I owe £39,500 on my mortgage which is up next year: Should I refinance or pay it off? DAVID HOLLINGWORTH replies

I have entered my final year on a fixed five-year deal at 2.1 percent, due for renewal in October 2024 – most likely at a higher rate given the current state of affairs.

My house is worth €303,000. My current mortgage balance is $39,500.

My monthly repayment is €247 plus I always overpay monthly by an additional €205. In addition, I occasionally pay a lump sum up to my 20 percent allowance.

I expect to be able to reduce my balance to around £30,000 by August 2024.

– Read: How to refinance your house and find the best deal

Mortgage Help: In our new weekly column Navigate the Mortgage Maze, real estate agent David Hollingworth answers your questions.

Would the best recommendation be:

A. Take out a new mortgage by October 2024, regardless of the balance, without paying anything too much in the meantime. I know my rate won't be as low as what I'm currently fixated on.

B. Remortgage in October 2024 with a balance of approximately £30,000 due to overpayment (without incurring costs in the meantime).

C. Pay off the entire amount early, so that I don't have to worry about a mortgage. There are no early repayment fees associated with early settlement.

I don't have this money yet, but I could get a family loan. This is the best option, but realistically it may not be possible.

In short: should I pay too much as much as possible this last year? Or relax and take out a new mortgage for any amount? JH

SCROLL DOWN TO FIND OUT HOW TO ASK DAVID YOUR Mortgage question

David Hollingworth replies: While many homeowners have already had to deal with the expiration of their fixed rate, there are still plenty who continue to enjoy the protection of an existing fixed deal.

When these expire it will almost inevitably mean we will face higher interest rates, as the era of historic lows in base rates came to an end a few years ago.

Since December 2021, the base interest rate has risen from an all-time low of 0.1 percent to the current level of 5.25 percent.

Although some fixed rates were as low as 1 percent at their lowest point, a lot will depend on the point at which you set the interest rate.

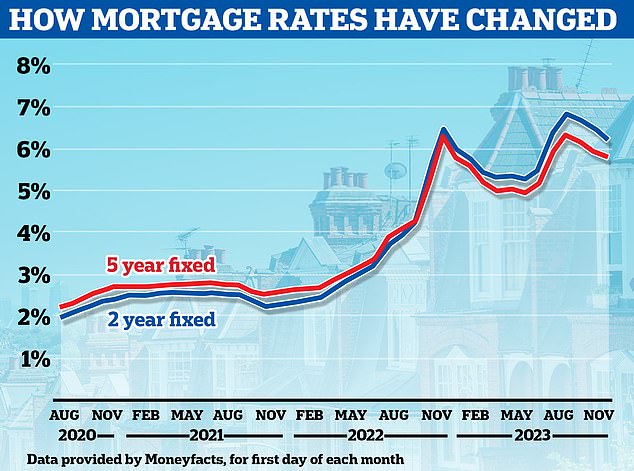

Fixed interest rates spiked during periods of volatility this year and after the mini-budget, with many reaching 6 percent or more, so your rate looks extremely attractive.

Fortunately, fixed interest rates have eased again as the interest rate outlook has improved, but still the rates offered for a current two- or five-year fixed rate will be more than double what you have enjoyed in recent years.

Making the most of the rest of that deal is exactly the right way of thinking, rather than just waiting for what currently seems like an inevitable increase in payments a year from now.

It looks like you used low rates as a good opportunity to make additional payments on the balance.

– What next with the mortgage interest rate and should you fix it for two or five years?

Declining: Average fixed mortgage rates appear to be retreating somewhat after a barrage of rate increases in the first half of the year, but remain much higher than in previous years

Most lenders offer some overpayment option without charging early repayment fees.

In most cases this will normally be 10 percent per year, but there are some lenders, including your current lender, who offer even more flexibility and allow you to pay off up to 20 percent of the balance each year without penalty.

It is always important to check the terms carefully as an ERC can be significant.

Continuing to plan toward the end of the current low interest rate environment can help soften the impact of higher interest rates.

If you pay too much, you'll have a smaller balance to deal with when your deal expires, limiting the increase in payments.

However, you may also want to consider whether saving the money over the next year could be an alternative or additional strategy.

Savings interest rates have risen and can reach more than 5 percent, meaning you could potentially earn more interest than you would save by overpaying.

However, you must consider any income tax on the interest earned, which could significantly reduce the apparent difference in rates.

You already have a relatively small mortgage and some lenders have a minimum loan size for their remortgage rates, but I don't think this should stop you from taking your preferred approach, whether that is saving a lump sum to reduce the mortgage if you that want the end of the current rate or by paying too much to reduce the balance month after month.

When you get to the point of figuring out a new rate, make sure you take any fees into account as they will have a big impact on the overall value of any future new deal.

– True Cost Mortgage Calculator: Check what a new fixed rate would cost

Overpaying: Hollingworth says overpaying the mortgage means they will have a smaller balance when their deal ends, which will help limit the increase in payments

Due to the size of the mortgage, it is unlikely to be worth paying a fee to get a lower rate. It is better to choose something with a slightly higher rate, but without costs.

An advisor will help you navigate the different options, whether it's switching to a new lender or striking a new deal with your current lender.

They can also explain other options to you, such as trackers that can be completely ERC-free, or compensation deals that allow you to offset your savings against the mortgage.

I therefore recommend that you continue planning for the end of the current deal so that you can make further moves in the mortgage.

Assuming you don't pay off the entire mortgage, you can still create a plan that will allow you to quickly close on the day you no longer have a mortgage.

NAVIGATE THE MORTGAGE MAZE

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.