Is a will REALLY enough to guarantee your money will go to your heirs? Experts warn long-forgotten documents can supersede your estate plans – and a small mistake will cost your children their inheritance

Is a will REALLY enough to guarantee that your money goes to your heirs? Experts warn that long-forgotten documents could replace your estate plans – and that a small mistake could cost your children their inheritance

- Experts warn that long-forgotten beneficiary forms can wreak havoc on your estate plans

- Problems can lead to nasty legal battles between children and ex-spouses when a loved one dies

- Have you experienced an inheritance nightmare? Send an email to: money@dailymail.com

Most families could be forgiven for thinking that a well-executed will is enough to ensure that their fortune is passed fairly to their heirs.

But experts warn that is increasingly not the case, as America’s growing number of financial accounts risk invalidating their wealth plans.

For example, an individual may have a will that specifies that his wealth is to be distributed among his children. But a long-forgotten form on a life insurance policy could list an ex-spouse as a beneficiary, leading to nasty legal battles.

Florida financial planner Paxton Driscoll told DailyMail.com: ‘The most important thing for older people to make sure is that their affairs are all in line.

‘Lawyers love to ask for money wherever they can, so families need to be crystal clear about who the beneficiaries of their estates are.’

Florida financial planner Paxton Driscoll told DailyMail.com that he regularly saw clients who didn’t realize they had an account with an ex-spouse listed as a beneficiary.

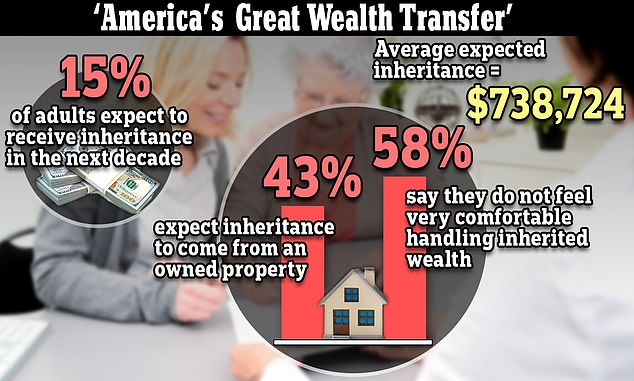

Adults who expect to inherit in the next decade estimate they will receive more than $700,000 on average, according to a report from life insurer New York Life.

America is about to embark on a “major wealth transfer,” experts say, with the average adult expecting to make more than $700,000 over the next decade, according to New York Life.

But financial planners warn that estate planning is becoming increasingly complicated because of the sheer number of accounts Americans now own that have beneficiary forms attached to them.

These include life insurance policies, pension pots and even some bank and broker accounts.

If these accounts name the wrong beneficiary, their entire value could be transferred to that person, regardless of what your will or other estate plans say.

Driscoll added, “I get people coming to me all the time who find out that their ex-wife is actually listed as a beneficiary on some financial account.

‘Most assume that the bank will let you know if something is wrong, but it is up to you to stay on top of it.’

The family of Dr. James Rocconi is among those who have had to endure an ugly lawsuit due to an outdated beneficiary form.

Dr. Rocconi changed all his estate plans after his third wife left him and hand-wrote a change to his life insurance policy, which was faxed to the insurer.

The note changed the beneficiary of his policy from his former partner to his children.

But after he died in 2017, his family discovered that the insurer had not accepted the faxed change because it had not been signed by the deceased.

It led to a six-year legal battle between the children and his ex-husband over the payout.

His son Dr. Tony Rocconi told it Wall Street Journal: ‘He told me what he wanted. I wouldn’t let her win. I just wanted him to be right.”

The children eventually got their share of the life insurance money and donated it to his father’s church, the WJ reported.

They won in court because their case was helped by the fact that there were voice recordings stating the father’s wishes. On a recording, the deceased could be heard saying, “I have to get her out,” police said WJ.

The Arkansas Supreme Court said he had “substantially complied” with the insurer’s policy modification requirements.

However, many families are not so lucky. And the issue is complicated by the different beneficiary rules for different accounts.

For example, laws surrounding 401(K)s mean that the spouse of a deceased owner is automatically entitled to the money unless he or she formally relinquishes it. Any waiver must be notarized.

But Individual Retirement Accounts (IRA) allow an owner to name someone other than their spouse as a beneficiary without obtaining an exemption.

Meanwhile, the beneficiary of a life insurance policy is dependent on the insurer’s own rules.

If the policy was purchased through an employer, the employer plan documents also determine the rules for payment.

Driscoll recommends that families put their money in a trust if they are trying to manage their affairs before they die. According to him, trusts go ‘one step further’ than a will and offer more legal protection.

The biggest difference between a will and a living trust is that the will takes action after death and must go through the probate process.

However, a living trust takes effect when the owner is still alive and does not have to go through probate.