Is a ‘SURPRISE recession’ on its way? Veteran technical analyst warns Wall Street has become too complacent about the US economy – and predicts more banks could fail like SVB

Is a ‘SURPRISING recession’ coming? Veteran tech analyst warns that Wall Street has become too complacent about the US economy – and predicts that more banks like SVB could fail

Wall Street has become too complacent about the risk of a recession, a veteran technical analyst warned as he predicted the S&P 500 could plunge to lows not seen since the pandemic.

Milton Berg, who has worked in financial services since 1978, said the collapse of Silicon Valley Bank (SVB) earlier this year was “just the tip of the iceberg” and speculated that more companies could fail.

His comments come after economists at Goldman Sachs cut the chance that America will enter a recession in the next 12 months from 20 to 15 percent.

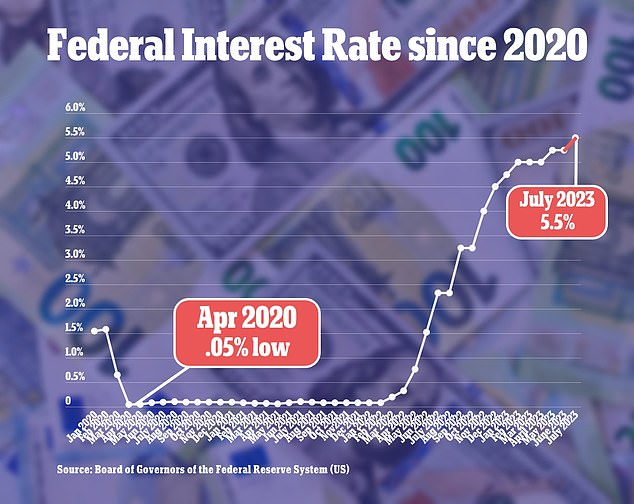

The bank said it had “confidence” in the Federal Reserve’s policy to curb inflation by raising interest rates from near zero to a 22-year high.

Berg told the Forward guidance podcast: ‘Everyone has given up on a recession for one reason or another. Suddenly the Fed continues to tighten and suddenly everyone says there is no recession.

Milton Berg, who has worked in financial services since 1978, said the collapse of Silicon Valley Bank (SVB) earlier this year was “just the tip of the iceberg” and speculated that more companies could go bankrupt.

“Goldman Sachs, which said a year ago there was a 65 percent chance of a recession, now drops to a 15 percent chance of a recession.”

But he warned: ‘It’s just amazing how, when you have a strong market, people suddenly start to doubt a recession. But now is a good time to worry.

“When the economy looks good, you’re going to have a surprise recession.”

Berg – who has advised elite investors such as George Soros and Stanley Druckenmiller – later added: “The reality is that the economy has been weak and may be getting weaker. We are more likely to have a recession now than at any time in the last two years.”

The banking sector fell into crisis when Silicon Valley Bank collapsed on March 10. It was the third largest bank failure in U.S. history and the largest since the 2007-2008 global financial crisis.

It was quickly followed by the collapse of First Republic Bank and Signature Bank.

Much of the panic has since subsided and investors have quickly emerged from the crisis.

However, Berg warned: ‘SVB is just a canary in the coal mine, the tip of the iceberg. That’s my opinion. It will happen to many more banks and many more assets.”

Experts have been sounding the alarm about a recession in the US since white-hot inflation took hold following Russia’s invasion of Ukraine.

Goldman Sachs chief economist Jan Hatzius said in a research note on Tuesday that the bank has lowered the chance that America will enter a recession in the next 12 months from 20 to 15 percent.

The Fed rate shot up to a 22-year high of 5.5 percent in July

However, much of the economy has defied expectations. The Fed’s policy of aggressive rate hikes has also brought annual inflation down to 3.2 percent – down from a high of 9 percent last summer.

And experts say the stock market has entered a “bull market” after the S&P 500 rose dramatically following a roughly 20 percent decline in 2022.

A “bull market” is a nickname used by Wall Street to refer to periods when the S&P 500 rises 20 percent or more from its most recent low.

But Berg urged caution about this “correction” as previous economic patterns indicate stocks are likely to fall again.

He said that in a “real, really bad recession,” the S&P 500 could fall to its March 2020 low.

But he added: “I’m not predicting that, I’m just saying we have to have in the back of our minds what could happen.”

His comments are at odds with those of Goldman Sachs chief economist Jan Hatzius, who praised Fed Chairman Jerome Powell’s approach, which had helped avoid a recession.

Hatzius wrote in a research note: “Our confidence that the Fed is done raising rates has grown over the past month.

“We view Chairman Powell’s pledge in Jackson Hole to ‘proceed with caution’ as a signal that a September increase is off the table and that the hurdle to a November increase is significant.”

The Fed will meet again on September 20 to decide whether another rate hike is necessary. The Fed’s benchmark interest rate provides a guideline for how much banks should lend and borrow money.