The insane new trend sweeping across Aussie workplaces to cope with the cost-of-living crisis – and it will make bosses furious

New research shows younger Australians are increasingly holding down two full-time jobs and working 80-hour weeks to cope with the cost of living crisis and unaffordable housing.

With unemployment still low (4.1 percent), people with office jobs are taking on full-time jobs to help pay the higher bills, job market website Indeed has revealed.

Workers from the younger Generation Z, born after 1997, were more likely to work 80 hours per week: one in six did so, compared to one in seven millennials born between 1981 and 1996.

Of those with two jobs, 93 percent perform their second job during the working hours of their main job. Working from home thus creates new opportunities.

According to Sally McKibbin, a career expert at Indeed, Australia’s cost of living crisis is forcing young Australians to work multiple full-time jobs, especially if they want to buy a home.

“As living costs and house prices continue to outpace incomes, Australian workers are responding by taking on additional paid work,” she said.

‘Purchasing power has not kept pace with rising house prices.

“For Gen Z and millennials, the path to real estate ownership proves challenging and unachievable for many, as they lack multiple streams of income.”

Australians are increasingly holding down two full-time jobs and working 80-hour weeks to cope with the cost of living and unaffordable housing, new research has found.

The average house price in Australia’s capital city is $992,473. This is far too high for an average full-time worker with an income of $98,218.

The average Australian worker buying a home independently can borrow just $510,700 to buy a $638,400 home with a 20 per cent mortgage.

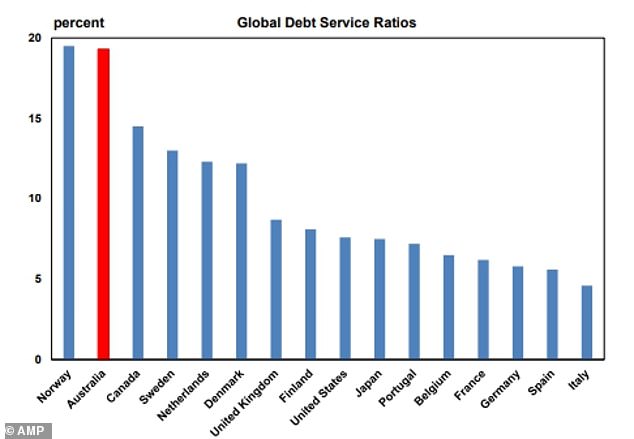

AMP research also shows that Australia has the second highest debt service ratio in the world after Norway. In Sydney, the average home costs $1.4 million, but the house price is more than 12 times the average salary, even with a deposit.

Deputy chief economist Diana Mousina pointed out that 80 percent of the Australian Reserve Bank’s rate hikes resulted in higher mortgage lending, simply because variable interest rates are much more common than fixed-rate loans.

The stress was much more severe than in other countries, with only 65 percent of official rate hikes resulting in higher monthly repayments in North America.New Zealand, compared with 53 percent for Canada and 32 percent for the United Kingdom.

“Australian consumers have generally underperformed their global peers over the past year, when looking at relative consumer confidence, retail sales growth and growth in per capita disposable income,” Mousina said.

‘This reflects the faster passing on of interest rates on outstanding mortgages.’

This means that people who want to buy a house in a suburb of a big city have to work an awful lot of hours to be able to buy a house or pay off their mortgage.

Sally McKibbin, a career expert at Indeed, said Australia’s cost of living crisis meant younger Australians were having to work multiple full-time jobs, especially if they wanted to buy a home.

Unemployment rose slightly to 4.1 percent in June, but 50,200 new jobs were created, giving full-time workers more options to take on extra work, data from the Australian Bureau of Statistics showed on Thursday.

But working many more hours also comes at a price. Indeed research shows that 77 percent struggle with mental health issues, while three quarters say it affects their physical health.

Eight in ten said it stopped them from spending time with their family.

Ms McKibbin said bosses would be shocked if their staff had another job on their time.

“It is concerning to see so many employees borrowing time from their primary employer to secure a second job. This is clearly having a significant impact on business performance and workplace dynamics,” she said.

People who combine multiple jobs almost without exception use artificial intelligence: 94 percent use AI for their primary job and 92 percent for their secondary jobs.

AMP research also found that Australia has the second highest debt service ratios in the world, after Norway. The average house price in Sydney of $1.4 million costs more than 12 times the average salary, even with a deposit.

Nine out of ten say AI will enable them to hold more than one full-time job.

“Using AI to manage multiple jobs demonstrates how technology is changing the workforce,” McKibbin said.

‘But the impact on workers’ mental and physical health cannot be ignored.

‘Combining two full-time jobs, regardless of technological efficiency, pushes many to the limit.’

Indeed’s research is based on a survey of 1,000 Australians aged 18 to 64, conducted in April 2024.