Is money back? Five ways we spend our money is changing

The way we spend our money is changing. While Brits may be spending more with debit cards, there is a surprising resurgence in cash, but checks are on life support.

Banking trade body UK Finance said there were a total of 45.7 billion payments in 2022, with 39.5 billion made by consumers and the rest by businesses.

Of those 39.5 billion, the debit card was the most popular payment method, with 23 billion purchases in 2022, compared to 19.5 billion in 2021.

But in a surprising second place was cash, with 6.4 billion payments last year, up from 6 billion in 2021.

Cashing: The use of physical money increased in 2022, with 6.4 billion cash transactions

There is also a trend towards consumers making more purchases but spending less each time – apparently in response to the cost of living crisis.

These are the five main ways our spending habits are changing.

The unstoppable rise of the debit card

Last year, no less than half of all consumer payments were made with the debit card, making it by far the most popular payment method.

UK Finance said more than 95 percent of the UK population now owns a debit card and uses it regularly.

We make more, smaller payments

An interesting trend is that Brits are shopping more, but spending less each time.

This appears to be a response to the cost of living crisis, which has seen consumers paying much more for things like utility bills and groceries.

UK Finance said: ‘Anecdotal evidence suggests that, for example, people are more likely to make smaller visits to supermarkets than to one large store.’

There has also been a decline in the use of travel cards and season tickets, with Britons instead paying for travel individually.

This is likely an attempt to gain more control over costs. Although paying for travel individually is often more expensive, it can help with budgeting in the short term.

Similarly, in 2022, UK Finance saw a trend for Brits to set up multiple bank accounts and use different debit cards for different expenses.

Cash is not dead

Despite negative headlines to the contrary, cash is not dead yet – even if it is starting to take a long time.

According to British financial data, cash was the second favorite way for Brits to buy things in 2022.

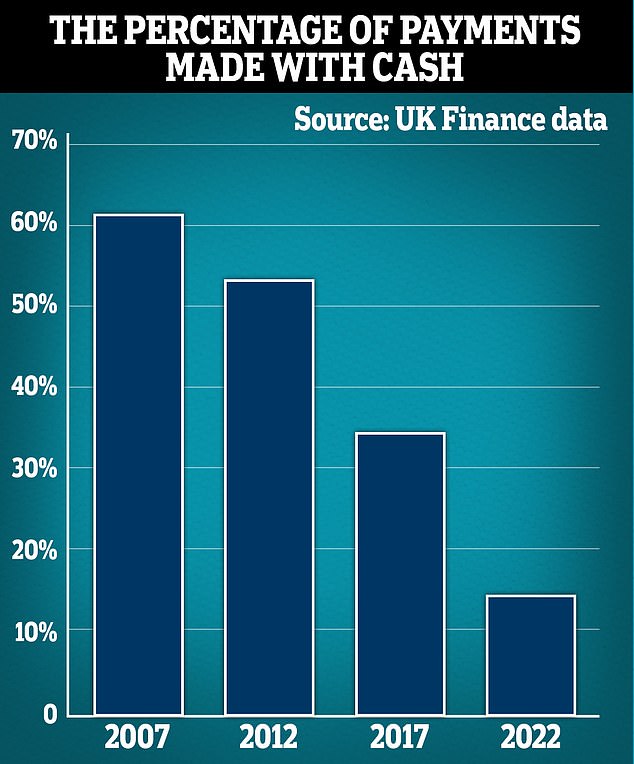

Decline: Although the use of cash has increased in 2022, it is still much less popular than in recent years

Last year, 6.4 billion payments were made with cash, compared to 6 billion in 2021.

That said, cash is clearly not as popular as it once was.

Since 2017, cash use has fallen by about 15 percent annually.

But in 2022, growing fears of inflation and the rising cost of living led some consumers to return to increased use of cash as a way to manage a tight budget.

UK Finance saw a similar trend in 2008, during the financial crash.

However, due to an increase in the overall payment volume in Great Britain, the share of payments made with cash has still fallen slightly, from 15 percent of payments to 14 percent.

Contactless payments are on the rise

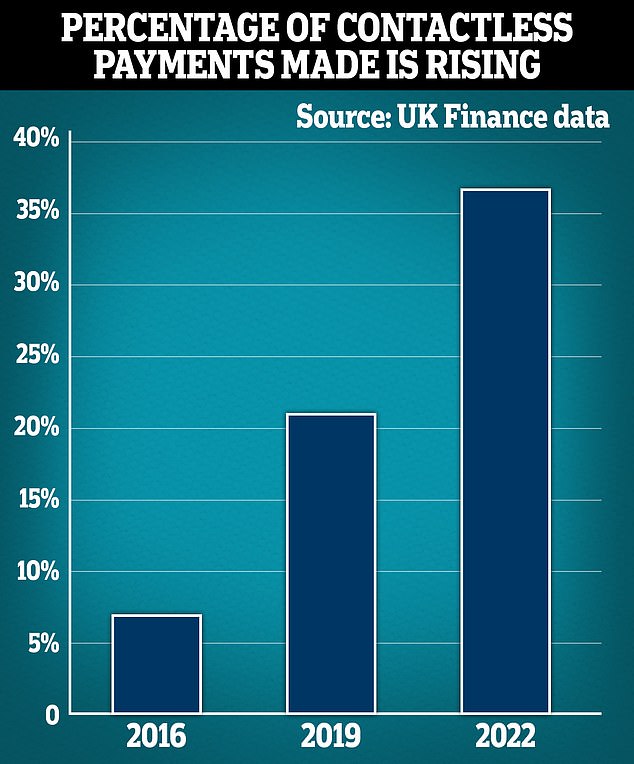

In 2022, the number of contactless payments in Britain will increase to 17 billion payments, up from 13.1 billion the year before.

Most Brits (87 percent) made at least one contactless payment per month by 2022.

Higher limit: Contactless payments have soared in recent years, partly due to the payment limit being increased to £100

Even among retirees, who might be expected to prefer more traditional payment methods, 87 percent made one or more contactless payments per month.

The group with the highest usage rate was the 35-34 age group, where 90 percent of people regularly made contactless payments.

The rise of contactless payments is partly due to the increase in the payment limit to £100 per transaction, and retailers encouraging these types of payments.

There is also growing consumer confidence in contactless payments, according to UK Finance.

Forget checks

Unfortunately for those who like to pay for things with the stroke of a pen, the humble check is nearing its end.

UK Finance said the number of checks used to make payments has fallen further in 2022.

There was a 14 percent decline over the year, to just 129 million check payments in 2022.

Cards and remote bank transfers are the main reasons why the use of checks is declining, according to UK Finance.

However, checks are here to stay because they provide an easy and secure way to pay someone if you don’t know his or her account information.

Not only that, but since 2019, most mobile banking services have allowed customers to deposit checks into their accounts by taking a photo of it with their cell phone camera.

This is thanks to the Image Clearing System, which was introduced by the Check and Credit Clearing Company in October 2017 and fully rolled out in September 2019.

However, UK Finance expects the use of checks to continue to decline, to just 66 million payments per year by 2032.

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.