‘Interest-free’ college tuition payment plans can ADD debt with a host of hidden fees, federal watchdog warns

‘Interest-free’ tuition payment plans could add to debt with a slew of hidden costs, the federal watchdog warns

- The CFPB examined the tuition payment plans of nearly 450 schools

- It turned out that despite being interest-free, most of them charge a host of hidden fees

- A third of colleges may withhold a student’s transcript to collect debts

Tuition repayment plans offered by many colleges put students at risk of being saddled with tuition and racking up debt, a federal watchdog warned.

These plans, used by an estimated 3.9 million students each semester, allow them to spread out their payments — and are often presented as an alternative to federal student loans.

Although ostensibly interest-free, students receive according to a report from the Consumer Financial Protection Bureau.

The agency, which examined the plans of nearly 450 schools, found that confusing terms often forced borrowers to sign away their legal rights — with some colleges even withholding transcripts as a debt collection tool.

“Colleges and universities should take a close look at their repayment plans and avoid subjecting borrowers to high fees or coercive collection practices,” CFPB Director Rohit Chopra said in a statement.

CFPB Director Rohit Chopra (pictured in June) said some colleges are using “coercive collection practices” and may withhold students’ academic transcripts

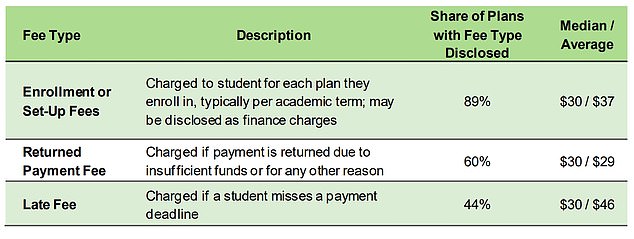

Although tuition payment plans are interest-free, they usually involve enrollment fees, late fees, and transaction fees. Shown are the average rates charged by the schools surveyed

About 89 percent of schools charged registration fees, with an average of $37. The highest observed enrollment fee for a tuition payment plan offered by a college was $200 at Arizona State University.

Nearly two-thirds of colleges charged refund fees if there were insufficient funds in the beneficiary’s bank account. They averaged $29.

Late fees averaged $46, but the CFPB observed 19 plans with late fees of $100 or more.

The agency said that while these payment plans are not marketed as loans, the school becomes a lender and some convert interest-free plans to interest-bearing loans if payments are missed.

It alleged that payment plans are used to generate revenue for schools and boost enrollment.

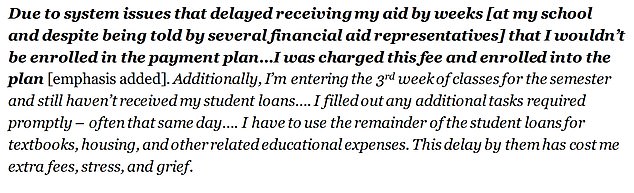

A number of students also complained to the agency that the way they received their federal student loans left them unable to pay tuition on time, forcing them into payment plans they did not want to enroll in.

According to the report, some colleges had systems that automatically enrolled students if they were late in paying.

The highest observed enrollment fee for a tuition payment plan offered by a college was $200 at Arizona State University

Filed a complaint with the Consumer Financial Protection Bureau. A number of students complained that the way they received their federal student loan money forced them to enroll in payment plans offered by the university.

“Because tuition payment plans are often offered to students by their school after they have already enrolled, the conditions can result in a captive market,” the report said.

Central to the agency’s warning was the allegation that many colleges are not transparently disclosing the details of the plans.

Unlike private education loans, they are not subject to disclosure requirements under federal law.

The agency quotes a description of Georgia Southwestern State University’s payment plan product, which claims, “This is not a loan program. You have no debt, there are no interest or financing costs and there is no credit check.’

At least one in three colleges reserved the right to withhold transcripts as a collection practice.

DailyMail.com wrote to Arizona State University for a comment about the $200 registration fee, but did not immediately hear back.