India’s gross tax receipts remain robust; fiscal deficit at Rs 7.02 trn

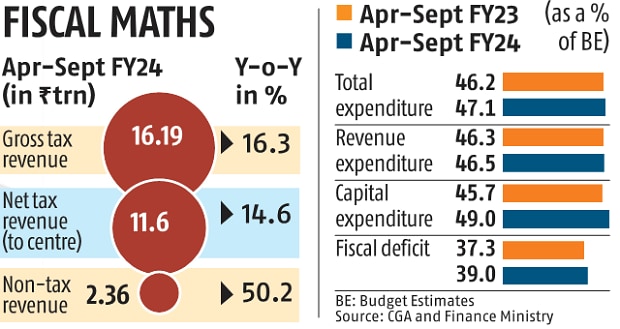

India’s gross tax revenues, comprising both direct and indirect taxes, rose 16.3 percent to Rs 16.19 trillion year-on-year in the first half (H1) of 2023-2024 (FY24). This upward trend continues after August, mainly due to a strong increase in corporate tax collections after a challenging start to the financial year.

During this period, net tax revenue reached Rs 11.6 trillion, representing 49.8 percent of the budget target, according to data released by the Controller General of Accounts on Tuesday.

Net tax collection was 52.3 percent of the previous year’s annual budget estimates (BE) in 2022-23 (FY23).

In September alone, net tax revenue stood at Rs 3.56 trillion. This is mainly attributed to a 26.6 percent increase in corporate tax to Rs 2.12 trillion and a 15.6 percent increase in personal income tax (IT) to Rs 91,247 crore.

“With a 27 percent increase in corporate tax collections by September 2023, coupled with healthy frontloaded tax inflows, almost 49 percent of FY24 BE has been collected, which is an encouraging trend. Moreover, half of the personal IT target for the financial year has been achieved in H1FY24,” said Aditi Nayar, chief economist at ICRA.

Meanwhile, the Centre’s fiscal deficit in the first half through September reached 39.3 percent of the full-year target, slightly higher than the 37.3 percent recorded in the same period the year before. In absolute terms, the fiscal deficit (the gap between expenditure and revenue) has increased to Rs 7.02 trillion during this period.

The government aims to reduce the fiscal deficit to 5.9 percent of gross domestic product (GDP) by FY24. The fiscal deficit for FY23 stood at 6.4 percent of GDP, lower than the previous estimate of 6.71 percent.

On the expenditure front, capital expenditure (capex) expansion continued with investments rising 43.1 percent to Rs 4.91 trillion in April-September, accounting for 49 percent of the capex target.

Total expenditure stood at Rs 21.19 trillion, or 47.1 percent of BE for FY24, slightly higher than the 46.2 percent recorded for FY23.

Of the total revenue expenditure, Rs 4.84 trillion was allocated to interest payments and Rs 2.06 trillion to major subsidies.

Although tax decentralization in September 2023 was in line with the previous month, it was 25 percent higher than the level of a year ago.

The government has transferred Rs 4.55 trillion to state governments as their share of taxes till September, which is Rs 79,338 crore higher than the previous year. It is worth noting that these transfers to states reduce the Centre’s net tax revenue.

“The higher-than-budgeted dividend surplus transfer of Rs 874.2 billion by the Reserve Bank of India is likely to provide some cushion to address any undershoots in other revenue streams, including disinvestments, or potential overspending in expenditure against the relevant BE, such as the Mahatma Gandhi National Rural Employment Guarantee Act and liquefied petroleum gas subsidy,” the economist pointed out.