I’m nearly 90, worth more than £200 million and still starting new businesses. Here’s how I did it – and my eight tips for getting rich

Tony Bramall is an unlikely ‘tech bro’, not least because he is almost 90. Having made his fortune not once but twice in a career spanning seven decades, the car dealer could be forgiven for driving off into the sunset.

At least in theory, he’s retired, but the energetic octogenarian remains a serial investor who shows no signs of taking his foot off the accelerator. Quite the opposite.

He may be decades older than the typical geeky, hoodie-wearing tech entrepreneur, but in his latest venture, Bramall is the main backer of a digital venture that he hopes will revolutionize car ownership.

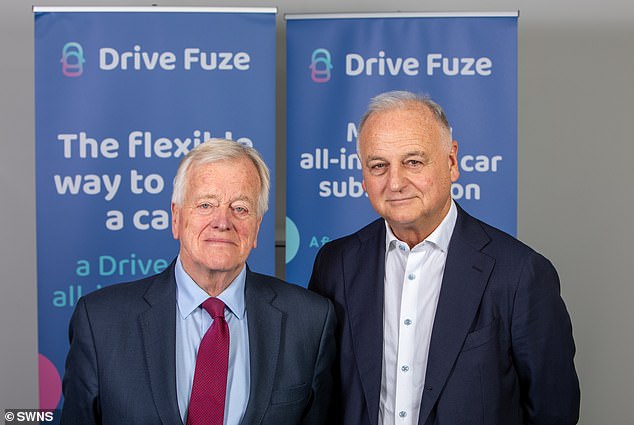

Tony Bramall is the main backer of Drive Fuze, a digital venture launched last year. He hopes this will revolutionize car ownership

Launched last year, Drive Fuze offers a comprehensive online car subscription service, which it says is more affordable and flexible than buying a car or entering into a personal rental contract.

In its former form it could well add millions more to the down-to-earth Yorkshireman’s already large fortune. Bramall, 88, is an excellent role model for so-called silver entrepreneurs who aspire to business success later in life.

“Most people in their 60s and 70s still have a lot of expertise to offer,” says Bramall. Two years ago he made £80 million from his stake in car dealer Lookers. Proof that it’s never too late to make (or increase) your fortune.

However, his story is not about getting rich quick. It took decades of hard work, and it’s still on the grindstone today.

“I was raised by a father who instilled in me a very strong work ethic from a very young age,” he recalls. ‘I can’t emphasize enough the impact that had on my attitude.

“You need a reason to get up in the morning, and a routine once the day starts.”

Francesca, his wife of 30 years, wakes him up at 6 a.m. and he is usually at his desk by 8:30 a.m. ‘I go to work every day. Well, I’m going to an office, so to speak. Whether it is work or not is for others to judge,” he jokes.

After earning an accounting degree, he worked in his family’s car dealership in the 1960s. He began expanding it, buying up smaller rivals and launching the renamed CD Bramall on the stock market in 1978. Ten years later it was sold to international car rental company Avis for £94 million.

Bramall, then a 52-year-old boy, was just getting started.

He used some of the proceeds to buy a textile company in Bradford. He then turned it into a very profitable car dealership and revived the CD Bramall name.

He floated CD Bramall mark two on the stock market before it was bought by bigger rival Pendragon for £230 million in 2004.

Building two listed companies and cashing in on both would be more than sufficient for most entrepreneurs. But Bramall, now 68 years old, was far from done.

In 2006 he emerged as a ‘white knight’ for another dealer, Lookers, which faced a hostile takeover bid from Pendragon. Bramall built up a big bet and foiled the deal. He remained on the Lookers board until 2020, before cashing out in 2022 to Constellation Automotive, the owner of online platforms WeBuyAnyCar and Cinch.

Today he is estimated to be worth over £200 million, much of which was earned after he reached retirement age.

And he’s not done yet.

His latest project, Drive Fuze, aims to cater to households who need their own car but aren’t ready to commit to a particular model long-term. He gives the example of a couple who wants to try out an electric car before buying one.

Or a young family that may need to upgrade to a larger car when more children arrive. Personal contract purchase (PCP) financing accounts for more than 80 percent of new private car financing deals, but drivers are locked in for up to four years.

Bramall is confident that customers – especially millennials – will be won over by the subscription service, saying: ‘People my age like to pick up a car, drive it and own it, but there is a trend towards using a car instead of him, especially among young people.’

There are no hidden extras with a subscription: the vehicle will even be delivered to your home and collected for good measure.

The subscription market is still in its infancy, but is expected to grow quickly. The most important thing Bramall has learned over the years is not to be blinded by fences.

“There is a big market, we only want a small part of it,” says Bramall. ‘You have to be humble. Overinvesting in your idea is the easiest thing you can do. Instead, you need to scale as you grow.”

The technology behind a car subscription service may be new to him, but few can match Bramall’s knowledge and experience in the car business. He has used his contacts to build a strong management team at Drive Fuze, where he insists he is “a passive investor.”

Tony Bramall with Nick Rothwell of Drive Fuze. Nick previously led Ford’s automotive finance business in Europe

“Support people, not just companies,” he advises. ‘As an investor you need to understand people’s character and motivations, not just their vision and ambition.’

He has ensured that the top team at his latest venture has what he calls “skin in the game.”

“Success is more likely when the people running the business have as much to gain as they have to lose,” he says. Drive Fuze is led by Nick Rothwell, who previously headed Ford’s automotive finance business in Europe.

Rothwell recently sold a similar car subscription business in Spain to Renault’s financial services arm for £90m.

Also on the board is his old business partner Peter Jones, a former CEO of Lookers. The closest Bramall came to retirement was when he met Jones at a car show in 1995 and asked him if he wanted to run his business.

“I’ll be 60 next year and I’m not going to die with my boots on,” Bramall told him.

Loyalty and trust are clearly important to him. His most important business lesson is: “Keep your word, it will pay off big time.”

His favorite film is The Godfather – the story of an aging patriarch who hands over his clandestine empire to a reluctant son.

But where does he get his energy from?

‘You have to enjoy what you do, otherwise there is no point; that’s where the energy and enthusiasm comes from,” he says.

‘I look forward to it every day.’

He calls his skills ‘fast growth, finance, management and negotiation’. A lifelong and avid Sheffield United fan, Bramall remains chairman of a family property and investment business based in Harrogate, North Yorkshire, where his two daughters are also directors.

He also oversees a charitable foundation that has supported a number of good causes over the past thirty years.

Providing for his eight grandchildren, aged between six and 32, is also ‘a major focus’ for him.

Bramall is clearly excited about Drive Fuze’s prospects and sees huge potential in licensing its proprietary technology to third parties. The company, he says, can grow slowly, as most startups do. “But I am convinced that I have made a decision that I will not regret,” he says. ‘Time will tell.’

With his track record, few would bet on him making a few more million before he turns 90.

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.