IRS crime chief reveals the telltale signs that tax-preparer is a SCAMMER – and other top tips to steer clear of fraud this filing season

As we head into tax season, the Internal Revenue Service has warned Americans to be vigilant about a wave of scams — and we have tips for avoiding them.

Fake tax preparers and bogus refund schemes that promise large refunds – in the $1,000 or more range – are among the tax crimes that spike this time of year.

Scammers may also try to gain access to a victim’s Social Security number to file a tax return and steal their refund, or simply pose as an IRS employee.

Federal IRS investigators launched 1,409 tax crime investigations through September 2023 and identified $5.5 billion in tax fraud.

“Tax crimes spike during tax season as criminals steal unwitting taxpayers’ information, hack into accountants’ servers, and victimize unsuspecting taxpayers with the false promise of huge tax refunds,” said Jim Lee, chief of criminal investigation for the IRS.

Tax crimes rise during filing season, warned Jim Lee, head of the IRS’s criminal investigations

According to CI, 655 suspects were convicted of tax crimes in the past financial year.

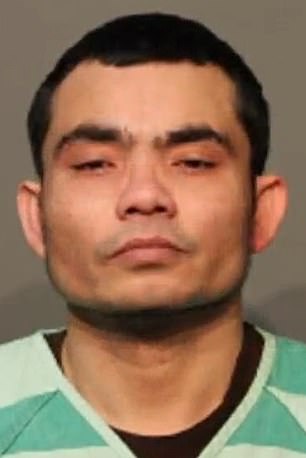

Among them were father and daughter Thein Maung and Phyo Mi, who were sentenced in October 2023 to 12 and nine years in prison for an elaborate fraudulent tax preparation scheme they ran from their home in Iowa.

According to CI, they victimized hundreds of immigrants and refugees working in the state’s meatpacking plants by fraudulently claiming tax credits and redirecting their customers’ tax refunds to their own accounts.

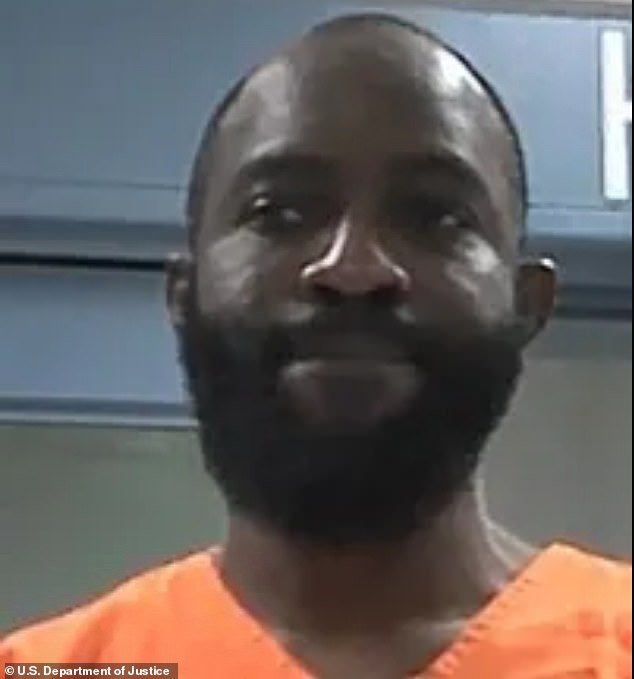

Ayodele Arasokun was sentenced to 34 years in prison in September 2023 for coordinating a scheme to file more than 1,700 false returns — resulting in $2.2 million in refunds from the IRS.

Filing season for the 2023 tax year officially began on January 29, and the majority of Americans have until April 15 to file returns. Taxpayers in Maine and Massachusetts have until April 17.

Thein Maung and Phyo Mi were sentenced to twelve and nine years in prison in October 2023 for an extensive fraudulent tax preparation scheme.

Ayodele Arasokun was sentenced to 34 years in prison in September 2023

CI warns taxpayers to avoid return preparers who claim they can receive larger refunds than other preparers.

If their fee is a percentage of your tax refund, this should also be a red flag, the report said.

Unscrupulous preparers may actually prepare the tax return, but when it is filed with the IRS, they ask the taxpayer to sign their own return, making it appear as if they filed it themselves.

Cesar Cobo, of legal marketing agency Webris, urges taxpayers to ensure companies have the correct licenses and credentials

This means the taxpayer is liable for any errors or omissions the preparer made, including penalties for underpayment and negligence, which often happens because the promised large refund was inaccurate.

Only allow money to be deposited into your personal accounts, experts warn.

Some scammers have money deposited into their own account, which they claim will be ‘distributed later’.

“When researching someone who can help with tax preparation, make sure he or she has the proper licenses and credentials,” says Cesar Cobo of legal marketing firm Webris.

‘Tax preparers are required by law to have a valid Preparer Tax Identification Number (PTIN). Search online to make sure your tax preparer is legitimate.”

CI warns taxpayers to avoid return preparers who claim they can get a larger refund than other preparers or if their compensation is a percentage of your tax refund

Americans should also watch out for fake emails or text messages claiming to be from the IRS – and avoid opening attachments in unsolicited messages.

These messages may contain malware that could compromise your personal information, including your social security number or banking information.

Taxpayers can also obtain an IRS Identity Protection PIN (IP PIN) as a layer of protection against identity theft.

This is a six-digit number known only to the taxpayer and the IRS and prevents fraudulent tax returns.

The IRS will never threaten taxpayers, demand payment, or ask for financial information.

If you suspect that a person or company is committing fraud, report it to the tax authorities and law enforcement.