INVESTMENT TRUST RIGHTS AND ISSUES: Duo Jupiter remains optimistic for a positive year in UK mid-caps

It has been 15 months since the investment trust board was established Rights and problems made the bold move to appoint new managers to run the fund.

While it is too early to judge whether the change has paid off, confidence appears to be heading in the right direction – and could be ideally placed to benefit from a revaluation of the UK stock market if inflation finally is under control and interest rates are starting to rise. head down.

Over the past year, shareholders have achieved a total return of more than 12 percent – better than the 2 percent gain they have made over the past three years.

“It's good to be positive about the UK stock market over the next 12 months,” said Dan Nickols, who took over the management of the trust along with Matt Cable in early October 2022.

“You cannot rule out further shocks and a general election could increase uncertainty, but all the ingredients are there for a revaluation of the market, especially in the small to mid-caps in which we specialize and where confidence is invested.”

Nickols and Cable work for investment company Jupiter Asset Management. They replaced long-standing manager Simon Knott, an experienced stock picker who had led the trust for 39 years.

With a significant personal and family stake in the £115 million trust, Knott now sits on the board as a non-executive director, overseeing the work done by the Jupiter duo.

Nickols is not at all impressed by Knott's presence. “Simon knows the portfolio extremely well, asks challenging questions and keeps our feet to the fire,” he says. 'Ultimately he is good for us and the shareholders.'

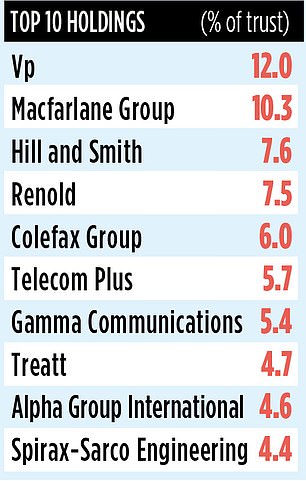

The trust is invested in 22 shares, mainly companies outside the FTSE 100 Index, the 100 largest companies listed on the London Stock Exchange by market capitalization.

While the number of shares is little changed from Knott's days as manager (one fewer position), the two managers have diversified the portfolio.

They have done this by offloading some of the trust's biggest holdings, such as equipment rental specialist Vp, packaging company Macfarlane and interior design company Colefax.

They have also gained exposure to new sectors and themes – for example financials, telecoms and companies whose revenues are not disrupted by economic cycles.

The result has been new stakes in companies such as Marshalls (a supplier of landscaping, construction and roofing products), which the trust acquired over the summer. Telecom Plus, owner of Utility Warehouse, is also a new feature.

“Utility is a great company, delivering savings for customers in everything from energy to broadband,” said Nickols. 'It has a market share of 3 percent, but I see that doubling in the next five years. Telecom Plus shares are also attractively valued.'

Disposals since the takeover include stakes in housebuilder Bellway and construction company Costain. At some point the administrators will also look to reduce the trust's position in Spirax-Sarco Engineering, a FTSE 100 company with a market value of £7.8 billion.

Nickols says: 'It's a great company, but it doesn't really fit our target area of mid- and small-cap stocks. We will sell it as new investment opportunities arise.” The trust's stock market identifier is 0739207, its ticker is RIII and its annual fees total 0.8 percent. Like many trusts, the shares trade at a discount (10 percent) to the value of the underlying assets, although the board does buy back shares to prevent their expansion.

Jupiter manages £1.5 billion of assets across the UK mid and small cap sector. The largest funds are UK Mid Cap and UK Smaller Companies (managed by Nickols).