Is now the time to invest in luxury assets? Cost of used Rolexes have fallen to two-year lows while polished diamonds have dropped 20% – but experts urge caution against scooping up goods while they’re cheap

The pandemic-era luxury boom appears to be coming to an end, as the price of expensive investments like Rolex watches and diamonds falls.

During the years of Covid-19 lockdowns, demand for designer handbags, precious jewelry, fine wines and second-hand timepieces soared as shoppers stuck at home had a surplus of capital to spend on luxury goods.

But with interest rates hovering at a 22-year high amid persistent inflation, and households increasingly feeling the pinch, the rise of luxury appears to be slowing – and with it, lowering the value of goods.

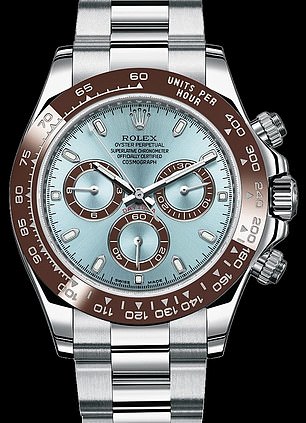

The price of used Rolex and Patek Philippe watches fell to a new two-year low last month, reflecting rising supply and falling demand.

According to figures, wholesale polished diamond prices have fallen by about 20 percent this year Bloomberg.

Amid the global slowdown, is now the time to buy luxury assets while they are still cheap?

The Bloomberg Subdial Watch Index, which tracks the prices of the 50 most traded watches on the secondary market, fell 1.8 percent in October

Andrew Shirley, head of rural and luxury research at Knight Frank, warns potential investors to do their research – and be aware of the difference between passing trends and collectibles before investing.

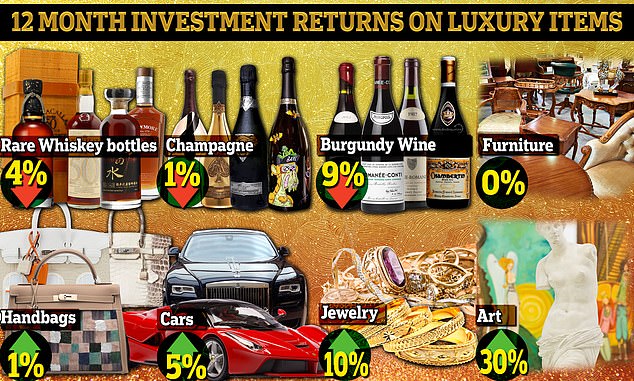

Shirley publishes the company’s annual Luxury Investment Index, which tracks the value of the ten most popular collectibles, including cars, jewelry, watches, art and whiskey.

“There are opportunities, but be careful,” he told DailyMail.com.

‘It is important to look for real fame and rarity. Keep an eye on these markets, research them and talk to them dealers that you feel you can trust, and you can perhaps start to identify areas that may be a little undervalued or that have growth potential.

‘But if Hermès handbags are worth a little less now, don’t just start buying an old Hermès handbag because you think they are cheaper than before.

‘Don’t jump into a market just because it’s going down in value. It could be that it drops even further because there was no reason for it to be high in the first place.’

Experts warn that second-hand Rolex and Patek Philippe watches, for example, could continue to fall in price.

Andrew Shirley, head of rural and luxury research at Knight Frank, warns potential investors to do their research

The Bloomberg subdial watch indexwhich tracks the prices of the 50 most traded watches on the secondary market, fell 1.8 percent in October to about $34,000.

It is at its lowest level since 2021 and has fallen 42 percent from a peak of almost $60,000 in April 2022.

Christy Davis, co-founder of UK trading platform Subdial, said in the company’s October update: ‘We are seeing increasing downward pressure on the market, which could lead to a further downward price decline as dealers cut valuations to chase sales. to hunt. ‘

Joe Osborn, finance and business editor at the non-profit organization Dealaid.org, told DailyMail.com: ‘Despite a huge drop, now is still not the best time to invest in used luxury watches if you strictly want to resell them.

‘What you want to see in the market is a flattening of prices for six to twelve months. That would be a more accurate indication of the bottom of market prices and would give you little downside risk.

“But if you plan to buy a used luxury watch and wear it yourself or give it as a gift, now is a good time to buy.”

Prices of the popular Rolex Daytona 116506 (left) and the Patek Philippe Nautilus Travel Time 5990/1A-001 (right) have fallen since the market peak

According to Bloomberg, wholesale polished diamond prices have fallen by about 20 percent this year

Shirley warns that a “false market” exists for some luxury watch brands as companies limited supply to create an “artificial sense of demand.”

The limited-edition watches, which are harder to come by, will be a good investment in the long run, he said, and the same can be said of many rare collectibles.

“The core markets are doing well because there is still an awful lot of money in collectors’ pockets,” he said.

“Maybe what’s going on is maybe the peripheral parts of those markets where there are collectors who can drift in and out when they think there’s money to be made.”

When it comes to diamonds, Shirley noted that white diamonds are not particularly rare.

‘White diamond prices are driven by the jewelery trade and any decline is likely due to consumers currently cutting back on spending.’

Color diamonds are where the rarity and value lies, he added.

(item name = module id = 119913159 style = undefined /)

The trick now for collectors is to identify markets that are undervalued, Shirley said.

According to the Knight Frank Luxury Investment Index published in August, works of art continue to show healthy returns, with women’s creations experiencing the biggest increase in value in the past decade.

The value of garments specifically made by women has increased by 163 percent in the past decade.

Women artists saw the bulk of this growth between 2016 and 2019 – a period that coincided with powerful social change movements such as ‘#MeToo,’ the report said.

According to the Knight Frank Luxury Investment Index published in August, works of art continue to generate healthy returns

“Values return to where they should always have been because they were intrinsically undervalued,” says Shirley.

For Shirley, it’s important to remember that these should be ‘passion investments’, and those looking for quick appreciation may be better off investing in more liquid assets.

“In my opinion, you should buy these things because they are assets you want to own,” he said.