it does play somewhat into the perception that the policy environment for long-term investments is not as predictable and stable as you would normally like from a business perspective.’

He adds: ‘There is still a huge opportunity for Britain to become net zero world champions.’

One constant refrain is that Britain needs to rethink the idea of an industrial strategy. This is something he believes has been lost in the revolving door of prime ministers and business ministers since 2015.

“It feels like we’re living from election period to election period and until then there’s just shouting,” he says. ‘The world is moving at warp speed. Investment decisions are now being made for the next ten to twenty years.

“An industrial strategy really needs to refocus on what our core strengths are,” he says, adding that we need to focus on where the UK can “really be competitive” and “stop trying to do things” in areas where realistically we have no chance.

Its strengths, he says, are green technologies, including carbon capture, which captures greenhouse gases and stores them under the sea. He believes that another focus should be the groundbreaking research of our leading universities.

‘Many people now think: where can we really be competitive? Where can we win? If we’re not confident we can win, we’re probably not the best to play.”

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.