Is $1 million REALLY enough to retire on? Number of 401(K) millionaires is rising – but experts say retirees need even more for a comfortable lifestyle

A $1 million pot was once considered the benchmark for a comfortable retirement. But amid rampant inflation and rising interest rates, is it really enough to get a saver through his final years?

The number of Americans with the seven-figure amount in their 401(K)s has increased 25 percent this year, according to Fidelity analysis.

Assuming someone retires at age 65 – and has a life expectancy of 90 years – this would leave them with just $40,000 a year to live on.

Yet figures from the Bureau of Labor Statistics suggest that the average American citizen aged 65 and older actually spends $52,141 per year.

Certified financial planner Marissa Reale told DailyMail.com: ‘$40,000 a year is not going to be enough for most people to live on.

A stock market boom has boosted the number of savers with $1 million in their 401(K)s by 25 percent this year, according to figures from Fidelity Investments.

Certified financial planner Marissa Reale told DailyMail.com that a $1 million pot probably wouldn’t provide most people with a comfortable retirement

‘I always advise my clients to also invest part of the money in shares. So it is not the case that you will receive the full amount in cash.

“If you really want the money to last, most people need more than a million dollars.”

But she points out that retirees would get a boost from Social Security benefits, which should also be taken into account.

The average Social Security benefit currently hovers around $1,800 per month – or $21,600 per year – according to GoBanking Rates. It would increase a saver’s annual income by $1 million to $61,600 a year. Social security benefits change according to the cost of living.

But many Americans are concerned that by the time they retire, these government supports will no longer exist — or at least will decline significantly.

a research by investment bank Natixis this week it emerged that 77 percent of investors were concerned that high government debts would contribute to cuts in social security.

To safeguard your pension fund, Reale is in favor of the ‘4 percent’ rule. This means savers look at the lump sum of their pension pot and assume they will spend 4 percent of that total each year.

To figure out how much you need, she recommends households examine their living costs and calculate what they actually spend in a year.

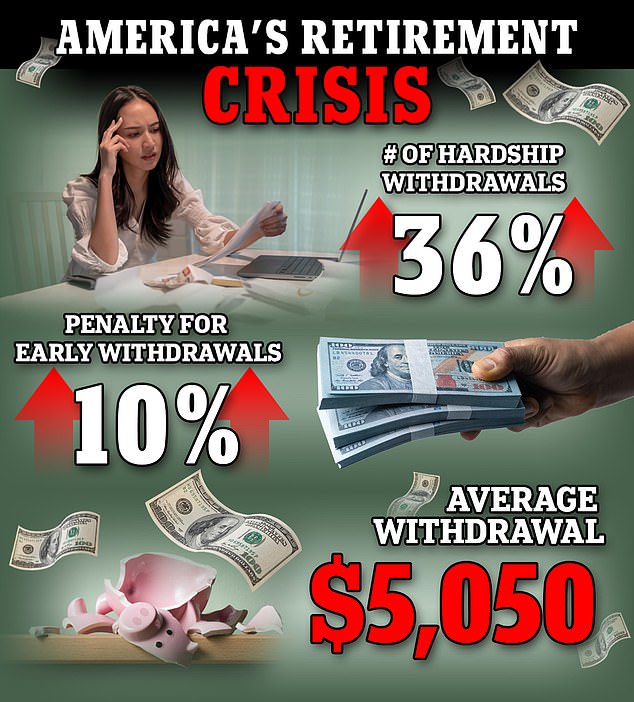

This week, a report from Bank of America (BofA) sounded the alarm about a rise in the number of employees taking “hardship” withdrawals from their 401(K)s

From there, they can multiply it by the number of years they predict they will be in retirement, based on when they want to retire and their life expectancy.

But Paxton Driscoll of Florida Financial Advisors points out that retirees may want to spend more than usual after work.

He told DailyMail.com: ‘When you work you go into an office every day and sit at a desk for hours a day – you don’t actually spend much money.

“But once you retire, every day is a Saturday. You’re probably spending a lot of money.’

To finance a twenty-year retirement, Paxton adds that a household spending $120,000 a year would need $2.4 million in the pot.

He said: ‘The absolute worst-case scenario that everyone wants to avoid is having to go back to work after retirement.’

Both experts say one of the biggest problems retirees face is underestimating their life expectancy.

A 2021 survey by investment firm Capital Ideas found that 43 percent of retirees underestimated their life expectancy by at least five years.

It comes as experts repeatedly sound the alarm about America’s so-called “pension crisis,” as rising costs of living have made it harder for workers to save enough money.

Earlier this year, a study from Northwestern Mutual found that the average worker had just $89,300 saved for retirement.

The problem is compounded by the fact that more and more workers are taking on ‘hardships’ to make ends meet. Figures from Bank of America show that the number of 401(K) plan participants rose 36 percent in the second quarter of the year compared to the previous year.