‘I was able to buy my dream home!’: Meet the millennials moving in with mom and dad to save up to buy their own place – amid soaring mortgage rates and punishing rent

For Tim Connon, the stress – and excessive costs – of renting an apartment eventually became difficult to justify.

“I tried renting in Las Vegas,” he said, “and then I moved to Tennessee and stayed there for a while, but it just didn’t work out very well.”

Tim, now 31, runs his own life insurance telesales business and didn’t want to throw his money away on unnecessary expenses.

So in his mid-twenties, Tim moved back in with his parents in Tampa, Florida. And just three years later, by the end of 2021, he had saved enough money to buy his own house in Tennessee.

Tim is among the group of millennial Americans who are moving back in with mom and dad amid skyrocketing rents and skyrocketing mortgage costs.

Tim Connon was able to save up to buy his own home in Tennessee after living with his parents

Although Tim admits there was some ‘friction’ at times, he was able to live rent-free in exchange for cleaning and repairs around the house.

“My father wanted to make sure I had enough money to buy a house, rather than having to resort to high rents,” he told DailyMail.com.

“There were a few times we had arguments, but I helped around the house and did everything I could to show appreciation for letting me live there.”

It meant that at the age of 28, Tim was able to buy a three-bedroom house, costing ‘in the low hundreds’, in Palmer, Tennessee – complete with ample outdoor space.

“Part of my dream of living here was raising my own animals,” he said.

“I work remotely, so I had more choice in deciding where I wanted to live, and there’s a nice little community here.”

For many millennials like Tim, moving in with family gives them an opportunity – which they might not otherwise have had – to get into the housing market.

The average 30-year mortgage agreement only recently fell below 7 percent, after rising 8 percent in the second half of last year.

Rental costs are also rising and the housing stock remains dangerously low, pushing many young people out of the market completely.

According to the National Association of Realtors (NAR), the share of first-time buyers who moved directly from a family member or friend’s home was 27 percent in 2022. This was the highest level since records began in 1989.

This dropped slightly in 2023, but still remains inflated at 23 percent.

For some, the trade-off comes down to giving up some of their independence – or feeling stuck in an extended childlike state.

Brandon Paulin slept in his childhood room until he was 26 to save enough to buy his own house with his girlfriend, despite already being mayor of his hometown of Indian Head, Maryland.

Paulin, now 28, told me The Washington Post how he was kept awake at night by his younger brother playing the video game Fortnite in the basement of his parents’ house.

But it was worth it, he said, as he was able to buy a $350,000 home with his current wife Taryn in June 2022 at a 6 percent rate.

Brandon Paulin and his wife Taryn were able to purchase a $350,000 home in June 2022

“It didn’t look like we were going to get much more,” he told the Post. “And we were afraid that if we kept waiting, interest rates would continue to rise.”

‘It wasn’t the conventional way to buy a house. But it’s what worked for us,” he added.

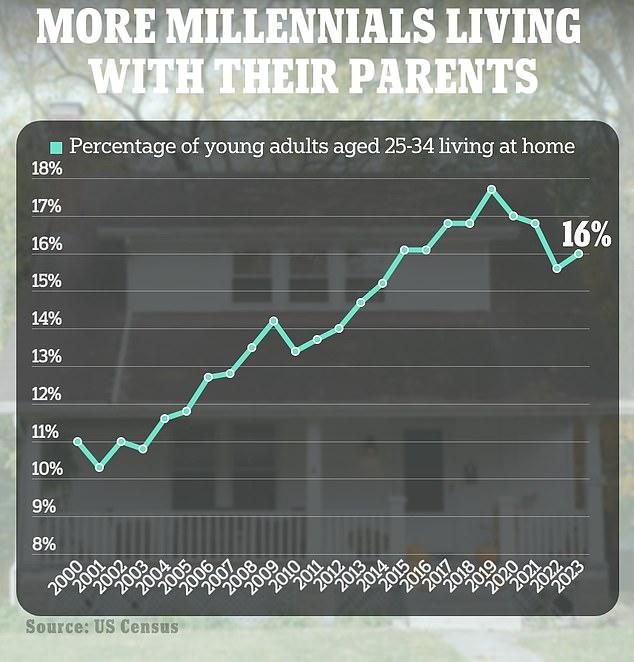

According to U.S. Census data, 16 percent of Americans between the ages of 25 and 34 lived with their parents or relatives in 2023 — an increase from 15.6 percent the year before.

And figures from the NAR show that the average age of a starter on the housing market is now a record high of 36 years.

Experts warn that the rising cost of buying a home is causing young people to miss out on $21 trillion in equity that older generations could build through homeownership.

According to US Census data, 16 percent of Americans between the ages of 25 and 34 lived with their parents or relatives in 2023

Analyst Meredith Whitney, once called the “Oracle of Wall Street,” warned last year how not owning homes is harming the “avocado toast generation.”

“We are seeing record low home ownership among people under the age of 38,” she told DailyMail.com.

“Homeownership has been a forced savings tool in the US, but especially in the last 12 to 15 years because interest rates were essentially at zero,” she told DailyMail.com.

“We’ve seen $21 trillion of equity in housing built up over the last decade, which is obviously an incredible wealth creator. Those who have not participated in that are the ones who have not had homes.”

While some millennials are resorting to fleeing to the ‘boring parts of the US’ in search of cheaper housing, as evidenced earlier this week, Tim is encouraging anyone with the option to consider moving back in with mom and dad .

He has no regrets.

“If it wasn’t for my parents, I’d probably still have to try to rent, and that would be a real headache,” he said. ‘It felt like I was throwing money away.

“All younger people should try to make it work with their parents so they can get a little bit ahead,” he added.